Paxos, the premier regulated blockchain and tokenization infrastructure provider, has announced that it will end its relationship with Binance for the BUSD stablecoin brand.

The decision, which comes in close coordination with the New York Department of Financial Services (NYDFS), will take effect on February 21, 2023.

Paxos Ends Relationship with Binance

Paxos maintains that customer safety has always been its top priority. And this will not change in the wake of the recent announcement, the firm said. BUSD stablecoin will continue to be fully supported by Paxos, with all BUSD tokens issued backed 1:1 with US dollar reserves, held in segregated accounts.

Paxos Trust Co., a regulated entity overseen by the NYDFS and audited by a top-four accounting firm, will continue to manage the BUSD dollar reserves.

For customers looking for alternative options, the stablecoin issuer will redeem funds in US dollars or convert BUSD tokens to the Pax Dollar (USDP), another regulated US dollar-backed stablecoin. This move will not impact Paxos’s ability to serve its customers, continue growing its staff or fund its business objectives.

In fact, the company is said to remain dedicated to becoming the global leader in blockchain tokenization infrastructure. It aims to continue providing faster, safer, fairer, and more efficient financial systems to global enterprises.

Regulatory Pressure on the Rise

Paxos has reportedly received a letter from the Securities and Exchange Commission (SEC) indicating that the agency intends to sue the company for violating investor protection laws. This move is part of the SEC’s growing campaign in crypto enforcement as the agency intensifies its focus on major players in the crypto market.

The SEC issued a Wells notice to Paxos, which is used to inform a company or an individual of a possible enforcement action.

According to sources familiar with the matter, the notice alleges that Binance USD, a digital asset that Paxos issues and lists, is an unregistered security. Binance and Paxos announced the partnership to launch BUSD in 2019, and the digital asset exchange run by Paxos, itBit, also lists BUSD, along side many other crypto exchanges.

The specific details of the SEC notice are unclear, as it couldn’t be determined if it is related to Paxos’ issuing of the coin, the listing of the coin, or both. When asked for comment, a Paxos company spokesperson stated, “Paxos is not commenting on any individual matter.”

Binance has noted that BUSD is issued and owned by Paxos and that Binance only licenses its brand. In a statement, Binance said, “We will continue to monitor the situation.”

Firms that receive Wells notices can respond in writing and explain to the SEC why it should not proceed with a lawsuit. The SEC’s five commissioners must vote to authorize any enforcement settlement or litigation, and a Wells notice is not a final indication that the SEC will take enforcement action.

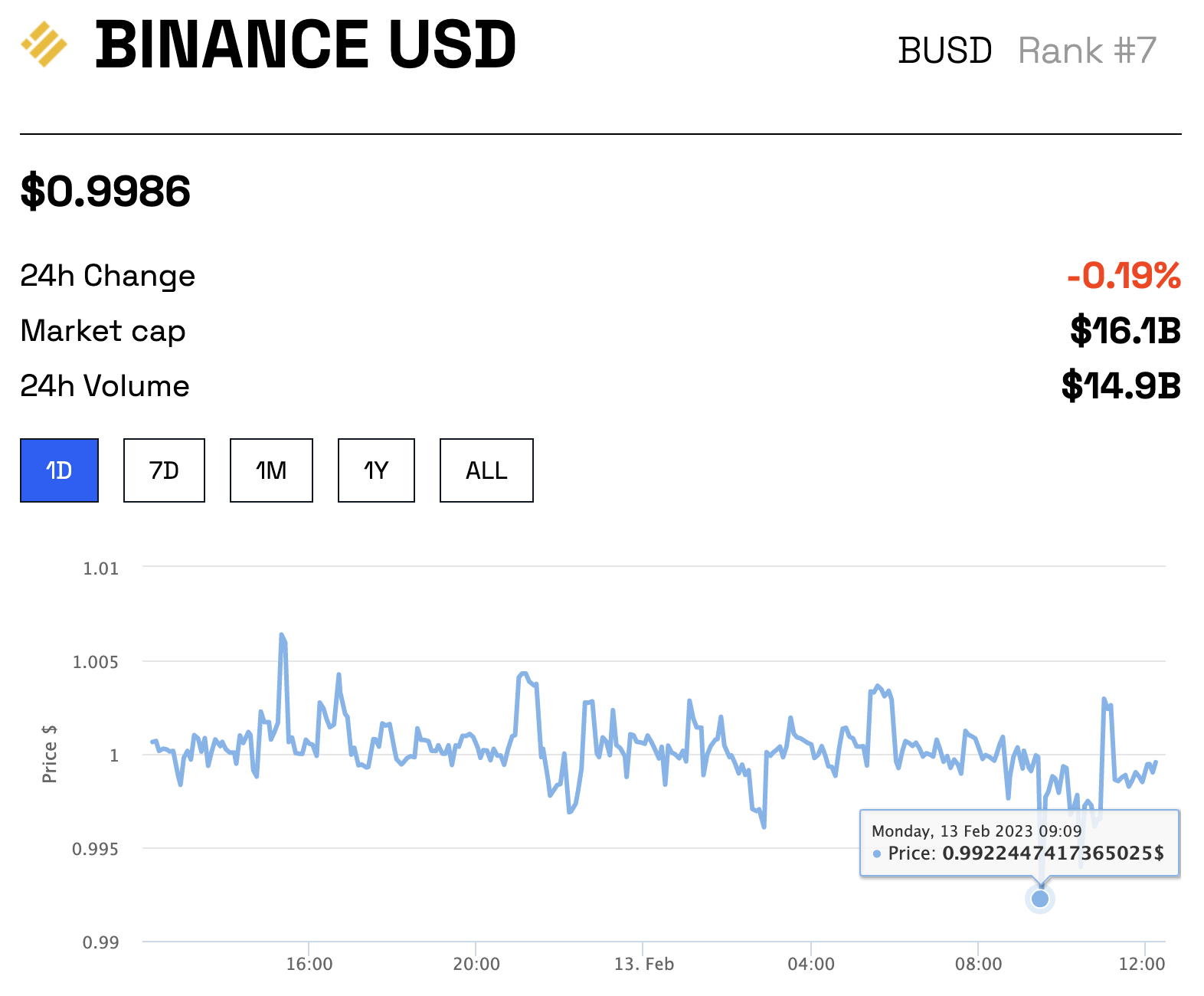

‘Stablecoin’ BUSD Depegs

The Binance-branded stablecoin, BUSD, faced a turbulent shift in value as regulators took action against its issuer, Paxos.

On Monday, BUSD, which aims to keep a one-to-one value with the US dollar, experienced a dip to $0.9922 compared to rival stablecoin, Tether (USDT), on Binance, as per data from BeInCrypto.

This deviation from its intended value came following the New York Department of Financial Services’ order for Paxos, which both issues and lists BUSD, to halt any additional minting of its tokens.