The Nigerian government continues to devalue its currency, the naira, according to reports from the central bank. The bank offered naira at a recent auction at 380 to the dollar, an increase of over 5%.

The increase followed a previous rate increase which saw a fixed price for dollars at 307 naira. The increase for the fixed currency auction reflects the black market pricing for dollars that is currently closer to 388 naira per dollar.

This devaluation also unifies the multiple exchange rates that the country has used. The International Monetary Fund (IMF) continues to call for a unification of its exchange rates. Unsurprisingly, the rate structure has caused substantial confusion among foreign investors.

Nigeria’s central bank hopes to stem the tide of inflationary pressures caused by the oil devaluation. As the most populous of the Oil Producing and Exporting Countries (OPEC), Nigeria experienced massive economic damage from the oil price collapse due to COVID.

Inflation Is Very Real

However, in spite of the country’s attempts to slow inflation, the government has now capitulated. The 5.3% devaluation reflects a more realistic exchange rate for the naira. Oil is Nigeria’s largest industry and the loss in revenue is palpable. The Nigerian central bank has already pumped $2.7 billion into its economy to help local businesses. The large stimulus has, however, naturally led to an increase in consumer pricing. The naira devaluation can already be seen on the black market. Much of the international business in Nigeria already takes place using dollars, and the naira’s revaluation only seeks to meet that rate.

The large stimulus has, however, naturally led to an increase in consumer pricing. The naira devaluation can already be seen on the black market. Much of the international business in Nigeria already takes place using dollars, and the naira’s revaluation only seeks to meet that rate.

Nigeria’s Stable Instability?

Of course, with the rebound in oil prices, the Nigerian economy has become somewhat stable again. While still nowhere near the pre-COVID pricing, oil has moved back into positive territory after experiencing unprecedented negative rates earlier this year. With oil prices stabilizing, the Nigerian government anticipates increasing economic stability as well. A similar type of recovery occurred after a currency change in 2016. Nigeria’s central bank governor, Godwin Emefiele, based in Abuja, said:“Having gone through this in 2015/2016, I am saying there’s no need for anybody to worry as long as you allow us to deal with this issue in an orderly fashion, you will be paid your money.”The promise of stability, however, has not kept foreign investors from looking elsewhere. A large number of foreign entities, particularly in the oil industry, have move operations out of the country.

Similar Declines

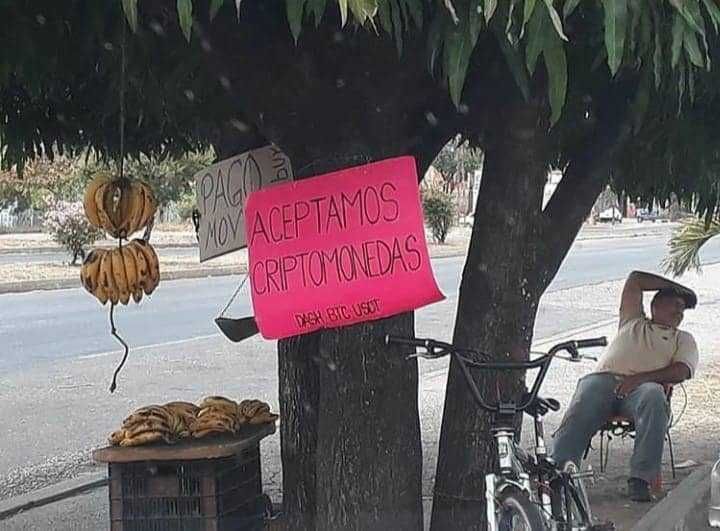

Currency devaluation is very quickly becoming a recurring theme in modern society. Recent events from around the world reveal similar collapses. Beincrypto recently reported on the fall of the Lebanese pound to under 1 Satoshi. The patchwork effort to fix the exchange rate only drew protests from locals who saw the financial ruin coming. The ‘Ponzi scheme’ had shifted production of local goods completely overseas, as imports from other countries vastly out-priced them. The result was a single-industry economy built on printed cash. With nothing to support the currency, COVID has subsequently left the currency decimated. In a similar vein, Venezuela continues to feel the effects of hyperinflation. The bolivar’s drop against the dollar is relentless. Even attempts to digitize local currency with the petro have failed as the free market rejected government-fixed pricing. As a result, foreign companies like Wells Fargo have moved operations out of the nation. The mass exodus has left the locals struggling to find ways to make payments of any kind, apart from digital currencies like Bitcoin or Dash.

Banking Crisis Looming?

The struggles have been widely blamed on the central banks in each of these nations. Of course, with no end of the COVID crisis in sight, most banks feel their hands are tied to generate stimulus. It’s evidently clear that the fiscal policies of these nations are one-directional. A consistent money printing plan that temporarily fills financial gaps never allows the market to correct. Nigeria’s current reserves stand at around $36 billion. However, the fundamental pressures leading to the devaluation remain in play. And the banking policies will continue to have negative lasting ramifications.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored