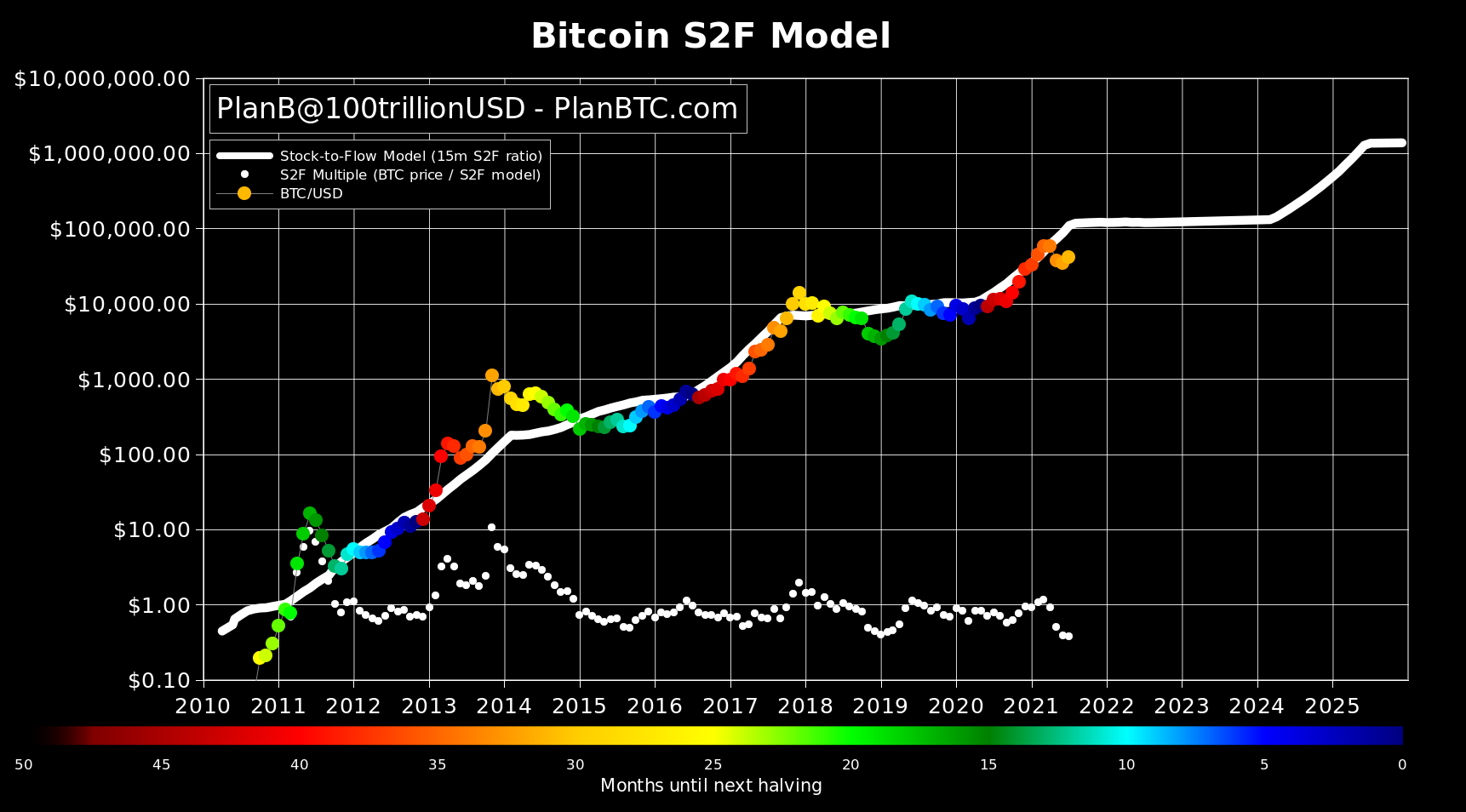

Popular crypto market analysts are paying attention to the bullish signal that the Stock-to-Flow model deflection chart is generating. If this one of the most famous models is to survive its crisis, Bitcoin must resume its long-term bull market.

Stock-to-Flow deflection gives bullish signal

Stock-to-Flow (S2F) deflection is a way to estimate Bitcoin’s value against one of the most popular models of its price.

If the chart turns green, then Bitcoin’s value is undervalued in relation to S2F. If it is red, it is overvalued. The chart therefore allows one to determine whether the price of Bitcoin relative to the S2F model is low, normal or high.

Currently, the S2F deflection chart is deep in green undervalued territory. We recently pointed out at BeInCrypto that this is the largest undervaluation in 10 years. This was happening with Bitcoin trading in an area of support between $29,000 and $31,000 from May 19 to July 21, 2021.

Commenting on such low S2F deflection values, cryptocurrency trader Michaël van de Poppe said in his YouTube video:

“If you follow the S2F model, or if you’re looking at evaluation through on-chain analysis, then this is a good signal to start investing.”

He further added that the current S2F deflection is reminiscent of the first half of 2017. At that time, the BTC market also experienced a deeper correction, and the deflection went deep into undervalued territory. In hindsight, this moment proved to be an excellent opportunity to invest in BTC.

The 6th bounce off the long-term trendline

In the same tone, popular on-chain analyst Will Clemente tweeted yesterday, drawing a long-term trendline on the S2F deflection chart. This line goes back to the first BTC cycle of 2011. He then marked the points where the deflection chart touched that line and connected them with vertical lines to the BTC price from that period.

It turns out that whenever the deflection reached this long-term trendline, the “Bitcoin has gone on an absolute tear”. If this scenario were to repeat itself, we can expect not only a reduction in the S2F deflection in the coming months, but also a continuation of the long-term bull market in crypto.

Will Stock-to-Flow survive?

There is an ongoing discussion that the current Bitcoin price is not keeping up with the S2F model. The consequence could be the rejection of this way of modelling the main cryptocurrency price as no longer adequate.

One of the arguments for this thesis is the lengthening cycle theory, whose main advocate is Benjamin Cowen. If indeed the current Bitcoin cycle will be longer than the traditionally accepted periods of 4 years between halvings, then the S2F model may no longer be helpful in forecasting further movements of BTC.

This is noted by the model’s creator PlanB himself, who openly stated in early July that the next 6 months will be decisive (“make or break”) for the relevance of S2F. Since that tweet, Bitcoin has managed to print another orange dot above the previous one. It gives hope to supporters of the S2F model that its forecasts will continue to be valid.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.