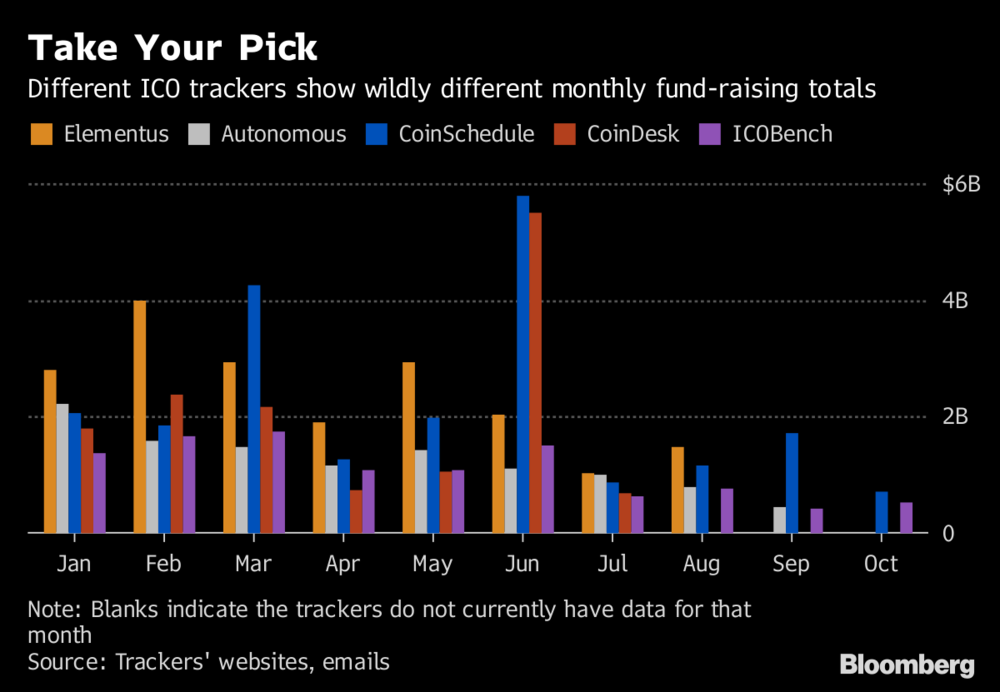

Organizations keeping track of ICO fundraising statistics are having a hard time agreeing on totals from month to month.

What could be the reasons for such large discrepancies?

Guesstimating

The Initial Coin Offering (ICO) model has been constantly evolving and adapting over time since the height of its popularity in late 2017. The biggest factor which caused the total fundraising amounts to decline heavily overall was, and obviously still is, the market-wide correction that has gripped the digital asset space since the beginning of the year. Some projects have lost all of the gains they made during the bull run, while some have even dipped back below the prices at the time of the ICOs’ launch. According to some information compiled by Forbes, the statistics reported by financial trackers involving the amounts of money that ICOs are bringing in have not quite been matching up. In some cases, the totals vary by billions of dollars. The reports assembled information from five different ICO trackers from the beginning of 2018 through October. Nearly every month has shown a wide range in recorded totals, leaving investors and enthusiasts to question the reasons for the spread.

What’s The Deal?

Alex Buelau, the co-founder of the digital token sale and ICO information site CoinSchedule, attributes the differing totals to inaccurate numbers being reported by the ICO projects. These numbers can also be skewed due to the increasing popularity of ICOs making private sales to private investors. Because ICOs do not need to follow the exact same guidelines as a publicly offered entity, they are not required to report the details of every sale. Other factors that could have an influence on the totals are the elements which the trackers focus on recording in the first place. Some organizations, like ICORating, use statistics directly from investors and token issuers, while Elementus focuses on collecting data directly from the transactions on individual blockchains — leaving less room for interpretation and manipulation in the totals. Do you think that we are past the ICO peak, or will the there be another huge wave rolling in during the next bull run? Let us know your thoughts in the comments below!

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kyle Baird

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

READ FULL BIO

Sponsored

Sponsored