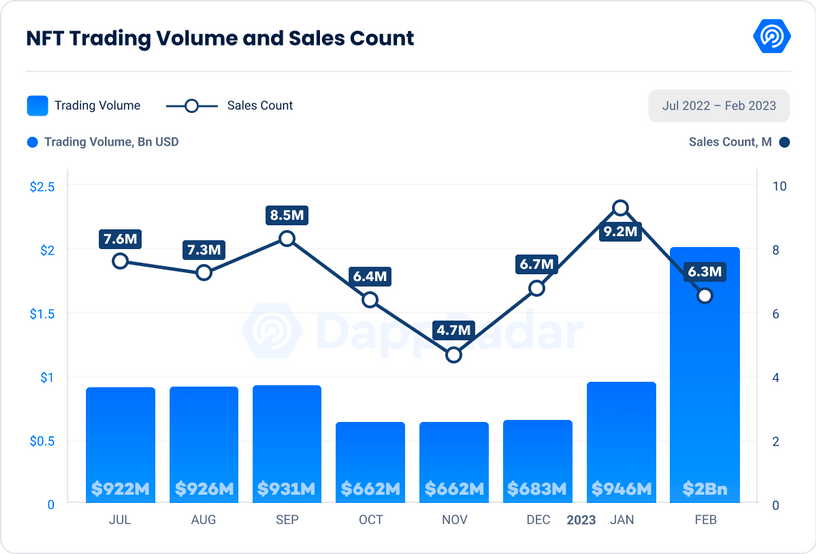

The NFT market looks to have pulled itself out of the nadir of 2022, according to the latest report by DappRadar.

The NFT market has been on a wild ride over the past few months, with February being a pleasant addition. The surge in trading volume was nothing short of remarkable—reaching $2 billion—the highest since May 2022. The rise was partly fueled by the popular NFT marketplace, Blur, which dominated the market with $1.3 billion in trading volume. The rise represents a 117% increase from the previous month.

The NFT sector also increased its dominance in February, reaching 9.46% from 8.47% in January, with an average of 153,337 daily unique active wallets (dUAW.) The DeFi ecosystem also experienced significant growth, with an average of 390,675 dUAW, increasing its dominance from 21% in January to 24% in February.

Polygon, the Ethereum sidechain, saw an explosive 147% increase, reaching $39 million in NFT trading volume. Meanwhile, other platforms, such as Immutable X and BNB Chain, also had a great month. Immutable X, focusing primarily on video games, witnessed a 71% surge in NFT trading volume, totaling $24.4 million. BNB Chain noticed a similar growth, with $7 million in NFT trading volume.

Blur Accused of “Market Manipulation”

However, the star of the show remains Blur, which boasts a unique trading pattern that sets it apart from other NFT marketplaces. Platforms like OpenSea cater more to casual NFT enthusiasts engaging in smaller trades on an occasional basis. Blur is meant to hook those who engage in high-volume trades with reasonable frequency.

Despite its success, not everyone is thrilled with Blur’s trading activity. CryptoSlam announced on Friday that it would remove $577 million worth of Blur trades from its data. It cited “market manipulation” as the reason for its decision.

Blur’s unprecedented rise in NFT trading volume is primarily driven by “whales” who engage in constant buying and selling of NFTs through bid pools to farm token rewards for the next airdrop. However, not everyone agrees that this kind of token flipping is tantamount to wash trading.

Despite the controversy, Blur maintains that its platform has a lower percentage of wash trading than previously suggested. It cites data from Dune Analytics as evidence to support its claim.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.