The price of Toncoin (TON), the cryptocurrency linked to the popular messaging app Telegram, has registered a double-digit rally over the past week.

However, despite this, short traders have maintained their bets against the altcoin, indicated by a persistent demand for TON shorts.

Toncoin Short Traders Are Unrelenting

At press time, TON trades at $6.27. Over the past seven days, the altcoin’s value has climbed by almost 20%. However, many traders have continued to open positions against a continued rally in its futures market. This can be gleaned from the coin’s negative funding rate across cryptocurrency exchanges.

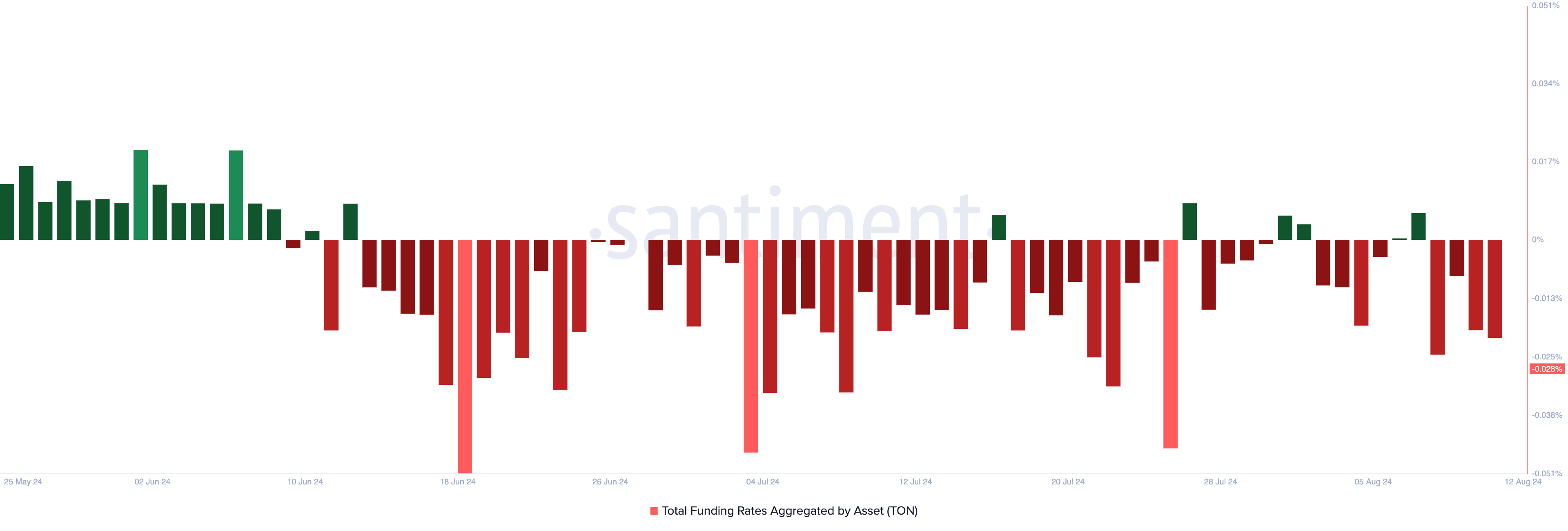

As of this writing, TON’s funding rate is -0.028%. Per Santiment, the coin’s funding rate has been predominantly negative since June 13.

The funding rate is a mechanism used by perpetual futures contracts to keep the contract price in line with the underlying asset price.

When an asset’s funding rate is negative, it indicates more traders are taking short positions. This means that more traders anticipate a decline in the asset’s price than those buying it and hoping to sell at a higher price.

When more traders are willing to pay to maintain short positions, it suggests that the prevailing market sentiment is bearish.A sustained negative funding rate, like in TON’s case, indicates that the majority of the market expects the asset’s price to continue falling. It suggests a significant bearish outlook among traders.

The decline in TON whale holdings reflects this bearish outlook. According to IntoTheBlock’s data, TON’s large holders’ netflow has plummeted by over 250% in the last month.

Read More: What Are Telegram Bot Coins?

Large holders refer to addresses that hold over 0.1% of an asset’s circulating supply. When an asset’s large holder netflow declines, its whale addresses are selling their holdings. It is a bearish signal that may prompt retail traders to distribute their coins, putting more downward pressure on the asset.

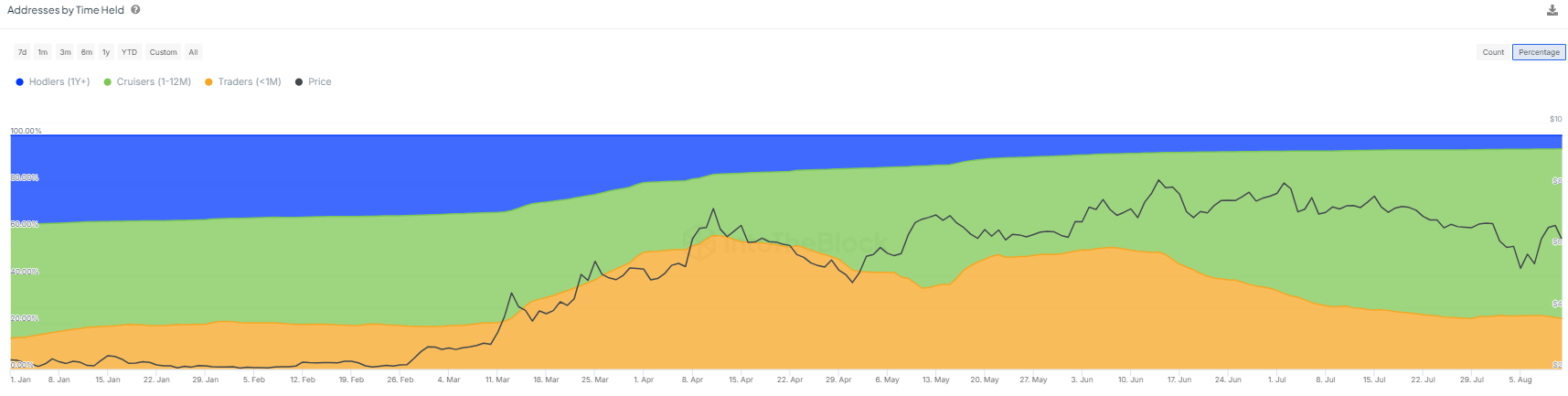

Juan Pellicer, Senior Researcher at IntoTheBlock, adds to this perspective by highlighting that the number of long-term holders of Toncoin is low compared to the surge in new addresses. This imbalance could signal a concern, as long-term holders are typically crucial for the asset’s price.

“TON witnessed significant growth this year, growing from 3.6 million addresses with a balance in January to currently over 39.5 million. Due to this recent and rapid expansion, long-term holders now make up only 6% of all wallets. This surge in new users reflects increasing interest and adoption, but it also suggests that a majority of the network’s participants are still in the early stages of their involvement, which could influence the overall market dynamics and price stability moving forward,” Pellicer told BeInCrypto.

TON Price Prediction: Bearish Cloud Rests Above Price

The short bets placed against TON’s price might yield positive results as the bearish outlook also persists in its spot market. At press time, TON’s price rests below its Ichimoku Cloud.

This indicator identifies an asset’s trend direction, gauges momentum, and defines support and resistance levels. The market is in a downtrend when the asset’s price lies below it.

This is because the cloud represents a key area of support and resistance, and being below it means that the price is trading below both the short-term and long-term averages.

If this bullish outlook persists, TON’s price may fall to $5.57, putting short traders in profit.

Read More: 6 Best Toncoin (TON) Wallets in 2024

However, if TON sees a spike in demand, its price may rally to $6.51, liquidating some short positions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.