The price of Notcoin (NOT) may not showcase a bullish momentum that could trigger a rally. However, it is showing sufficient strength to potentially break through the downtrend.

This could reinvigorate the altcoin with enough strength to breach the three-week-old barrier.

Notcoin Investors Change the Tone

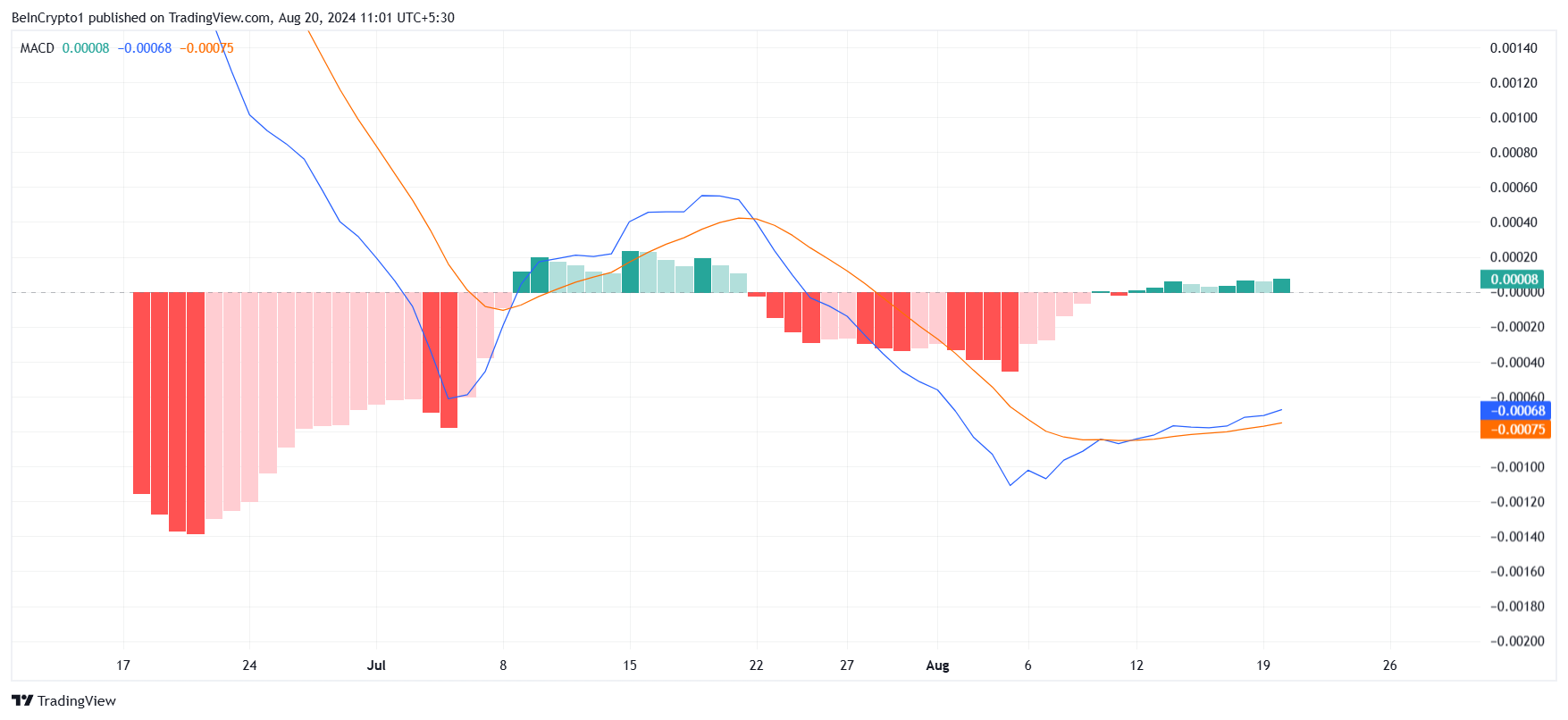

Notcoin’s price has been failing to note a recovery largely because the altcoin has witnessed no considerable bullishness yet. The Moving Average Convergence Divergence (MACD) indicator substantiates the same.

The indicator has been displaying green bars on the histogram, which is a sign of optimism towards recovery. However, the lack of price growth has subdued this hope, although there is just enough momentum to break out of the downtrend potentially.

Read More: What is Notcoin (NOT)? A Guide to the Telegram-Based GameFi Token

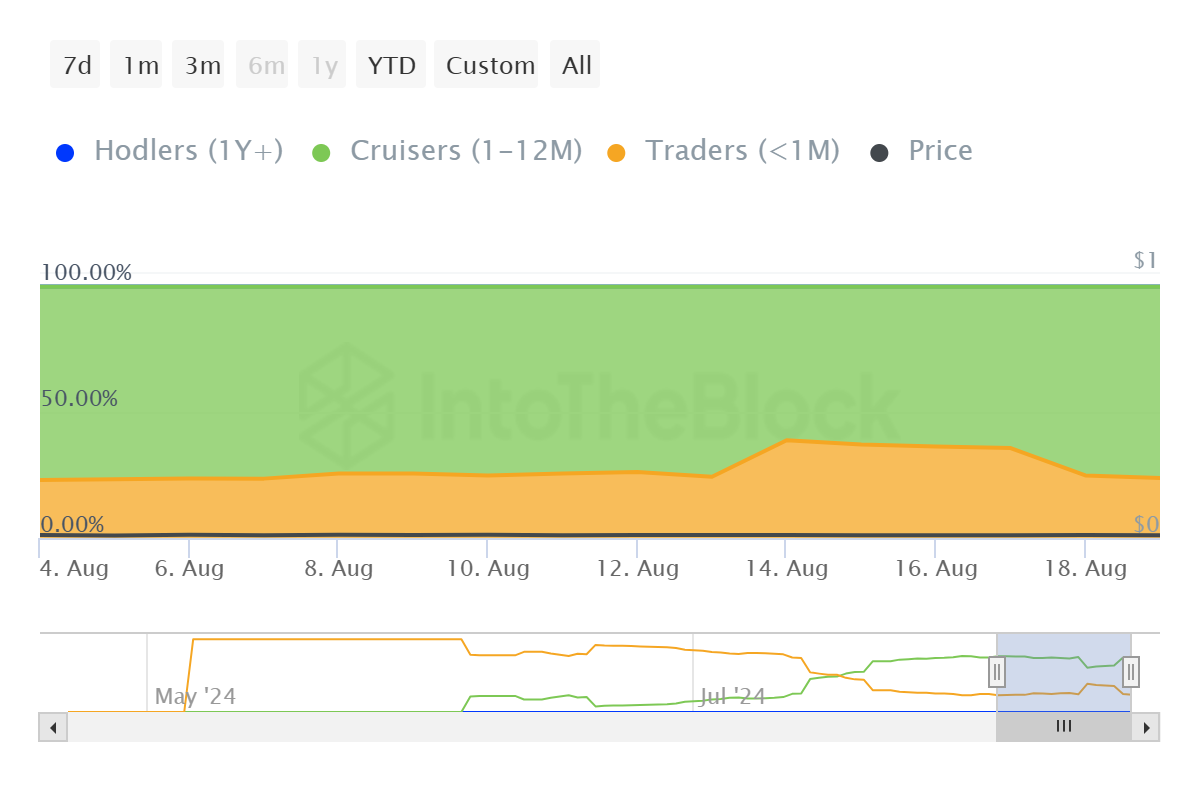

The reason NOT’s rise was subdued is the broader market cues and the recent surge in short-term investors. Towards the beginning of last week, short-term holders’ dominance rose from 24% to 38%.

This is a bad sign as these investors tend to hold for less than a month, making them susceptible to selling. Their domination above 25% is a bearish signal.

However, on the flip side, it has now dropped to 23%. This change could positively impact the price of the altcoin.

NOT Price Prediction: Rise Ahead

By the looks of it, Notcoin’s price could now initiate a recovery rally, as this downtrend has subdued the altcoin’s rise in the past. A confirmation sign of the initiation of recovery would come once the NOT token manages to flip $0.013 into support.

This line has been tested for support and resistance multiple times, making it a critical level. Breaching it would enable a further rise in Notcoin’s price, potentially sending it to $0.015.

Read More: How To Buy Notcoin (NOT) and Everything You Need To Know

But if the breach fails, the crypto asset could continue consolidating between $0.013 and $0.009. Prolonged sideways movement could invalidate the bullish thesis, extending investors’ wait for profits.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.