NEAR price is failing to secure its recent gains, as the altcoin just lost half of its profits from early July.

Worsening this is the increase in investors’ pessimism, which could cause further damage to the altcoin.

NEAR Investors Pull Back

NEAR price could remain sideways bound or note a drop owing to the market’s changing conditions and the investors’ sentiment. The Moving Average Convergence Divergence (MACD) indicator recently noted a bearish crossover, signaling increased selling pressure on NEAR investors.

This technical development suggests that downward momentum may continue in the near term.

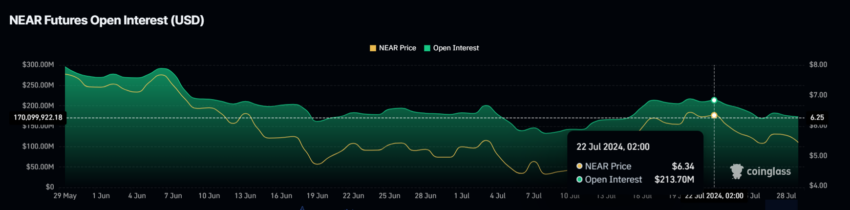

Additionally, NEAR’s Open Interest has declined significantly. Over the past week, it has dropped by 20%, falling from $213 million to $170 million.

This decrease in Open Interest is largely attributed to the recent price drop. As the price fell, traders likely closed their positions, leading to a reduction in overall market activity.

Read More: What Is NEAR Protocol (NEAR)?

Overall, these indicators suggest that NEAR is currently facing substantial selling pressure, which could impact its short-term price movements. Investors should remain cautious and closely monitor these developments.

NEAR Price Prediction: Another Drawdown on the Cards

NEAR price trading at $5.63 is holding above the 23.6% Fibonacci Retracement line. This level is known as a bear market support floor, which keeps the altcoin from falling further despite the bearish cues.

However, if the aforementioned conditions intensify, a decline below this line cannot be ruled out. Losing the support of $5.39 could send NEAR falling below $5.00, potentially sliding to $4.39.

Read More: Near Protocol (NEAR) Price Prediction for 2024

But a bounce back is also possible if the support remains intact and the market improves. Once the 38.2% Fib line at $6.08 is flipped into support, a recovery rally could initiate, invalidating the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.