Chamath Palihapitiya might have just turned the conventional asset allocation model on its head.

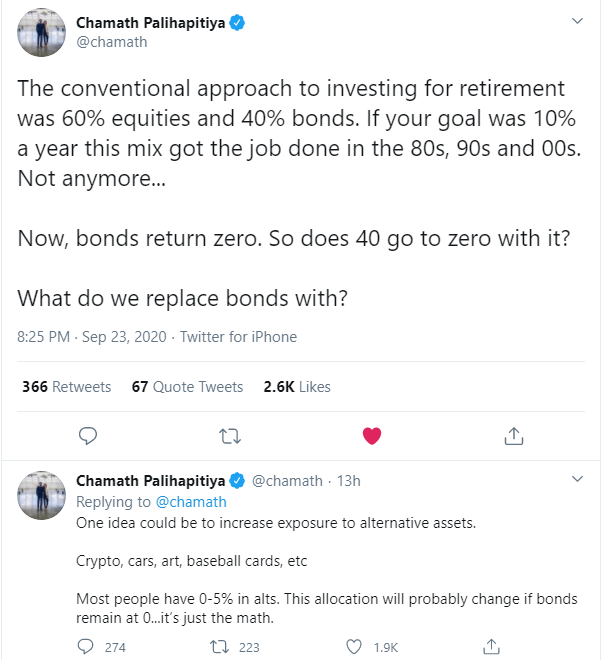

In a tweet, the Social Capital CEO challenged the traditional 60/40 retirement investment model, which represents allocations of 60% and 40% to stocks and bonds, respectively, targeting returns of 10% returns annually in past decades. This rule has been widely followed, but given the current economic environment coupled with a dovish Fed, bond returns are not what they used to be. This dynamic has thrust hard assets like bitcoin and gold into the spotlight.

Palihapitiya asks now that bonds are returning zero, if the “40 go to zero with it?” He suggests lifting one’s exposure to alternative assets — in which most people have a 0-5% allocation — as a possible solution, including “crypto, cars, art, baseball cards, etc.” On that note, investors might also incorporate tokenized art and collectibles to kill two birds with one stone, so to speak.Interest rates are going to stay near 0 for years.

— The Wolf Of All Streets (@scottmelker) September 16, 2020

Buy some hard assets.

Bitcoin Bull

While the venture capitalist didn’t name any specific cryptocurrencies, he is known for being a bitcoin bull who considers his BTC bet his best wager yet. Not everyone was on board.

Bitcoin and gold have both been taking it on the chin of late, with both assets trading under pressure as technology stocks stage a recovery. Bitcoin’s returns have trounced gold’s so far in 2020. https://twitter.com/blockfolio/status/1306666133672669186#Bitcoin Performance in 2020

— ecoinometrics (@ecoinometrics) September 24, 2020

Sep. 23, 2020

Year to date

BTC +46.7% 🔥🔥🔥🚀

Gold +22.2%

SP500 -0.86% pic.twitter.com/C8I8FKGSdt

Bitcoin and Retirement

A bitcoin ETF could go a long way to bolster bitcoin’s role in retirement portfolios. ETFs are popular in 401(k) retirement plans for their low cost and diversification, not to mention their technological superiority. The U.S. Securities and Exchange Commission, however, has so far blocked every attempt for a bitcoin ETF by the crypto community.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Gerelyn Terzo

Gerelyn caught wind of bitcoin in mid-2017, and after becoming smitten by the peer-to-peer nature of crypto has never looked back. She has been covering the space ever since. Previously, she wrote about traditional financial services, Wall Street and institutional investing for much of her career. Gerelyn resides in Verona, N.J., just a hop, skip and a jump from New York City.

Gerelyn caught wind of bitcoin in mid-2017, and after becoming smitten by the peer-to-peer nature of crypto has never looked back. She has been covering the space ever since. Previously, she wrote about traditional financial services, Wall Street and institutional investing for much of her career. Gerelyn resides in Verona, N.J., just a hop, skip and a jump from New York City.

READ FULL BIO

Sponsored

Sponsored