According to a recent CNBC interview appearance, MicroStrategy Chairman Michael Saylor took a jibe at Charlie Munger and other elite business leaders over their continued criticisms of Bitcoin.

According to Saylor, Munger and other crypto critics would have appreciated this asset class if they had spent time studying the Bitcoin. The American entrepreneur affirmed that the commoner’s plight is evident in countries where the national fiat currencies have massively declined.

He added that he was “sympathetic” toward Munger’s objections to Bitcoin.

Saylor’s comment is coming on the heels of Charlie Munger’s recent article on why the US government should ban crypto. According to Munger, crypto is not a Bitcoin but a gambling contract.

Previously, Munger described crypto as a rat poison and a bad combo of fraud and delusion.

Michael Saylor Remains Bullish on Bitcoin, Asks For More Regulation

Saylor also shared his company’s plan to launch a Bitcoin Lightning enterprise software. MicroStrategy’s Lightning would allow businesses to reward their customers at the speed of light. He added that he is committed to the spread of the flagship digital asset.

The Bitcoin advocate also noted that the crypto market needs to mature. He highlighted that the space needs more regulatory clarity from regulators worldwide to reach its peak. Saylor said:

“Our strategy is to buy and hold Bitcoin, and the key for us is to be consistent, transparent and responsible in the pursuit of that strategy.”

Following the record market crash in 2022, regulators have increased their regulatory efforts toward the industry. Recently, the US Commodities and Futures Trading Commission (CFTC) promised to bring more enforcement actions toward non-compliant crypto projects.

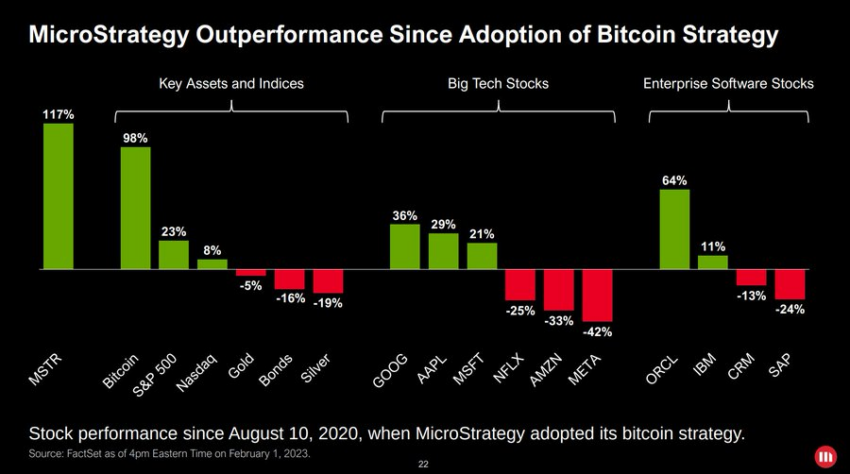

MicroStrategy Stock Soars

MicroStrategy shares have risen by almost 100% since the beginning of the year. MSTR saw its market value grow to $285.45 during Feb. 3 before dropping to its current value of $284.76.

The improved stock performance is coming on the heels of another quarterly loss — the firm reported a net loss was $249.7 million during the fourth quarter of 2022. Canaccord Genuity also upped its price target on MicroStrategy to $400 from $372.

Other analysts have pointed out that the firm is only down 20% due to dollar cost averaging into the market, besides the highly controversial buys near ATHs.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.