The injective (INJ) price did note a bullish development, but this may not be sustained owing to rising investor skepticism.

The increasing selling pressure is evident in the actions of the INJ holders, which is reducing the chances of recovery.

Injective Holders Are Moving Their Holdings

Injective’s price is bearing the brunt of the surge in selling among investors, which is increasing the outflows on the network. Chaiking Money Flow, sitting at a two-month low, is evidence of this.

The Chaikin Money Flow (CMF) is a technical analysis indicator measuring the volume-weighted accumulation and distribution average over a specific period. It helps traders identify the strength of a trend by analyzing the relationship between price movements and trading volume.

The indicator’s presence above 0 suggests rising buying pressure, while a dip below it suggests increasing selling pressure. Currently, INJ is witnessing the latter, with the indicator sitting at April lows.

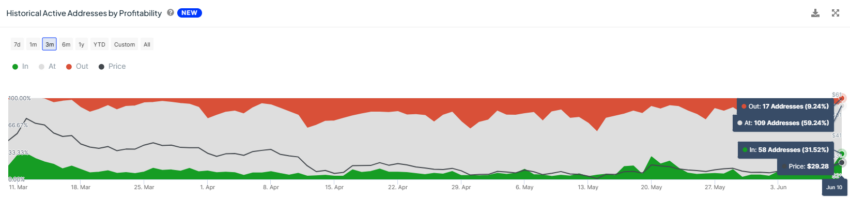

The actions of investors themselves further substantiate this outflow. Upon observing active addresses by profitability, one can note that the investors in profit have considerable domination.

This cohort’s participation hints at potential selling, and their domination of more than 25% is a bearish sign. In the case of INJ, their presence dominates 31% of all active addresses, making the case for a bearish outcome.

Read More: 9 Cryptocurrencies Offering the Highest Staking Yields (APY) in 2024

INJ Price Prediction: Breakout May Breakdown

Injective’s price, trading at $29.3, is close to the resistance at $30.9, but in order to breach it, the rally would need to continue. Given that the altcoin recently broke out of the consolidation between $28.0 and $21.3, it seems possible.

However, the aforementioned conditions suggest a different route for INJ. The breakout could fail, and Injective’s price could fall back below $28.0, making it vulnerable to consolidation again.

Read More: Top 9 Web3 Projects That Are Revolutionizing the Industry

Nevertheless, if INJ bounces back from $28.0, having already closed above it, it could prevent the decline. This would also enable the altcoin to breach $30.9, invalidating the bearish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.