Some months ago, Shiba Inu (SHIB) was part of the prestigious top 10 cryptocurrencies in market capitalization. Fast forward to this day, the token has dropped two places below the number.

On-chain analysis offers insights into the potential of the memecoin. As of this writing, SHIB’s price changes hands at $0.000018.

Market Cap and Activity Fall by Staggering Numbers

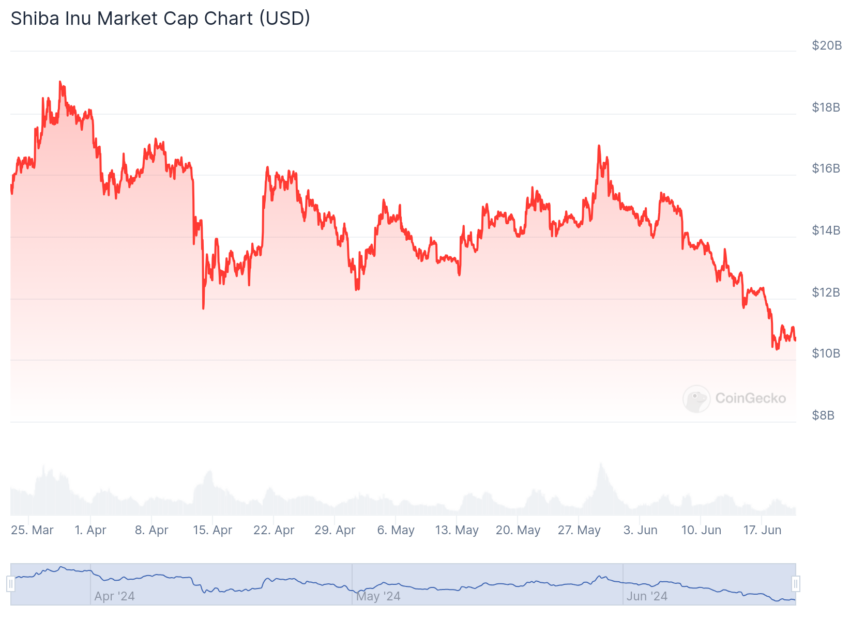

Shiba Inu’s price is not the only metric that experienced a notable downturn. According to CoinGecko, the market cap is now a shadow of its former self.

Market cap, a short form for market capitalization, is the product of price and circulating supply. Therefore, for a token whose total supply is in circulation, an increase in price brings about an increase in market cap.

Also, when the market cap decreases, prices follow. In March, the market cap of SHIB was over $18 billion, according to CoinGecko. At press time, the same market cap holds at $10.64 billion, meaning the value has decreased by a mind-blowing $8 billion.

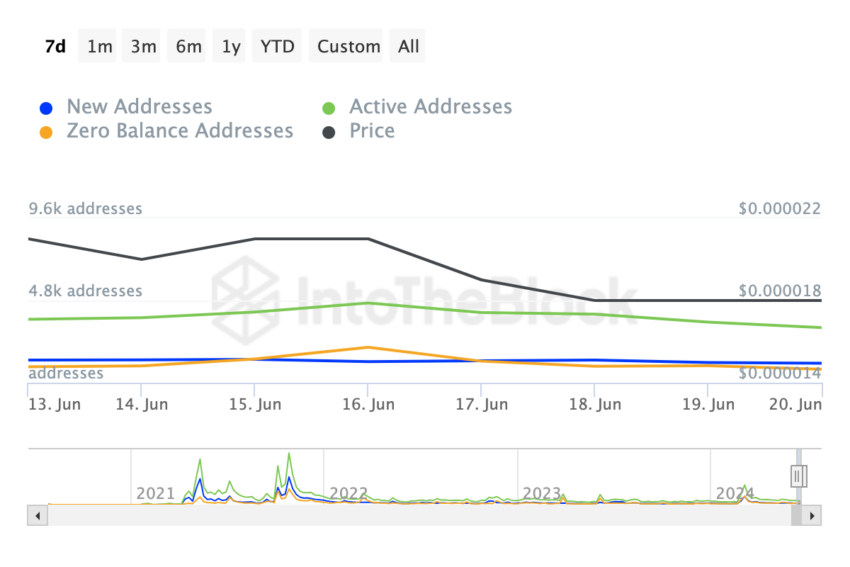

Apart from the market cap, activity on Shiba Inu’s network has been unimpressive, as shown by the active, news and zero-balance addresses

As the name implies, active addresses track the number of unique active users on the blockchain. However, new users indicate adoption as they measure the number of users making their first transaction on the network, similar to the zero-balance addresses.

Further, an overview of all three shows major declines within a seven-day window. For instance, new addresses have fallen by 15.45%. Zero-balance addresses dropped by 71.27%, while active addresses were no better, with a 45.39% decrease.

Read More: Shiba Inu (SHIB) Price Prediction 2024/2025/2030

Should the overall network activity continue to decrease, SHIB’s price may not experience a significant respite.

Traders Prefer Short Positions

Furthermore, the Funding Rate remains negative after dropping on June 17. Specifically, SHIB’s Funding Rate is 0.008%.

The Funding Rate represents the difference between a cryptocurrency’s perpetual price and the index value. When it is positive, it means that traders are bullish on the price. It also means that the contract value is at a premium compared to the spot price.

Conversely, a negative reading implies that the contract price trades at a discount to the spot value. In Shiba Inu’s case, the negative ratio suggests that the broader trader sentiment is bearish. As such, it will be challenging for SHIB’s price to bounce off the current 28.50% 14-day decrease.

To predict SHIB’s next movement, BeInCrypto looks at the In/ Out of Money Around Prices (IOMAP) indicator. The IOMAP gives traders insights into potential prices to buy or sell based on holders’ current profits and losses.

SHIB Price Prediction: Is It Time to Buy the Dip?

A large cluster of addresses in the money can support the price. Also, a large cluster of addresses out of the money will be a resistance point. For SHIB, the IOMAP shows that 6,720 addresses bought 413.41 trillion SHIB tokens at an average price of $0.000018.

This cohort is in the money. On the right side,13,940 addresses that purchased 1.12 trillion tokens at the same price are out of the money. Considering the closeness in resistance and support, SHIB may keep trading sideways in the short term.

However, if many of the 13,940 addresses decide to break even, Shiba Inu’s price will slip to $0.000016. Furthermore, the daily SHIB/USD chart indicates a similar pattern, the Fibonacci Retracement indicator reveals.

This indicator identifies resistance and support levels, like the IOMAP. In addition, the chart below shows a potential nominal pullback to $0.000016 as of this writing.

On the other hand, traders should watch out for the state of the Funding Rate. If the number of short positions continues to increase, it could catalyze the price to bounce. Should this happen, the token’s price can rise toward $0.000020.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

This is also the region where the 0.382 Fibonacci level positions. Meanwhile, Lookonchain disclosed that a whale accumulated $6.60 million worth of SHIB on June 20.

Buying large amounts of cryptocurrencies like this can fuel a significant price increase. If similar orders appear in the coming days, SHIB may begin a move that takes the price closer to $0.00020, as reiterated above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.