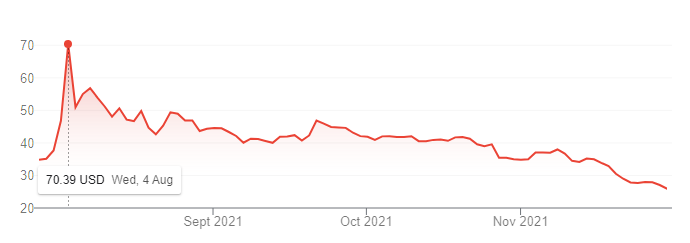

Shares of Robinhood (HOOD) have dropped by 70% over the past four months. The company has suffered both reputation hits and revenue drops in Q3, which could be behind the drop in valuation.

Shares of Robinhood’s (HOOD) stock closed at an all-time low of $25.94 on Nov 30, down nearly 70% from August 2021. Near the start of August, the stock was valued at just over $70. The drop is a huge blow for the trading app, which has endured a rough year.

The near-future looks difficult for the company, which is working towards repairing its reputation. In the last month alone, Robinhood has been the subject of bearish calls, suffered a security breach, and saw a drop in crypto trading revenue, as revealed in a financial report.

As for why there could be such a big drop in the valuation, one partial reason could be the fading away of meme coins. In the second quarter of 2021, Robinhood’s revenue was boosted by the mania for Dogecoin (DOGE). Those trades accounted for more than 60% of the $233 million generated by crypto that quarter.

A more significant reason why Robinhood’s shares might have dropped is the considerable decrease in crypto revenue experienced in Q3 2021. The firm recorded only $51 million in crypto-generated revenue, as opposed to $233 million in Q2.

The company launched its highly anticipated IPO in late July 2021 and is taking steps to combat potential violations. It even hired a former Grayscale compliance chief to help with regulation.

How will the new year be for Robinhood?

The outlook for Robinhood going into the future isn’t particularly bright, either. The company could turn itself around and find renewed vigor with new products, but there are some obstacles on the horizon.

The SEC serves as one of those obstacles, as it is now reviewing banning payment for order flow (PFOF). The authority fined Robinhood $65 million in December 2020 for charging “hidden” fees that fell under the PFOF model. Robinhood receives a majority of its revenue from the latter, as it has a zero commissions business model.

Robinhood will hope that new features will help attract users and boost revenue. It launched a recurring crypto investment feature in Sept. 2021 and is working on other features to be released later.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.