Trading at the psychological level of $60,000, bitcoin (BTC) has just generated the sixth green candle in a row. Many on-chain analysis indicators suggest we are witnessing the start of the second phase of the ongoing bull market.

This week, we are taking a look at some indicators that suggest a creation of a solid base for the continued bull run in the second quarter of 2021. Long-term “hodlers” are increasingly selling off their BTC, but there is still more room for potential gains.

BTC price action

BTC has just closed its sixth green monthly candle in a row, marking an ongoing bull market. On-chain analyst @WClementeIII, a.k.a. William Clemente III, pointed out that in the 2017 run, the leading cryptocurrency managed to generate not more than five green monthly candles. However, during the even earlier cycle, it happened twice — from April to September 2012 and from October 2012 to April 2013.

On the daily chart, BTC is still consolidating between $51,250 and $61,160 that has lasted since reaching an all-time high on March 13. Along with approaching the upper end of the range, the correction of almost 20% seems to be coming to an end. Reclaiming the $60,000 psychological price level would send a bullish signal to the market.

A foundation for increase

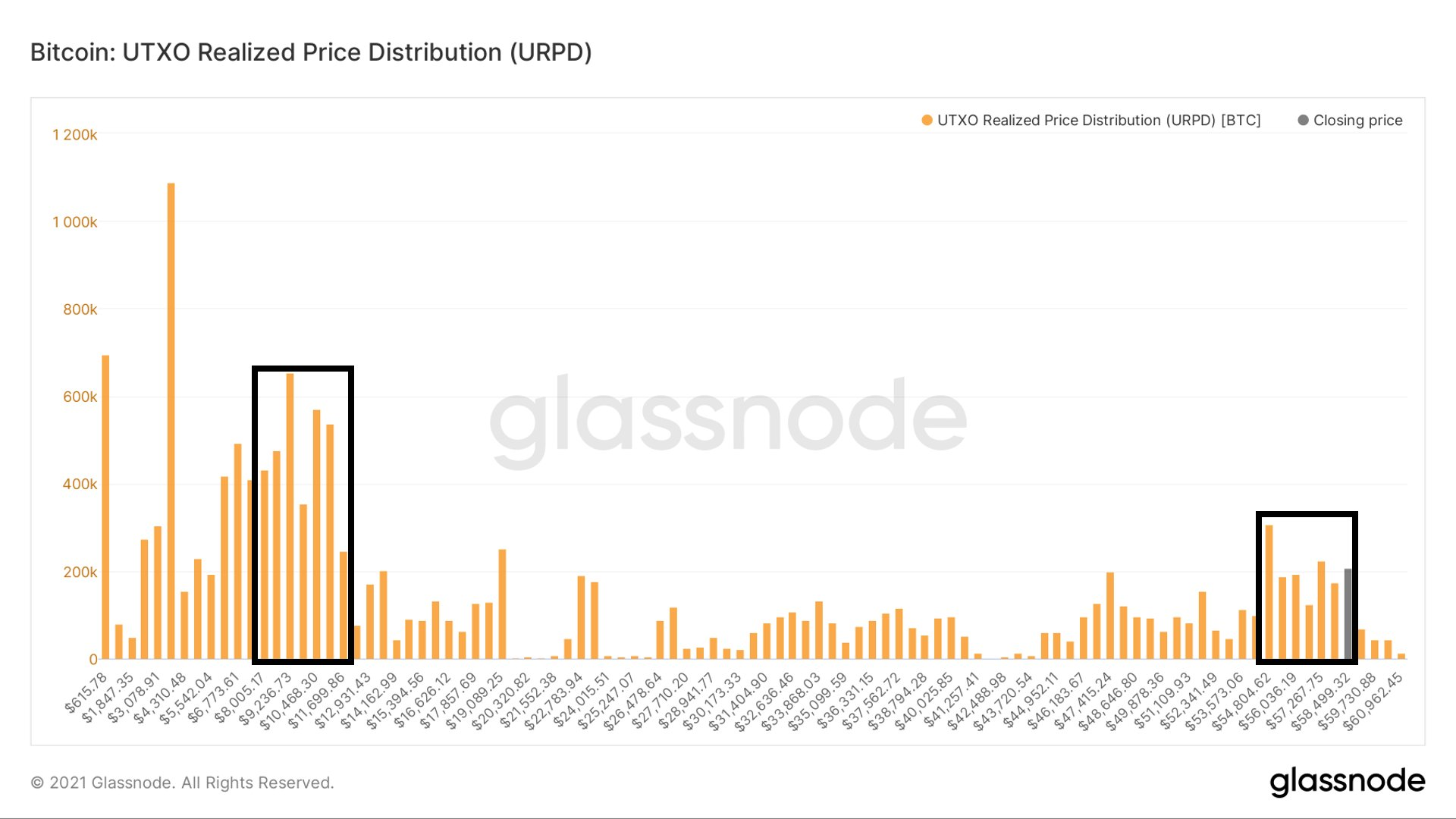

More and more on-chain indicators confirm that the crypto market is entering the second phase of the ongoing bull run. @WClementeIII posted on Twitter a URPD chart (UTXO Realized Price Distribution) that shows price ranges against the increase in the volume of generating new UTXO (unspent transaction outputs).

We see a clear increase in volume in the $55,000 to $60,000 range. Such levels have not been seen since the $9,000 – $12,000 area, which last year laid the foundations for current increases. According to @WClementeIII, this is a very bullish signal, indicating that one should not “expect BTC’s price to stay in this range for much longer.”

The risk of the second phase of the bull market

Another indicator that signals a maturing bull market is Reserve Risk. It is used to assess the level of confidence of long-term hodlers in relation to the current BTC valuation. The stronger the hands of the hodlers, the greater their risk tolerance and they are willing to sell bitcoin at a higher Reserve Risk level.

When investors are confident of their long positions and the price is low, the risk-reward ratio is attractive. Then, the Reserve Risk parameter is low. When investors lose confidence and the price rises, the risk-reward ratio becomes less attractive and the Reserve Risk indicator gives a high reading.

The current value of this indicator is slightly below 0.008 (red line). Previous cycles peaked in the region above 0.02. This leaves a lot of room for growth in this cycle.

It is also worth adding that as the price increases, more and more hodlers will apparently decide to sell their assets. Thus, the Reserve Risk parameter is also an indirect indicator of “wealth transfer” from long-term investors to new buyers.

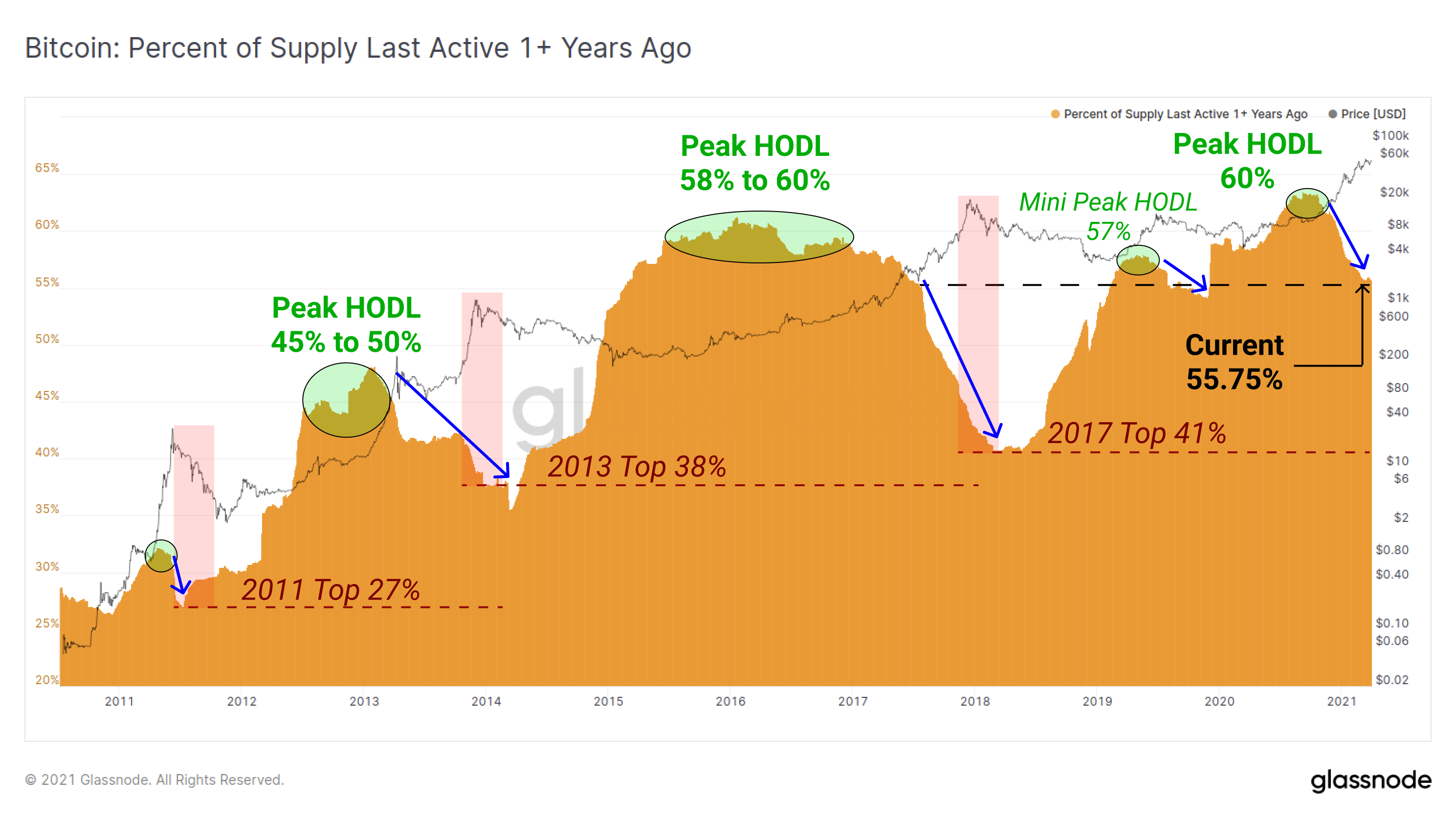

HODL peak and support

Another indication that continued growth is in BTC’s near-future is the chart of its active supply. The chart shows the accumulation of BTC in the early bull market (green areas), which are later increasingly sold as the price increases (blue arrows).

Commenting on this chart, Willy Woo highlighted a tendency for old investors to sell BTC early in the bull market. He then emphasized that each successive level of “HODL” support is getting higher (dashed lines). This means investors are selling fewer and fewer coins — even when faced with very high prices.

Most important, in the context of an ongoing bull market, is Willy Woo’s prediction of the expected area of HODL support for this cycle. The on-chain analyst says that, again, the bottom should be expected higher, or around 45%. With the current value of 55.75%, this leaves plenty of room to continue selling BTC in the short-term.

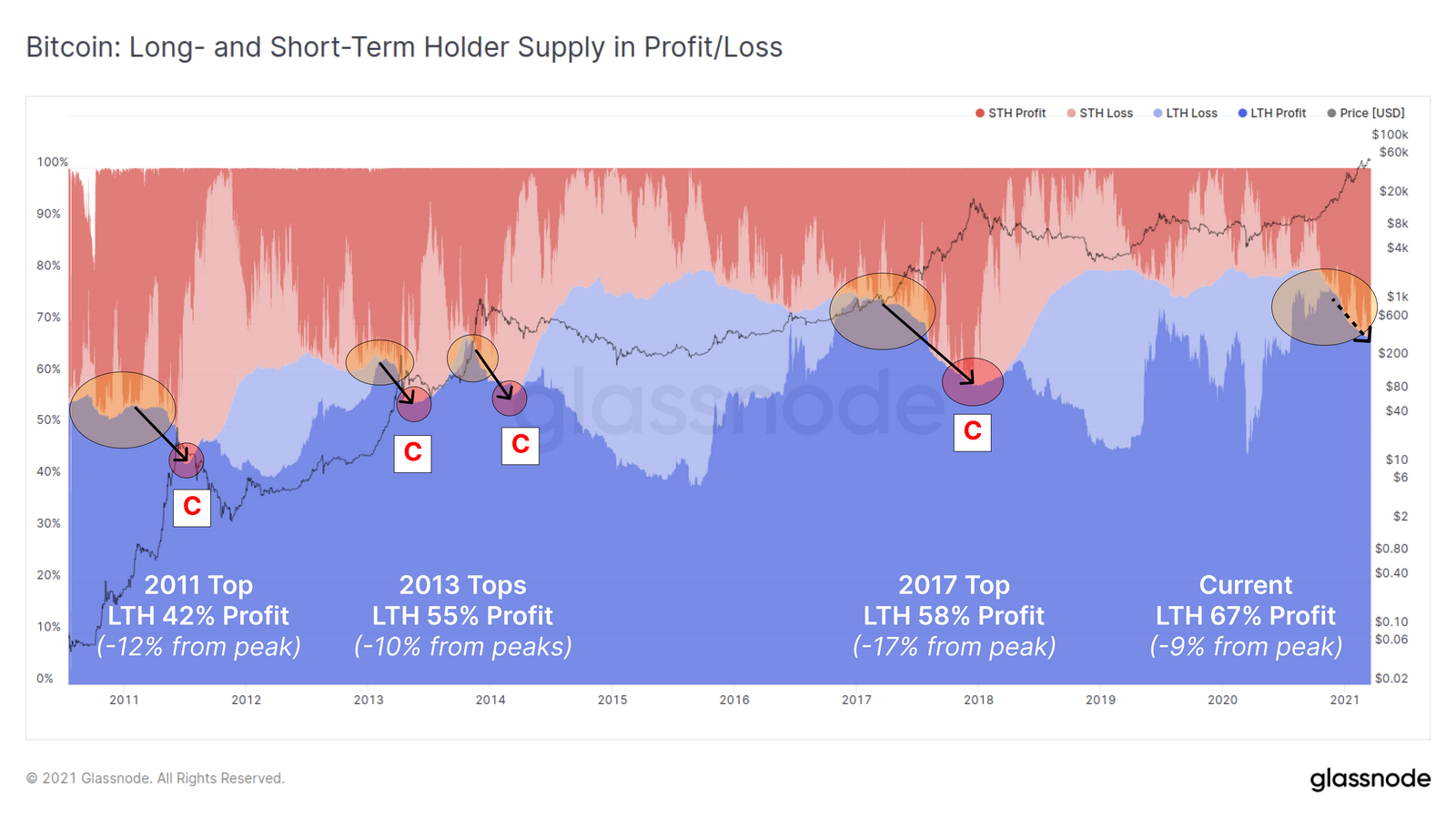

HODLers sell in profit

Last week, Glassnode published a very interesting analysis of hodlers in profit on the basis of a comparison of the profit/loss of long- and short-term holder supply in profit/loss. Without going into too much detail, it turns out that all of the cycles to date have been characterized by three phases of “wealth transfer” between market participants:

- Max Pain (A): most investors are in loss and long-term hodlers start to accumulate.

- Peak HODL (B): the initial phase of the bull run, in which more and more investors are in profit; most often it corresponds to the breakthrough of the previous ATH.

- Cycle Top (C): the market is euphoric and a significant number of long-term hodlers sell out to new speculators.

Glassnode’s analysis leads to the conclusion that we are currently in a phase of increasing sell-off and profit taking from long-term hodlers, which corresponds to the second half of the bull market.

About 9% of BTC’s supply since the HODL peak has now been spent. During the previous bull market, this figure reached 17%, which again gives room for more price increases for the top cryptocurrency.

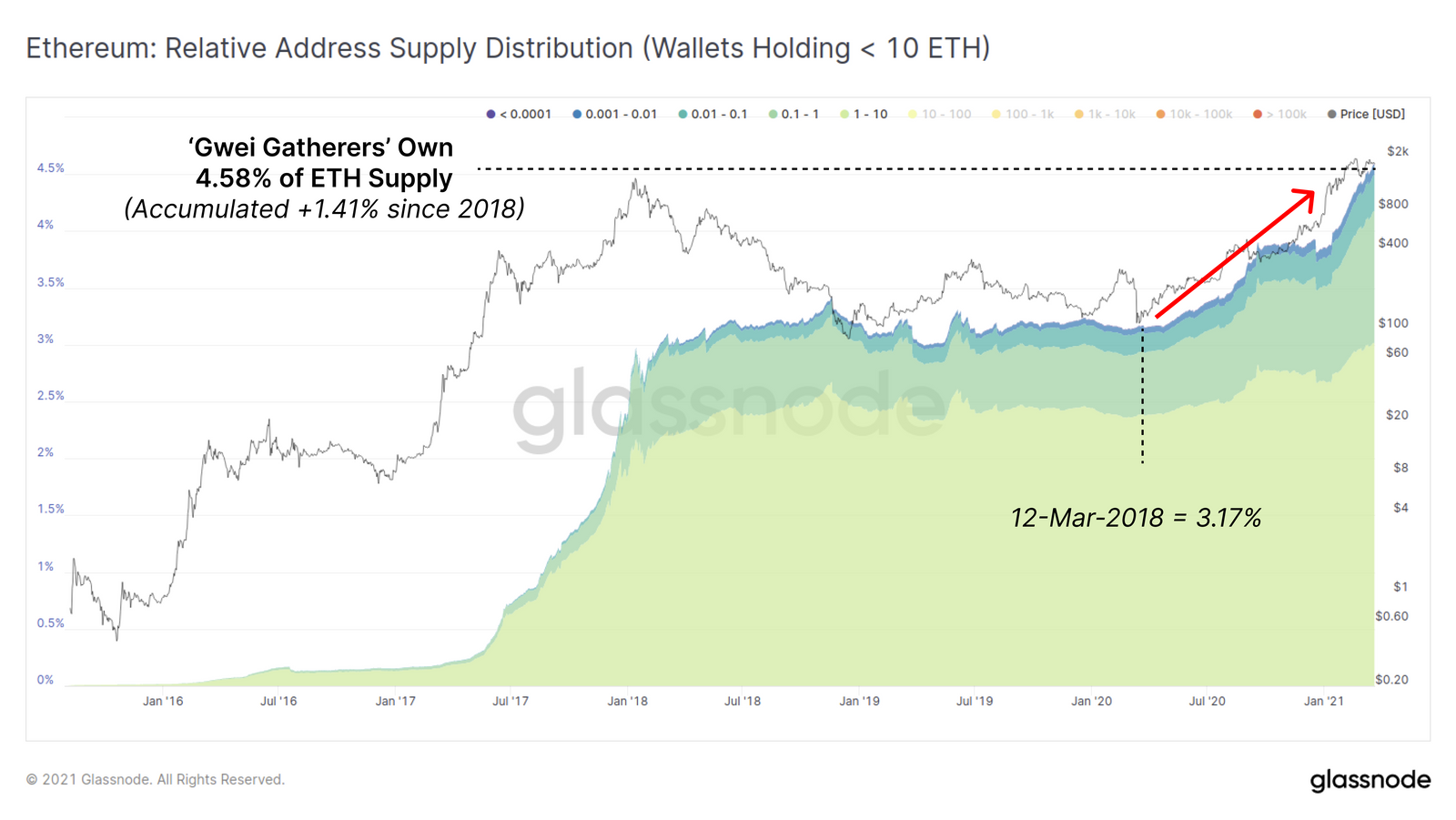

Ethereum gatherers grow in numbers

It’s not just bitcoin investors who accumulate their assets. From March 2020, a continuous increase in ethereum (ETH) wallets with a balance sheet of less than 10 ETH is visible. According to the Relative Address Supply Distribution (RASD), “Gwei gatherers” currently own 4.58% of the total ETH supply.

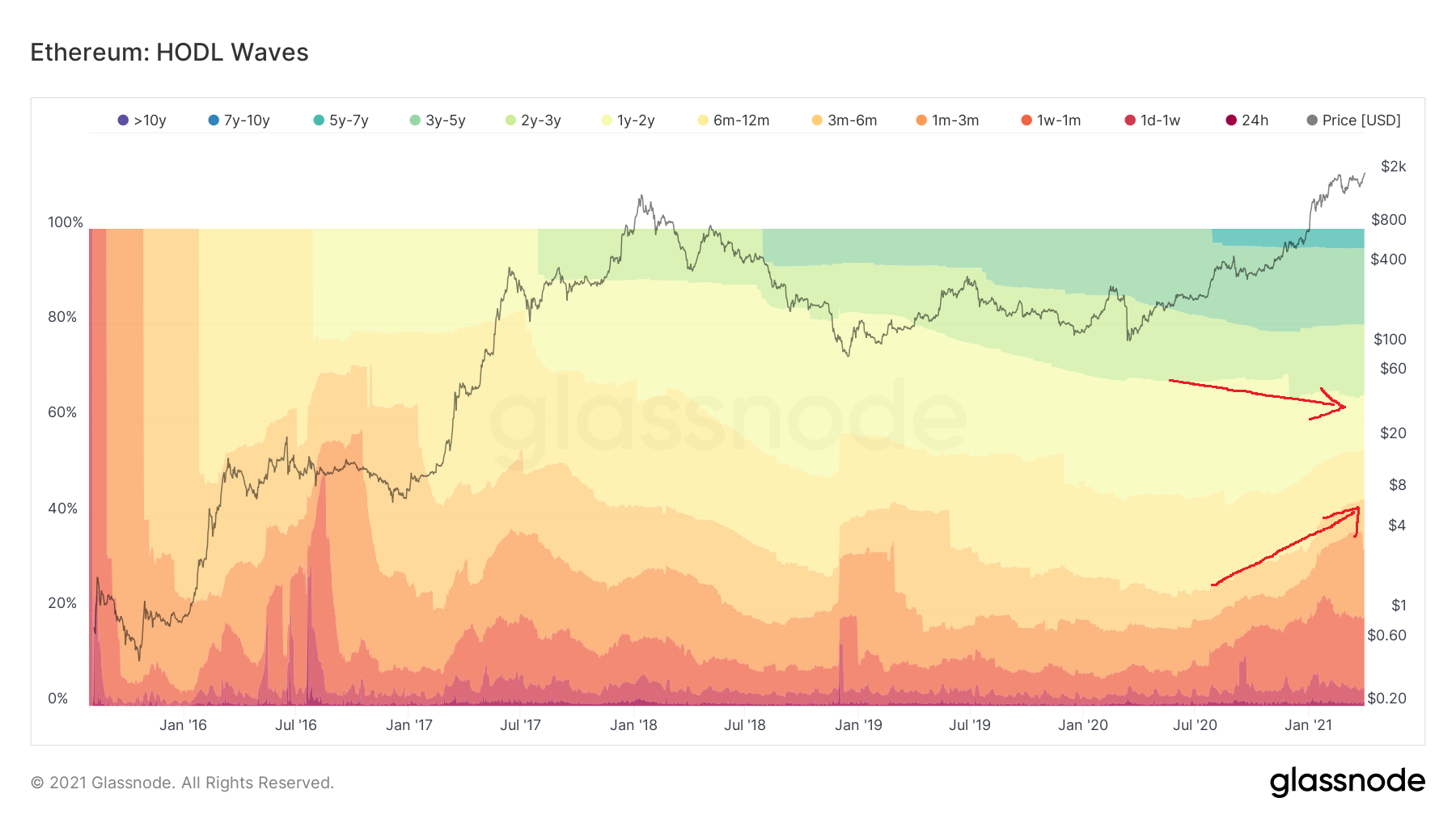

The HODL Waves indicator shows that the amount of ETH kept for more than six months has been decreasing since May 2020. This could be related to the dynamic growth of the DeFi space and the transfer of ETH to smart contracts, as well as the ETH staking at the end of last year.

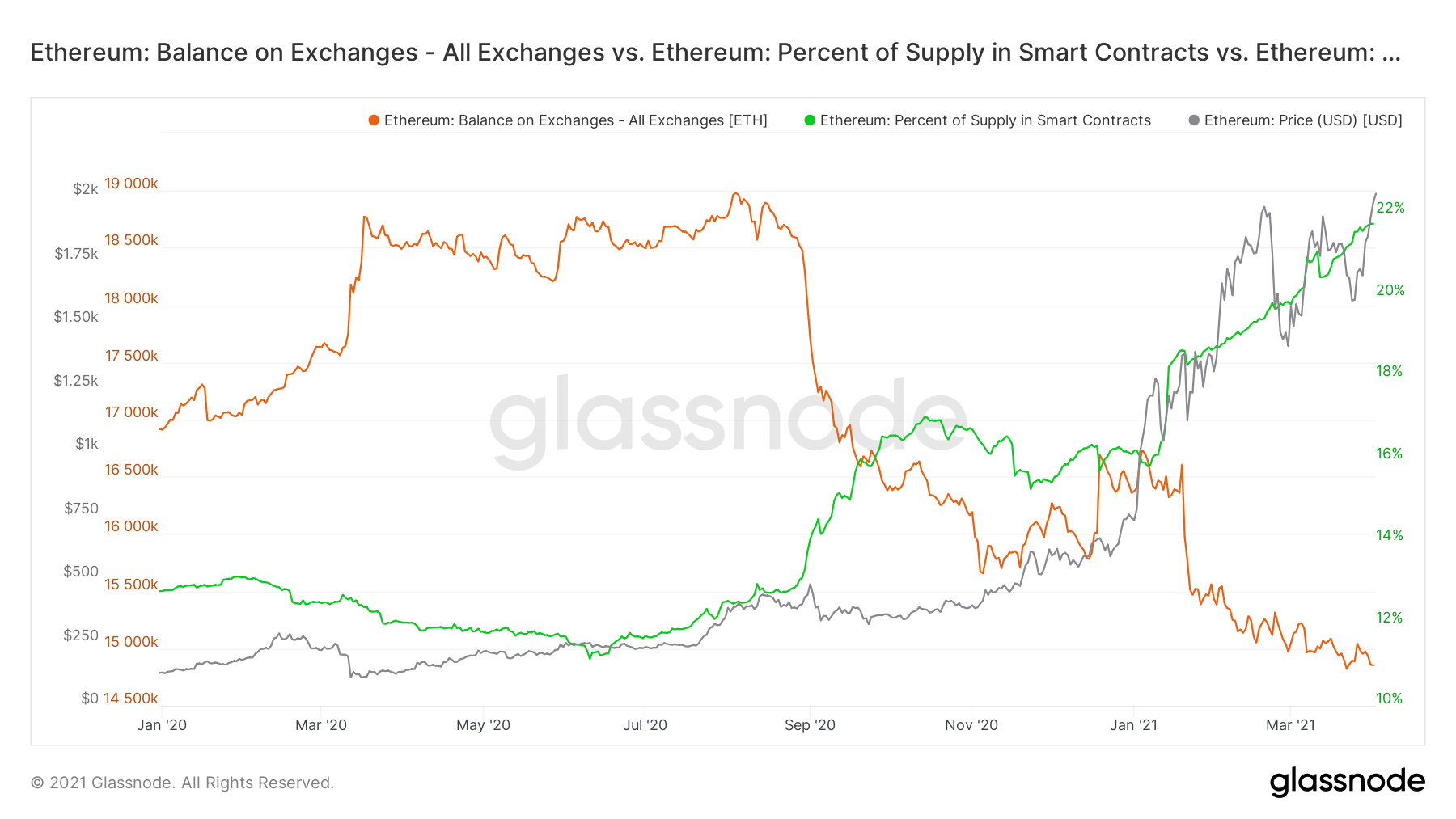

This is confirmed by the chart of ETH locked in smart contracts versus ETH held on exchanges. Over the past year, the proportion between the two values has been completely reversed.

Crypto exchanges already hold only 14.8% of the available ETH, while the value locked in smart contracts reaches 21.8%. The turning point came at the end of summer 2020, at the peak of last year’s DeFi bubble.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.