Islamic Coin (ISLM), the native coin of the HAQQ blockchain, has seen its value grow by double digits in the last month. At press time, the altcoin trades at $0.05, recording a 25% price surge during that period.

However, as coin holders begin to book gains, ISLM has initiated a downtrend.

Islamic Coin Looks to Break Below Ascending Channel

ISLM’s price rally in the last month has led to the formation of an ascending channel. An ascending channel is a bullish signal formed when an asset’s price moves between two upward-sloping parallel lines.

The upper line of the channel acts as resistance, while the lower line serves as support. Since beginning to trade within this channel, ISLM has faced resistance at $0.06 and found support at $0.05.

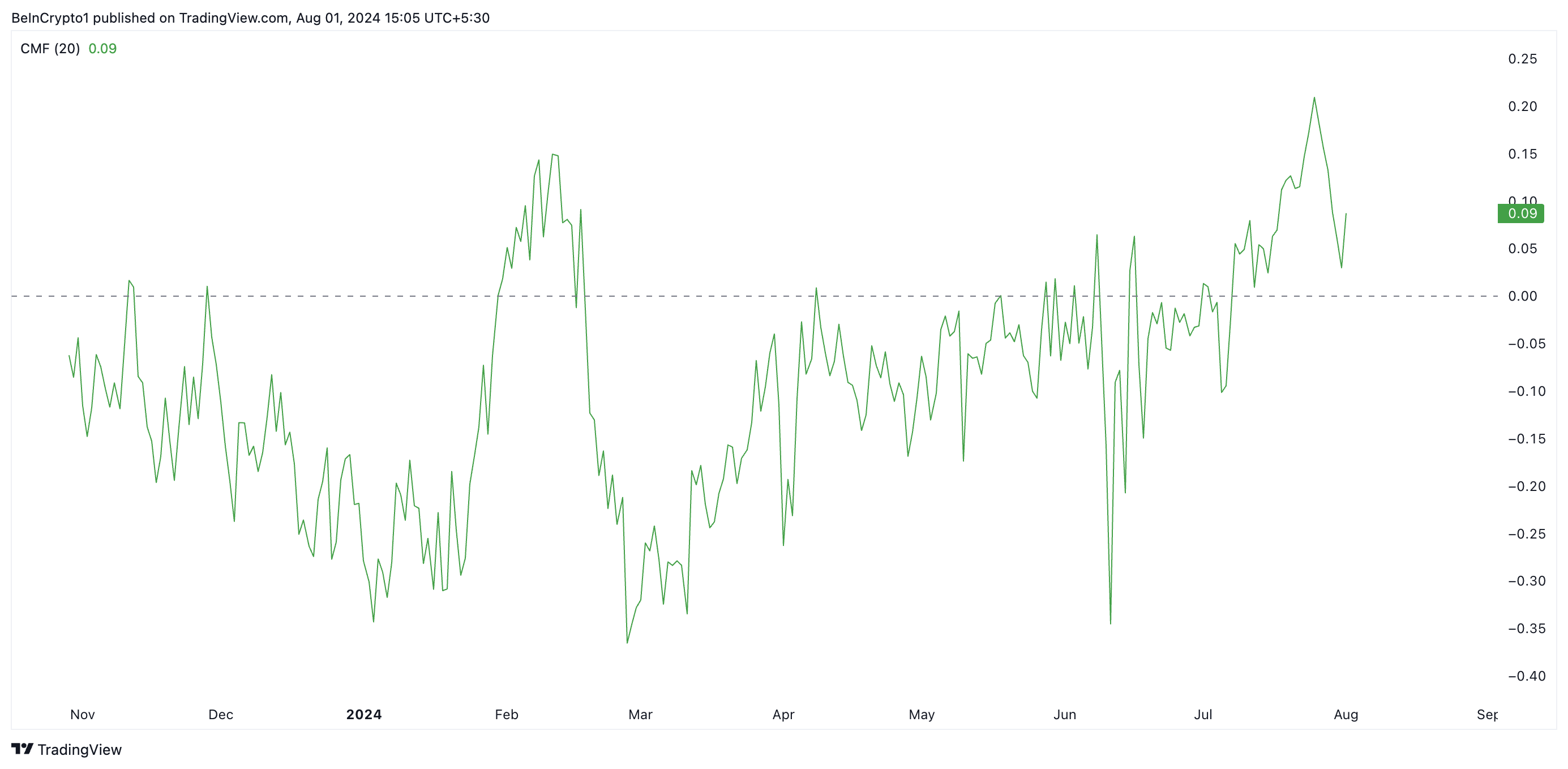

As selling pressure gains, ISLM now trends toward support. This confirms the decline in buying activity and a preference for profit-taking. At press time, the coin’s Chaikin Money Flow (CMF) is in a downtrend, suggesting a decrease in liquidity inflow.

An asset’s CMF measures how money flows into and out of its market. A falling CMF indicates a decrease in buying pressure relative to selling pressure, suggesting a shift in market sentiment towards a more bearish outlook.

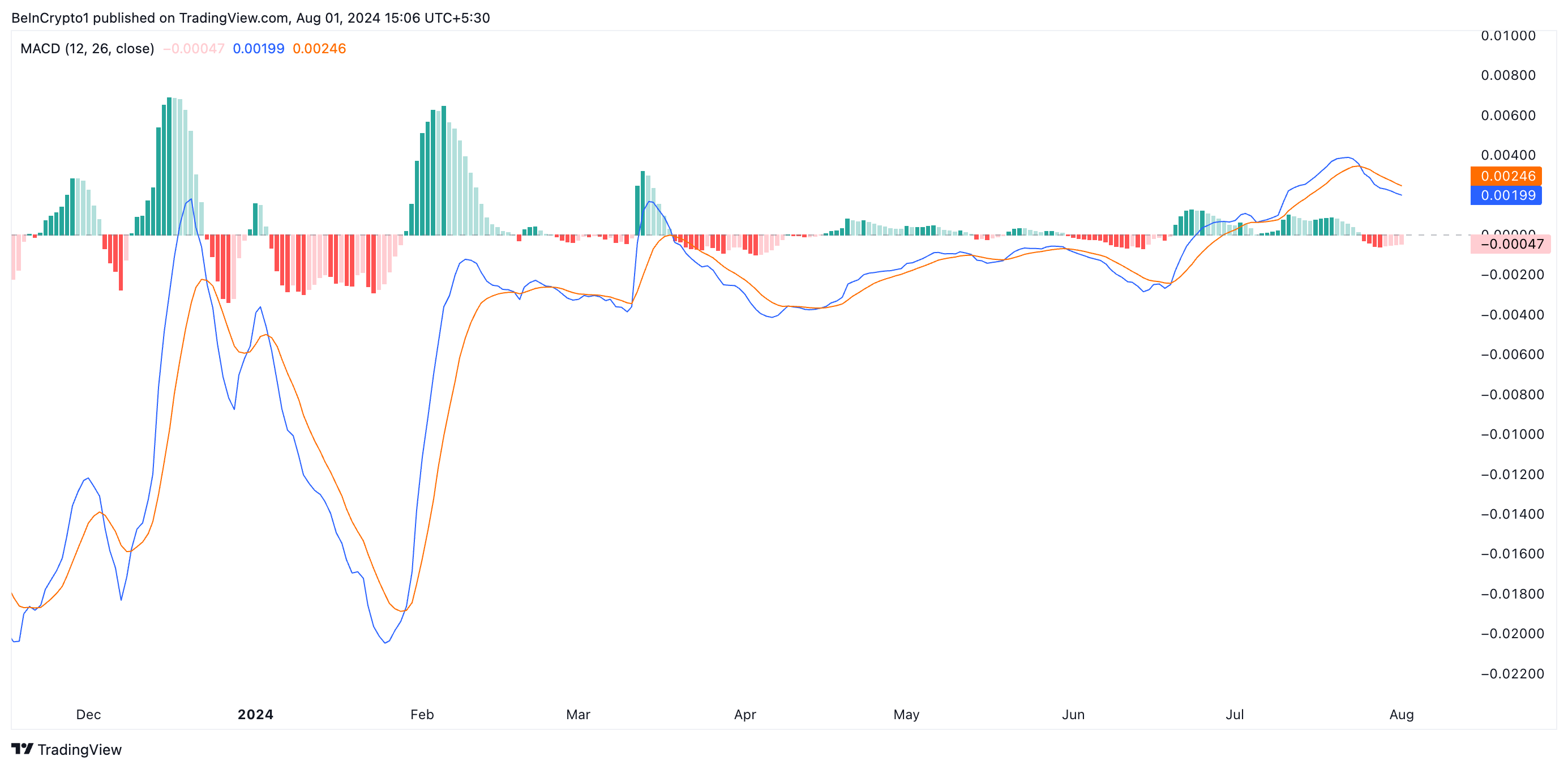

According to readings from ISLM’s Moving Average Convergence/Divergence (MACD) indicator, the bears have regained market control. This is evidenced by the MACD line (blue), which crossed below the signal line (orange) on July 24.

Read more: Which Are the Best Altcoins To Invest in August 2024

The MACD indicator identifies an asset’s trend direction, changes, and potential price reversal points. When the MACD line falls below the signal line, it suggests that the asset’s price momentum is weakening and may be starting to reverse its upward trend. Traders interpret this bearish signal as a sign to exit long and take short positions.

ISLM Price Prediction: Bulls Must Defend Support Level

If ISLM continues this trend, it will breach the lower line of its ascending channel. When an asset breaks below this line, it typically indicates that the bulls have failed to defend support, signaling a weakened uptrend and dominant selling pressure. This often precedes a sustained price decline.

Should ISLM’s bulls fail to defend support, its price may fall to a multi-month low of $0.034.

However, if current trend changes and buying pressure increases, the coin’s price will rally to $0.11.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.