The price of MATIC, the token that powers the leading Layer 2 (L2) platform Polygon, has declined by 10% in the past seven days. This has caused it to trade close to the lower line of the horizontal channel, which it has trended within since April 13.

If the bearish bias toward altcoins surges, the price risks plummeting below this critical support level and finding new lows.

MATIC Bears Look to Break Below Support

MATIC exchanged hands at $0.63 at press time, its lowest price since October 2023. Since April 13, its price has oscillated within a horizontal channel, bouncing between resistance at $0.75 and support at $0.64.

Usually, this channel is formed when an asset’s price consolidates within a range for some time. It is caused when there is a relative balance between buying and selling pressures, which prevents the price from trending strongly in either direction.

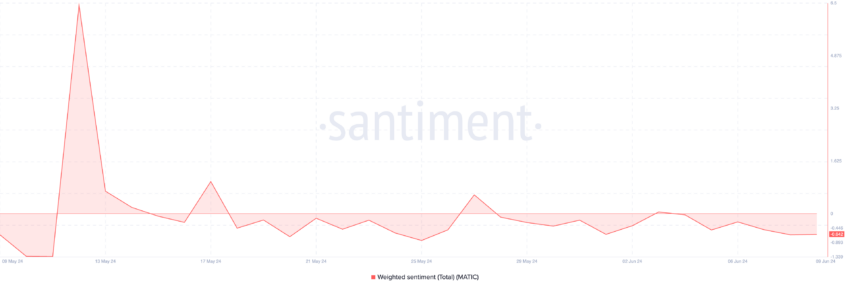

With MATIC’s price trending toward the lower line of this channel in the past week, it suggests a spike in bearish bias toward the altcoin. This was confirmed by its negative weighted sentiment observed on-chain.

Since the beginning of the month, MATIC’s weighted sentiment has been predominantly negative. At press time, this was -0.64.

This metric measures the overall positive or negative sentiment toward an asset by tracking the sentiment and volume of mentions.

A weighted sentiment value of -0.64 indicates a negative bias in the sentiment surrounding the asset. There are significantly more negative mentions than positive mentions.

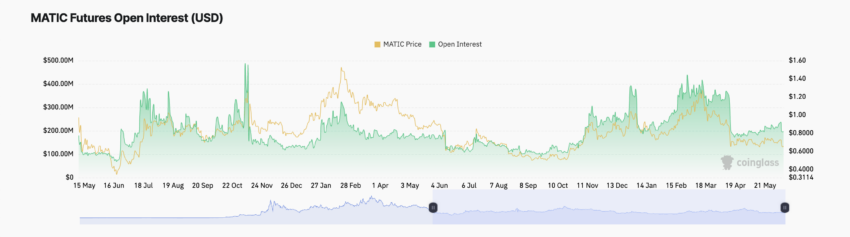

This bearish bias was also confirmed by MATIC’s declining futures open interest. At $197 million at press time, it has fallen by 8% since the beginning of June.

Read More: How To Buy Polygon (MATIC) and Everything You Need To Know

MATIC’s futures open interest tracks the total number of outstanding futures contracts or positions that have not been closed or settled. When it declines, more traders are closing their positions without opening new ones, which is a bearish signal.

MATIC Price Prediction: The Bulls Have Support to Defend

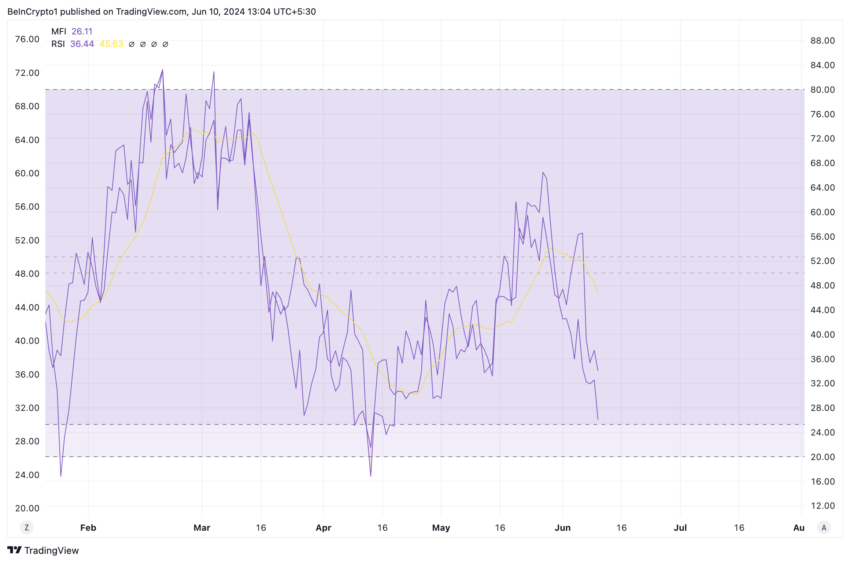

Readings from MATIC’s key momentum indicators showed an uptick in its sell-off among market participants. For example, its Relative Strength Index (RSI) was 36.44, while its Money Flow Index (MFI) was 26.11.

Traders use these indicators to measure an asset’s price momentum and identify potential buying and selling opportunities. At these values, MATIC is oversold as buying pressure continues to weaken.

If this trend continues, MATIC will fall below support at $0.64 to exchange hands at $0.61.

However, suppose the bulls successfully defend this support level, and sentiment towards the altcoin shifts to positive. In that case, it might rally to $0.67 and trend toward the upper line of the horizontal channel.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.