The Financial Action Task Force (FTAF) has criticized Qatar for its inadequate response to crypto money laundering and terrorist financing. Despite banning virtual asset providers and crypto transactions, Qatar has not effectively enforced the prohibition.

The Financial Action Task Force (FTAF) has reprimanded Qatar for its poor approach to money laundering. A report by the organization says that the country needs to make “major improvements” in its response to terrorist financing.

Qatar’s Crypto Money Laundering Convictions

The FATF is a Paris-based international watchdog that sets global standards to combat money laundering and terrorist financing. The organization’s report noted that although the country’s financial intelligence unit is “well-equipped,” its “sophisticated analysis capabilities” are not being used fully.

“Qatar has only secured a small number of terrorist financing convictions and prosecutions. There are major inconsistencies between Qatar’s risk profile and the type and extent of terrorist financing activity prosecuted and convicted.”

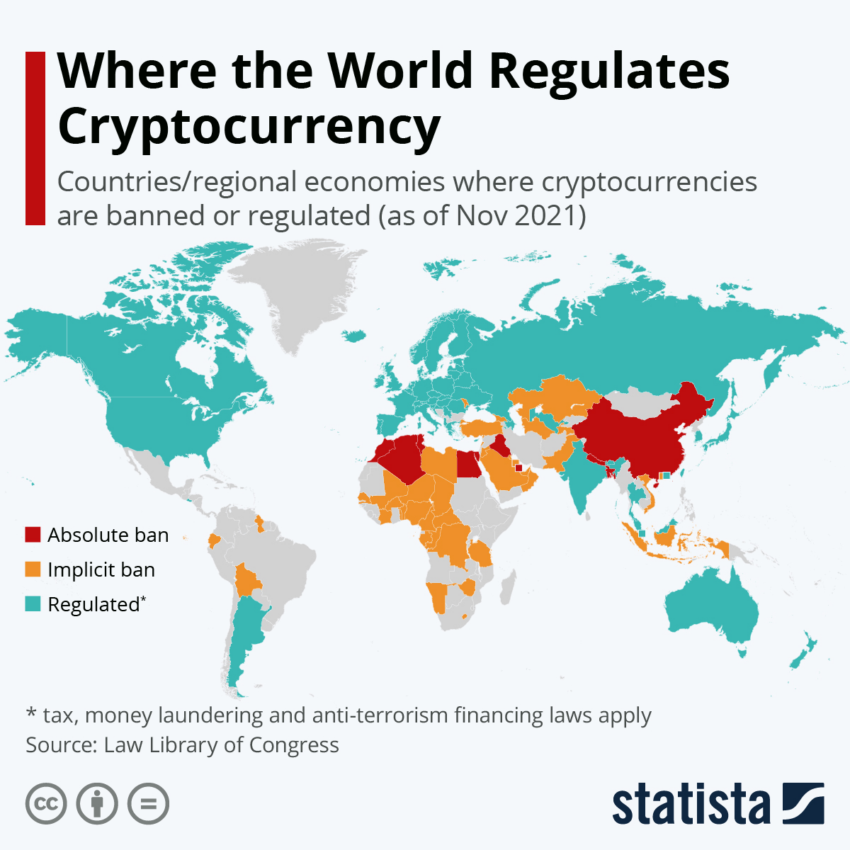

Qatar banned crypto in 2019. Still, FATF suggests that implementation was insufficient.

The organization concluded that Qatar had “not demonstrated that the competent authorities proactively identify and take enforcement action for potential breaches of this prohibition.” However, it did acknowledge that between 2020 and June 2022, 2007 transactions were rejected, and 43 accounts closed.

Ban on Cryptocurrencies in 2019

Responding to the FTAF’s report, Martin Cheek, managing director at digital compliance firm SmartSearch told BeInCrypto:

“Qatar has rightly won praise for the progress made in its anti-money laundering (AML) measures. But despite displaying strong technical compliance with FATF requirements, there is still work to be done to strengthen their AML framework. Without a robust digital compliance structure in place, any business can provide a vehicle for money laundering and a front for some of the world’s worst crimes.”

He continued:

“While Qatar has implemented a risk-based approach to assess both money laundering and terrorist financing, understanding the complex forms of these crimes needs improvement. The implementation of digital compliance would further bolster Qatar’s overall anti-money laundering framework”

Despite the ban on crypto and other digital assets, Singapore-based crypto exchange Crypto.com was an official sponsor of the 2022 FIFA World Cup. However, attendees could use the BitPay Card, a crypto debit card, to make purchases.

As the use of digital assets has risen, so has the concern about money laundering. Only this week, the EU opened a new consultation about tackling the crime. Across the globe, enforcement agencies are hiring more on-chain analysts to detect illicit capital flows.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.