Global rating agency Fitch has issued a warning stating that the independence of central banks could be waning.

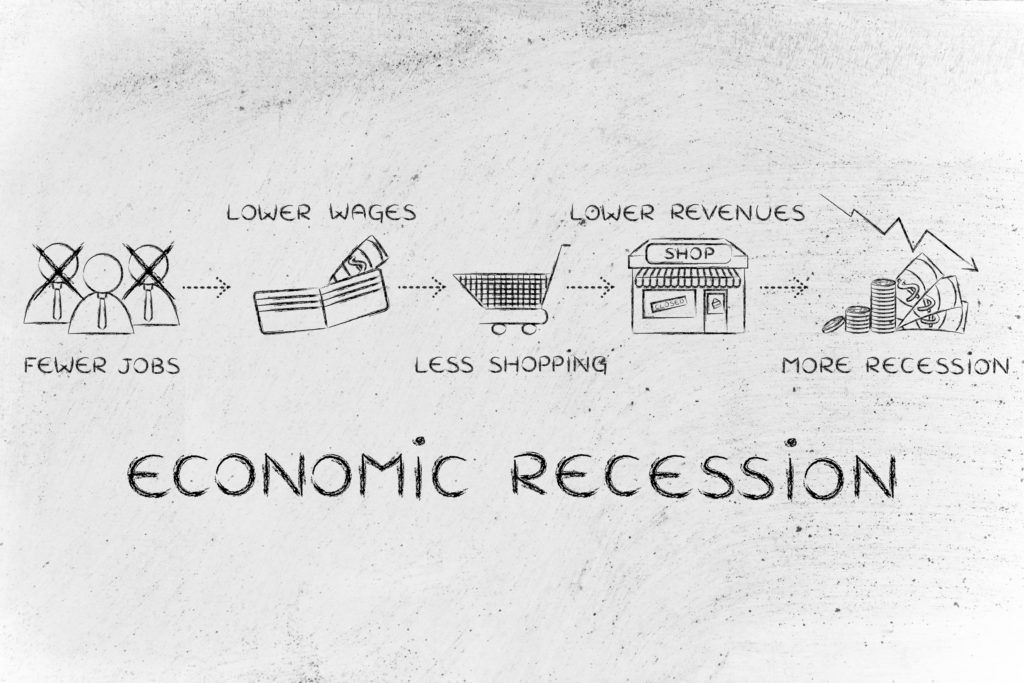

According to a report by Bloomberg Quint, extensive periods of slow growth have led to great unrest among the political and social classes. The general public has blamed central banks for being unable to revive growth after the economic crash of 2008. Governments have also tried to influence monetary policy, which has reduced the independence and separation of central banks from the government.

In the event of a recession, it remains to be seen whether or not Bitcoin (BTC) can survive as an alternative to the existing monetary policy of central banks.

Pressure on Central Banks to Deliver

James McCormack, Global Head of Sovereign Ratings at Fitch, said that investors are beginning to consider the implications of political interference in monetary policy. Slowing growth rate across the world has piled pressure on central banks to take steps to revive the economy. However, the financial crises in Zimbabwe and Venezuela have shown the world the ramifications of a poorly managed economy. Meanwhile, governments and world leaders are also trying to influence central banks. They are beginning to use monetary policy as state actors to increase their popularity. This is a major disadvantage of central bank issued fiat currencies. On the other hand, Bitcoin is censorship-resistant, decentralized, and trustless. Governments and financial institutions cannot influence the functioning or future development of digital currencies — but the masses can.

Bitcoin as an Alternative to Fiat Currency

The genesis block of Bitcoin was mined by Satoshi Nakamoto in January of 2009. It famously included a newspaper headline from Jan 3, 2009, which read “Chancellor on brink of second bailout for banks.” While Nakamoto never acknowledged why the text was included, the timing of the cryptocurrency’s launch in the aftermath of the 2008 economic crisis suggests that it was always meant to challenge the prevailing financial system. Central Banks across developed nations are trying to navigate their economies around another similar economic slowdown. Fiat currencies are losing their value due to inflation, which is, in turn, affecting their purchasing power. Cryptocurrencies, on the other hand, are widely known to be a better alternative as compared to fiat currencies in several aspects. Bitcoin will always remain fungible and is an effective store of value due to low or negative inflation. Decentralization is another key principle of Bitcoin that ensures it cannot be influenced by state governments and financial institutions. Do you think Bitcoin will serve as a usable alternative to fiat currencies in the near future? Let us know in the comments below.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored