Meet Kyber Network, a multi-chain cryptocurrency trading and liquidity hub that connects liquidity from different sources in order to enable trades at the best possible rates for traders, while enabling liquidity providers to maximize earnings through capital efficiency.

Background and history

Founded in 2017, Kyber Network has offices in Singapore and Vietnam, and team members all over the world.

Kyber Network is an ever-growing pioneer in the DeFi space having developed one of the earliest decentralized exchanges (DEX) with the co-founder of Ethereum himself, Vitalik Buterin, as an advisor. The Kyber team has continued to innovate; spearheading the launch of WBTC (Wrapped Bitcoin).

WBTC is the most popular ERC20 version of Bitcoin at this point in time. The team is also hard at work at developing amplified liquidity pools on the KyberSwap platform in order to offer capital efficiency for any token pair. Kyber Network has been growing exponentially and as such is a part of the pioneer batch of Alliance DAO/DeFi Alliance mentors.

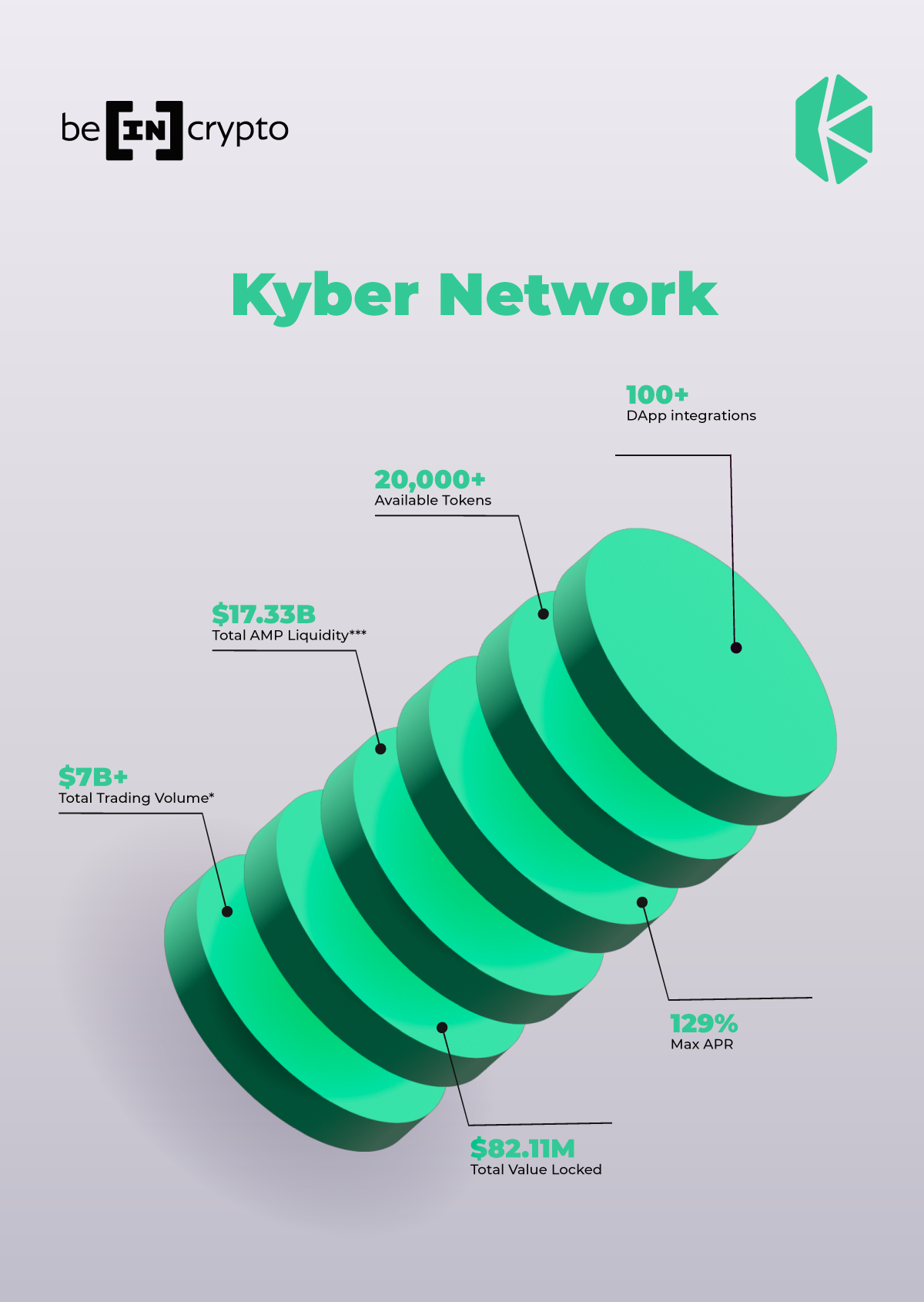

Through its flagship DEX (decentralized exchange) aggregator and liquidity protocol, KyberSwap.com, Kyber Network connects liquidity from different sources to enable instant token trading at the best rates and the best returns for token liquidity providers.

The Kyber Network vision is to become the preferred liquidity hub for the decentralized economy and community. A place where any user, trader, or application can easily access the required tokens for their liquidity needs.

Kyber Network is committed to expanding its reach and building protocols that support convenient and secure value exchange in decentralized finance, and beyond.

KyberSwap, the DeFi disruptor

DeFi needs decentralized liquidity and that’s where KyberSwap.com excels. As Kyber’s flagship DEX aggregator and liquidity protocol, KyberSwap has the potential to be the key infrastructure that provides the necessary liquidity for the whole ecosystem of Dapps to operate. KyberSwap intends to revolutionize the DeFi space and build a world where any token is usable anywhere at the best rates.

Over 100 integrated projects have integrated KyberSwap and over $7B worth of transactions for thousands of users have been facilitated since its inception. KyberSwap is currently deployed across 11 chains including Ethereum, BNB Chain, Polygon, Avalanche, Fantom, Cronos, Arbitrum, Velas, Aurora, Oasis, and BitTorrent.

Problems solved

Kyber solves the ever-present liquidity issue in the decentralized finance (DeFi) industry by allowing developers to build products and services without having to worry about liquidity for different needs.

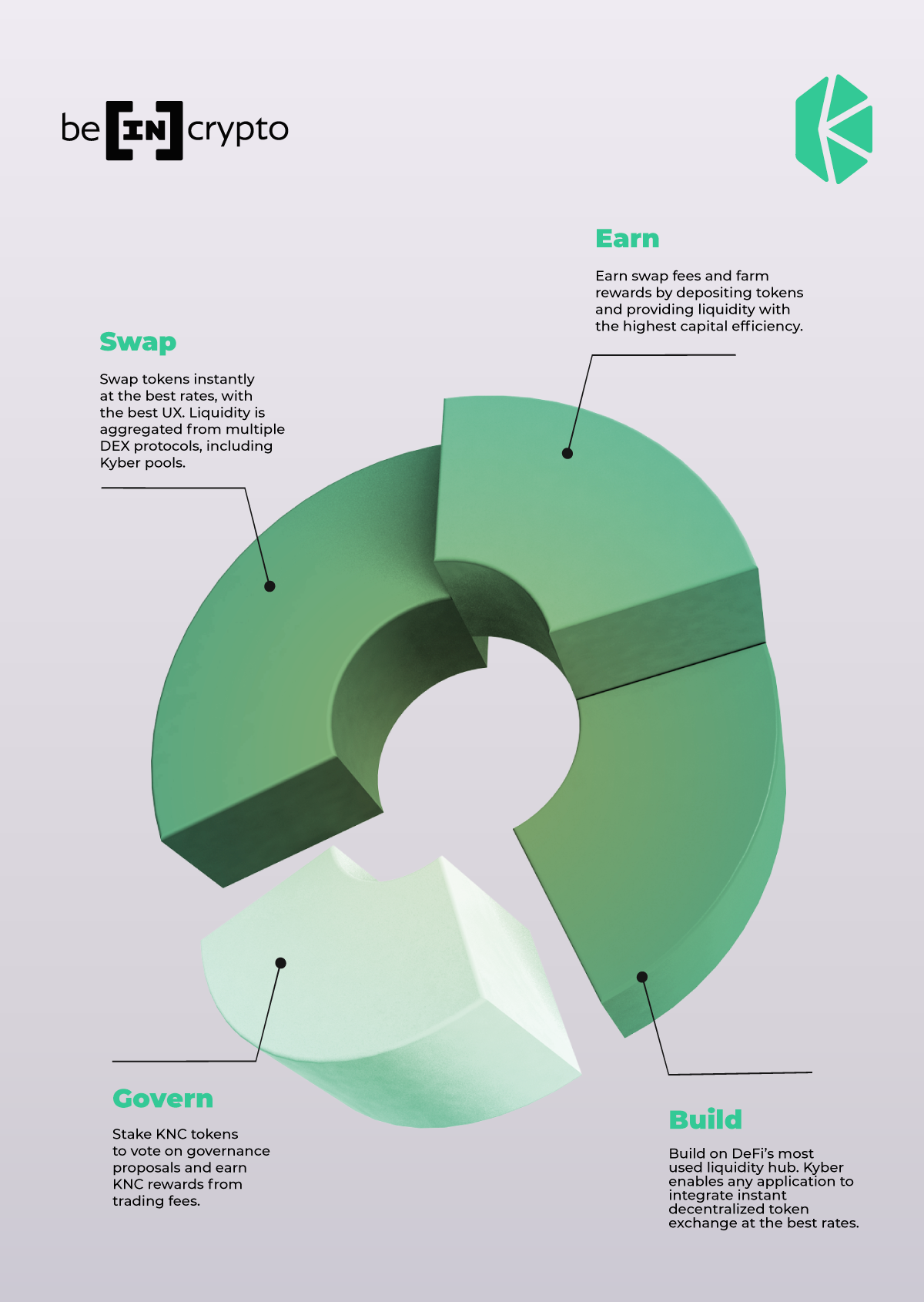

- For Traders: KyberSwap aggregates liquidity, automatically searching multiple DEXes to identify and select the optimal trade routes and best prices for users. KyberSwap makes trading more efficient and saves time and money for thousands of users. KyberSwap sources liquidity from over 60 different DEXs such as Uniswap, Sushi, Curve, QuickSwap, Pancakeswap, Traderjoe, Pangolin, SpookySwap, SpiritSwap, VVS Finance and many others to achieve the best rates for traders on supported chains.

As a bonus, KyberSwap users can identify which tokens are ‘Trending’ and ‘Trending Soon’. Tokens that are displayed under the Trending tab on the platform are based on current trending data that has been gathered from leading data aggregators CoinGecko and CoinMarket. Whereas tokens displayed under the Trending Soon section are detected based on Kyber Network’s trend detection algorithm. The algorithm makes use of trading volume, price, market cap, and other on-chain data in order to display the final results.

- For Liquidity Providers: KyberSwap allows anyone to deposit tokens and efficiently make use of their capital, earning fees over time. This is possible via KyberSwap’s amplified liquidity pools that greatly improve capital efficiency and reduce trade slippage. KyberSwap is able to cater to the needs of different liquidity providers and market makers. Liquidity providers achieve better capital efficiency, rates, volume, and returns compared to other platforms. In addition, KyberSwap has joint liquidity mining activities with top DeFi projects that provide bonus incentives so liquidity providers earn even more.

- For Dapp developers: On its mission to disrupt the industry, KyberSwap prioritizes easy integration by allowing blockchain Dapps to easily integrate with its liquidity pools and aggregation API to give the best rates to their users, saving time and resources. KyberSwap is integrated by Dapps such as Coin98 Wallet, DEXTools, Kattana Trade, and Rome Terminal, as well as other top Aggregators such as 1inch, Paraswap, 0x API, Matcha, and Slingshot. KyberSwap documentation can be found here.

KyberSwap’s operations are open, transparent, and verifiable on the blockchain, with permissionless access for any trader, liquidity provider, or Dapp.

KyberDAO and KNC

KNC is Kyber Network’s native token and KyberDAO is a decentralized autonomous organization (DAO) that allows KNC holders to participate in the governance of Kyber Network. In 2021, KNC went through a migration/upgrade process to enable KNC to be more dynamic and flexible with the capacity to undergo upgrades more efficiently and give greater control to the KyberDAO.

The upgrade made the token more dynamic and flexible with the capacity to undergo upgrades more efficiently. KNC is a dynamic token and can be upgraded, minted, or burned by KyberDAO to better support liquidity and growth. KNC is primarily an ERC-20 token that can be bridged to other chains such as BNB, Polygon, Avalanche, BitTorrent, and other EVM compatible chains. For now, KNC staking is only available on Ethereum, with plans for multi-chain staking in the future.

KNC allows token holders to play an integral role in building a wide base of stakeholders and capturing the value created by new innovations on the network. KNC holders stake and vote in order to receive trading fees from KyberSwap.

The more trades that are executed and protocols integrated with KyberSwap, the more rewards are generated.

KNC holders who stake KNC in KyberDAO are given the privilege to vote on important decisions. As a voter, you receive trading fees and other benefits from ecosystem collaborations on the network. KNC allows KyberDAO to shape token behavior and upgrades, thus making KNC more adaptable and also providing better support for innovation and growth.

KNC investors and backers include Hashed, Signum Capital, ParaFi Capital, HyperChain Capital, and Stake Capital.

Staking and Earning KNC on KyberDAO

Anyone is allowed to stake KNC, vote on proposals, and claim KNC rewards on the official KyberDAO interface, Kyber.org. Kyber.org has been optimized for all devices including mobile and works well on any web3 and DApp browser.

The amount of KNC rewards received by the user is based on the trading volume of KyberSwap and other factors such as the user’s staked KNC amount.

How to participate in KyberDAO

Follow these steps:

- Visit the official KyberDAO website kyber.org

- Connect your Ethereum wallet

- Stake KNC to get voting power. Alternatively, you’re also able to delegate your voting power to someone else, e.g. a staking service

- Wait for the next voting epoch to commence. Each epoch is ~2weeks

- Vote on all proposals

- After voting, claim your rewards in the next epoch. Rewards are paid in KNC.

- Join Kyber’s official Discord Server and follow the KyberDAO Twitter account for the latest updates

Kyber Ventures

Kyber Ventures is the investment arm of Kyber Network, with the goal of supporting the entrepreneurs building the next giants of the decentralized world.

The goal of the investment arm is to share its insight, experience, and connections from all its years of building in the space to help new projects and new founders succeed.

Kyber Ventures takes a robust hands-on approach to taking on projects from technical designs, product positioning, branding, business development to community building at all stages. Some notable portfolio companies include GameFi projects Pegaxy and Sipher, and the NFT-centric L1 chain, Aura Network.

Trade and earn tokens at the best rates in DeFi

Kyber Network’s goal for the coming years is to make its flagship product KyberSwap.com the best platform for users to trade, earn, and participate in DeFi on all chains. Aside from solidifying its position in the market, Kyber aims to be at the forefront of DeFi and continue to innovate and pioneer new initiatives in the industry.

To stay up to date with Kyber Network, their latest developments, and news, follow them on their social media channels: Discord | Twitter | Blog | Global Telegram |