Most Crypto Investors Sitting in Profit

Around 92% of all bitcoin currently sitting in wallets was acquired at a lower price than the current market price. Some digital assets outperforming Bitcoin are those that went live after the 2017 mania and they too have a large number of addresses in profit. LINK, VET, CRO, and SNX have all attracted waves of speculative interest during 2020 that have resulted in a breach of their previous all-time highs. According to data from IntoTheBlock, 95% of ChainLink and Crypto.com addresses are currently in profit. Meanwhile, 94% of VeChain addresses acquired their holdings at a lower price point than today. Finally, having experienced a mammoth 2,320% price rise in the last twelve months, most Synthetix Network Token holders are sitting pretty.At the other end of the spectrum are crypto assets that were hardest hit by the 2018 bear market. Just 77% of Ethereum addresses, for example, are in profit. Faring even worse are Litecoin, Dash, and Cardano with 55%, 56%, and 57% of wallets now in profit respectively.For any address with a positive balance, @intotheblock identifies avg price at which tokens were acquired, indicating if the address is at profit or loss.

— intotheblock (@intotheblock) August 17, 2020

Addresses at profit:$BTC 92%$ETH 77%$LINK 95%$BCH 90%$LTC 55%$ADA 57%$CRO 95%$VET 94%$DASH 56%$MKR 76%$SNX 100% pic.twitter.com/XceYlTgsUu

Rising Prices Prompts Greater SegWit Adoption

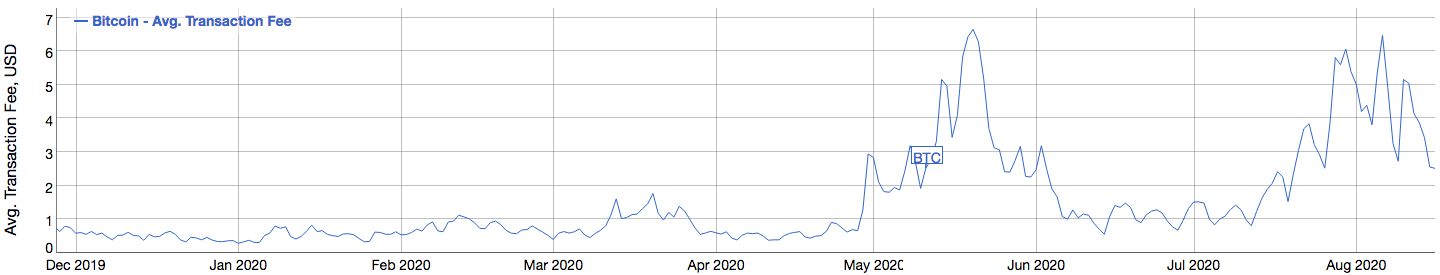

As mentioned previously, bullish price action is also causing some transaction fee issues. Perhaps the worst hit is Ethereum. BeInCrypto reported on the rising gas prices last month. The surging interest in DeFi has meant a spike in network usage. Bitcoin is no outlier in this phenomenon. According to data from BitInfoCharts, the average transaction fee in early August hit almost $6.50. The increasing prices not only make each satoshi used for fees more valuable but also appears to attract greater speculative interest. The growing numbers of transactions make block space particularly valuable.

Milne argues that companies not using SegWit will eventually be “forced to enable” it. Mentioning Blockchain.com as an example, he states that not making efforts to reduce the block space used per transaction may spell the end for heavy users like exchanges.#Bitcoin SegWit adoption continues to march higher

— Alistair Milne (@alistairmilne) August 17, 2020

Higher fees give an incentive to switch to SegWit wallets

Eventually bad actors like @blockchain will see their growth reverse and be forced to enable pic.twitter.com/PCdcPSTL8y

Pushing the Envelope

SegWit reportedly benefits the entire network. Decreased demand for block space results in lower average fees across the network. In fact, Milne recently put up a 0.1 BTC bounty for the creation of a bot that would simply post “When SegWit?” as a reply to every tweet for companies not using SegWit transactions. https://twitter.com/alistairmilne/status/1293984610611802112Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.