So far, July has been marked by a decline in user demand for the leading Layer-0 blockchain Polkadot (DOT). Activity on its Relay Chain and parachains is poised to close July at its lowest since the beginning of the year.

Its native coin, DOT, has also trended within a narrow range since the beginning of the month and is starting to see an uptick in selling pressure.

Polkadot Witnesses User Exodus

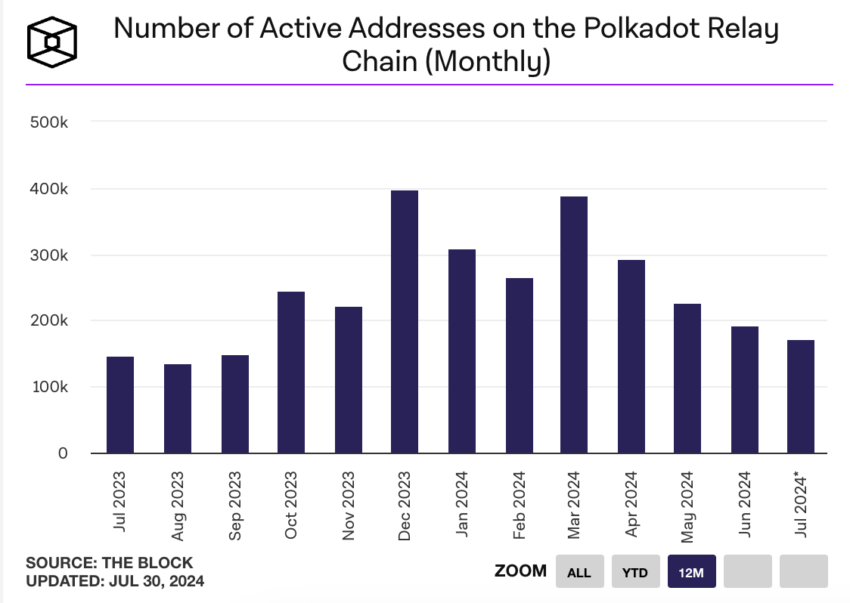

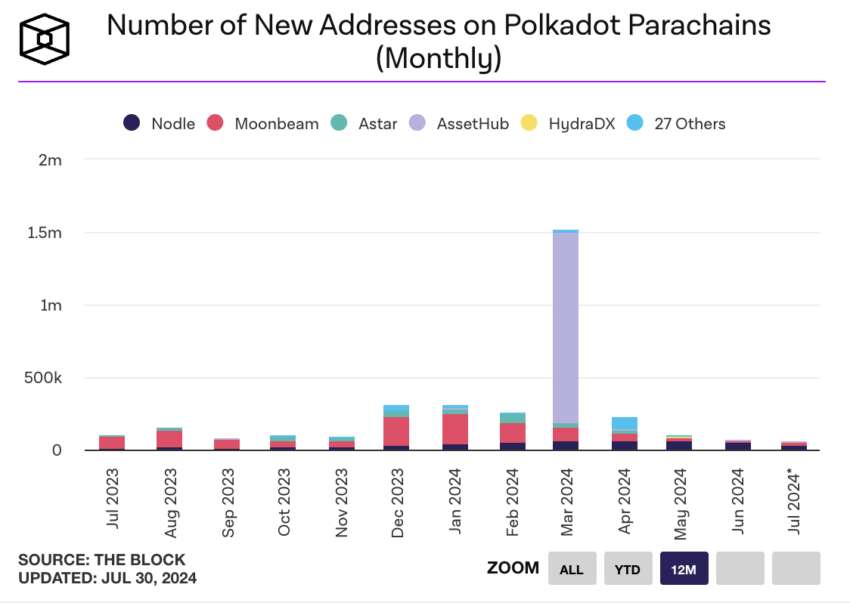

User activity on Polkadot’s Relay Chain and its parachains has plummeted to its lowest since January. Polkadot’s Relay Chain is the central chain of the network, which handles the coordination and security of the blockchain. Its parachains are individual blockchains that run parallel and are connected to the Relay Chain. They leverage the Relay Chain’s security and interoperability while operating independently.

According to data from The Block, 170,111 active addresses have completed at least one transaction on Polkadot’s Relay Chain this month, either as a sender or a receiver. This marks the network’s lowest monthly active user count since the start of the year.

Polkadot’s Relay Chain has also seen a significant decrease in new user activity. Over the past 29 days, only 27,900 unique addresses have participated in a transfer for the first time on the network. This marks a more than 75% drop in month-over-month demand since the year-to-date high of 112,000 new addresses in March.

A similar decline has also been observed across the parachains on the Polkadot network. During the month in review, the number of new addresses created on these chains has plunged by 21%.

These declines highlight waning interest in Polkadot among new and existing users.

DOT Price Prediction: Coin Trends Sideways, Amid Rising Bearish Activity

At press time, DOT trades at $5.68. The coin’s price has traded within a horizontal channel since the beginning July.

A horizontal channel is formed when the price of an asset consolidates within a range for an extended period. An asset trends within a range like this when there is a relative balance between buying and selling pressures, preventing its price from trending strongly in either direction.

The upper line of this channel forms resistance, while the lower line forms support. DOT has faced resistance at $6.53 and has found support at $5.56.

As selling pressure intensifies, DOT’s price is approaching the support line. If the bulls cannot defend this level, the downtrend will be confirmed, leading to a further decline in the coin’s price. If this happens, its next price target will be an eight-month low of $4.93.

However, if the bulls successfully defend support and DOT initiates an uptrend, its price may rally above resistance, and it will trade at $6.57.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.