The United States Securities and Exchange Commission (SEC) has put out a request for comments on Fidelity’s spot Ethereum exchange-traded fund (ETF) application.

“The Commission is publishing this notice to solicit comments on the proposed rule change from interested persons,” the statement declared.

SEC Wants The Public Opinion on Fidelity’s Application

In a recent court filing, the SEC urges individuals interested in expressing their opinions on the Fidelity spot Ethereum ETF application to do so through various channels.

“Interested persons are invited to submit written data, views and arguments concerning the foregoing, including whether the proposed rule change is consistent with the Act.”

The filing explains that the application proposes a rule change that will allow Fidelity to list and trade shares of the Fidelity Ethereum Fund.

Read more: Solana vs. Ethereum: An Ultimate Comparison

It further declares that the objective of the Trust is to track the performance of ETH. However, it will take into account deductions, by subtracting the Trust’s expenses and other liabilities.

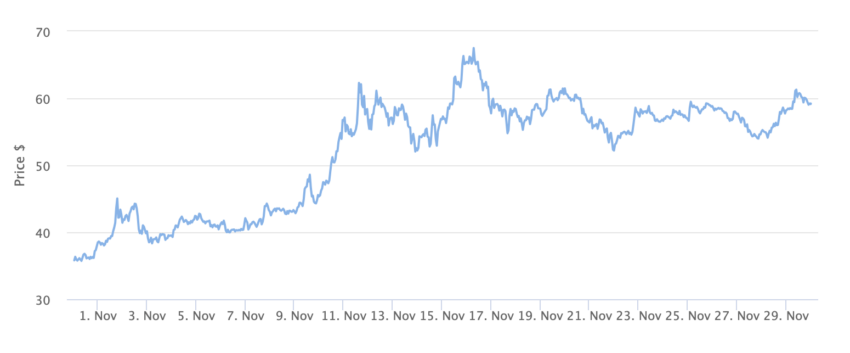

At the time of publication, Ethereum’s price stands at $2,047.

Other Countries Surpassing the US in Offering ETFs

Fidelity states that each share will signify a fractional undivided beneficial interest in the Trust’s net assets.

In the filing, Fidelity highlights the absence of a regulated means for gaining Ethereum exposure in the US.

Moreover, it asserts that this compels them to face counter-party risk. Furthermore, also to legal ambiguity, technical challenges, and complexity when accessing Ethereum.

Meanwhile, it points out that investors outside the US, particularly citizens in Germany, Switzerland, and France, can access Ethereum through regulated means.

Read more: Ethereum Merge: Everything You Need To Know

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.