Cryptocurrency analytics firm Crystal has published a report detailing all of the major security breaches, fraudulent activity, cyber-terrorism, and scams in the crypto space since 2011.

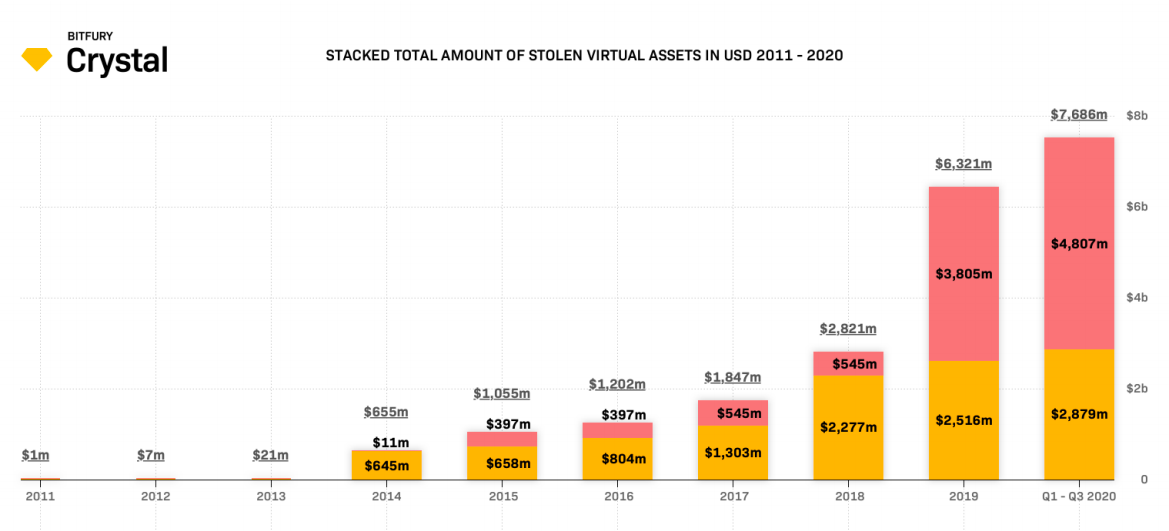

According to the report, since the emergence of cryptocurrency markets, 113 security attacks and 23 fraudulent schemes have resulted in the theft of approximately $7.6 billion worth of crypto assets. As noted by a press release announcing the report, that’s comparable to the GDP of Monaco.

The report highlighted a handful of key findings, including the most common locations for exchange security breaches.

Perhaps unsurprisingly, this was countries with the most developed crypto markets, i.e., the United States, the United Kingdom, South Korea, Japan, and China.

The United States, in particular, seems to be a major target. Since the beginning of the blockchain ecosystem’s existence, US-based crypto services have been targeted by bad actors a total of 13 times. But in terms of the value stolen, China was the runaway leader.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Colin Adams

Colin is a writer, researcher, and content marketer with a keen interest in the future of money. His writing has been featured in numerous cryptocurrency publications, and his holdings don't amount to more than a handful of BAT.

Colin is a writer, researcher, and content marketer with a keen interest in the future of money. His writing has been featured in numerous cryptocurrency publications, and his holdings don't amount to more than a handful of BAT.

READ FULL BIO

Sponsored

Sponsored