Toncoin [TON], the blockchain network linked to the popular messaging app Telegram, has witnessed a spike in activity across its Decentralized Finance (DeFi) in the past few weeks.

This comes amid the decline in the general DeFi ecosystem due to recent downturns in the overall cryptocurrency market.

Toncoin Leads, Others Follow

The last month has been marked by a steady decline in the values of several crypto assets. This has led to a drop in the total value of assets locked (TVL) across the DeFi protocols on most blockchain networks.

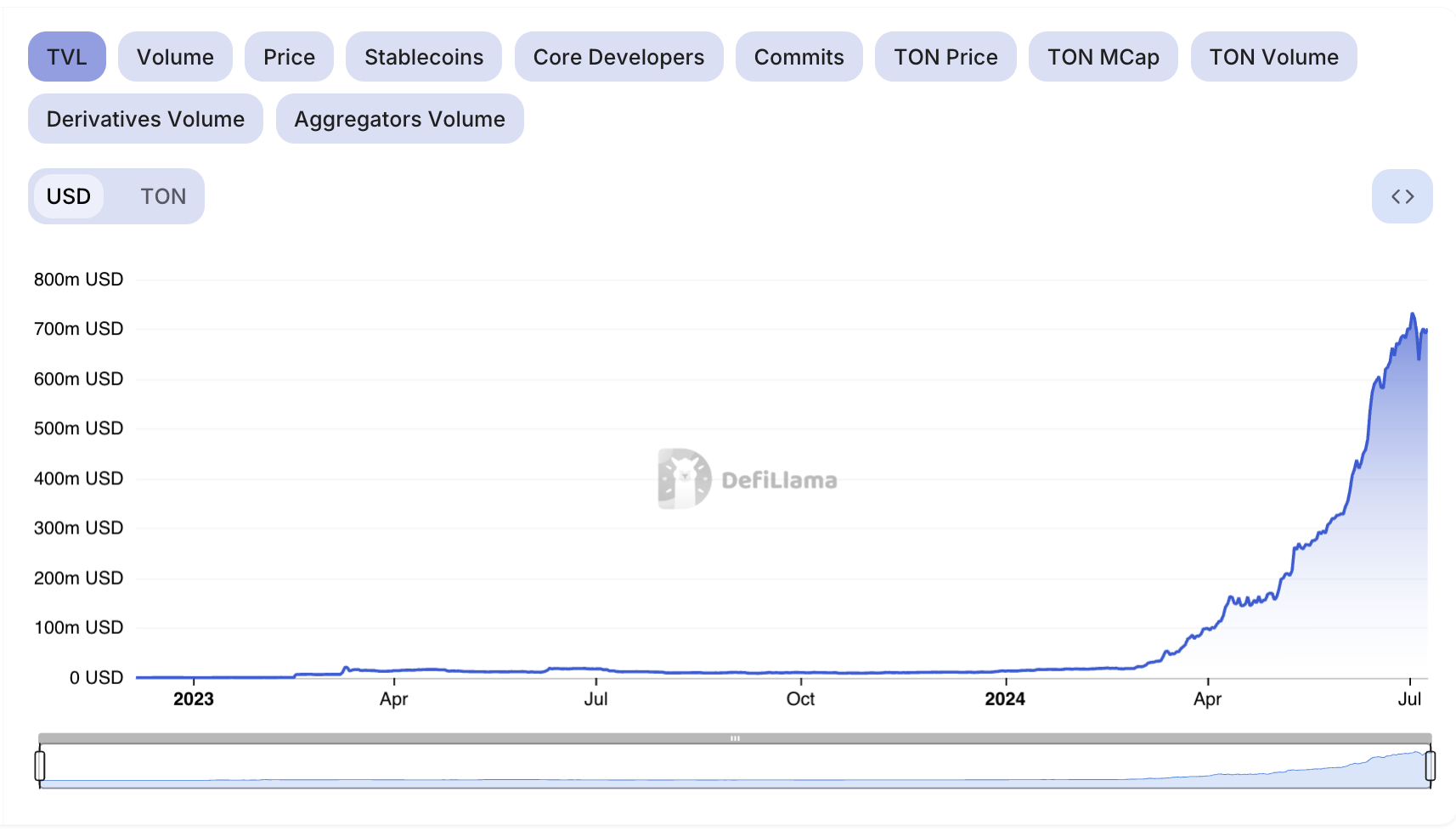

Bucking the trend, Toncoin’s TVL has risen in the last month. On July 3, the network’s TVL event surged to an all-time of $723 million. At $702 million as of this writing, Toncoin’s DeFi TVL has skyrocketed by over 60% in the past 30 days.

Further, only five of the 17 DeFi protocols hosted on Toncoin experienced a decline in TVL during this period. In fact, the largest protocol on the chain by TVL, DeDust, has seen its TVL spike by over 100% in the last month.

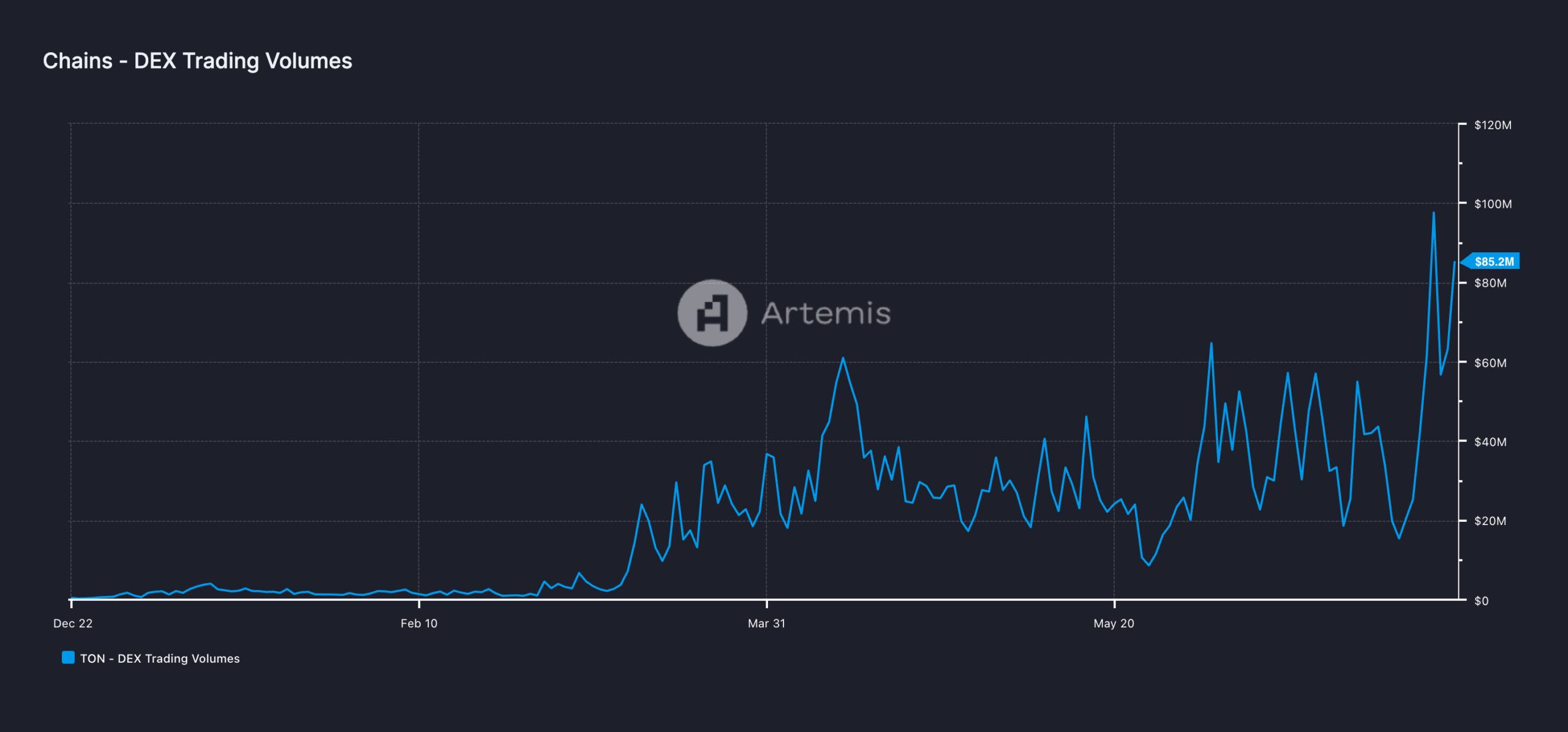

Mirroring the uptick in DeFi activity on Toncoin, daily trading volume across the decentralized exchanges (DEXes) on the network spiked to an all-time high of $97 million on July 5.

TON Price Prediction: Coin Trades Below Key Moving Average

As of this writing, TON trades at $7.25. The general market decline has caused its price to fall under its 20-day exponential moving average (EMA)

An asset’s 20-day EMA tracks its average price over the past 20 trading days. When an asset’s price trades below this level, it signals a decline in buying pressure. It is considered a bearish signal.

If TON’s selling pressure continues to surge, its price may plummet to $7.1.

However, if sentiment shifts from bearish to bullish and demand spikes, TON may rally to $7.46.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.