Fantom’s (FTM) price has fallen by 20% in the past 24 hours amid the broader market downturn. Exchanging hands at $0.29 at press time, the altcoin currently trades at a price low last observed in October 2023.

FTM’s price fall over the past 24 hours has put many holders in losses. Its spot market has recorded fewer profitable transactions, while its derivatives market has seen a surge in long liquidations.

Fantom Traders Are Selling At a Loss

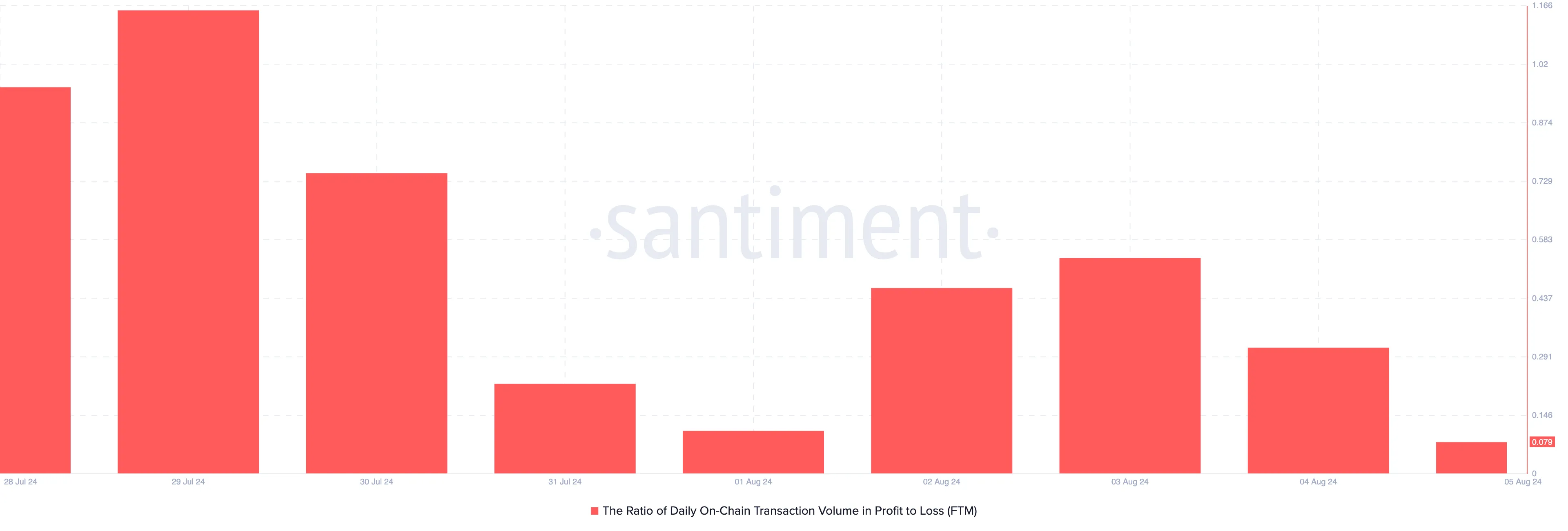

An assessment of the ratio of FTM’s daily on-chain transaction volume in profit to loss shows that coin holders have seen more losses than profits in the past 24 hours. At press time, the metric’s value is 0.07.

This metric measures the total volume of FTM transactions, resulting in a profit for the sender compared to the total daily on-chain transaction volume. At 0.07, it indicates that for every transaction resulting in a loss today, only 0.07 transactions have been profitable.

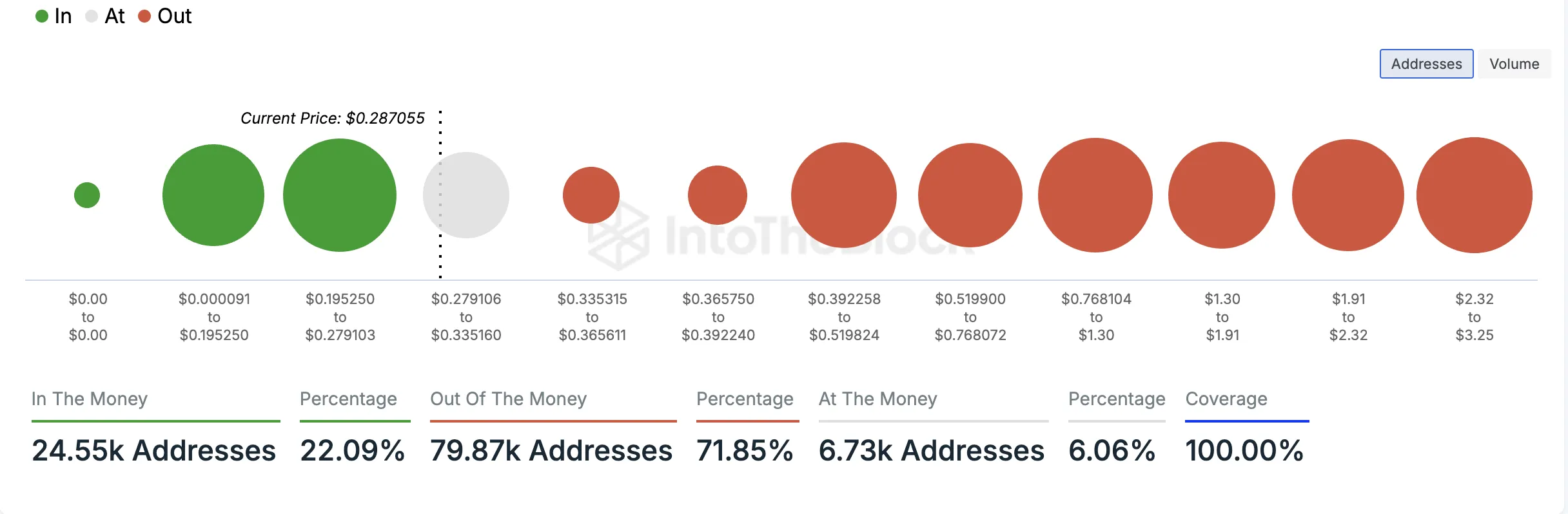

Currently, 80,000 wallet addresses, which comprise 72% of all its holders, are “out of the money.” According to IntoTheBlock, an address is considered out of the money if the current market price of an asset is lower than the average cost at which the address purchased (or received) the tokens it currently holds.

Conversely, only 23,000 addresses, representing 23% of all FTM holders, hold their coins at a profit.

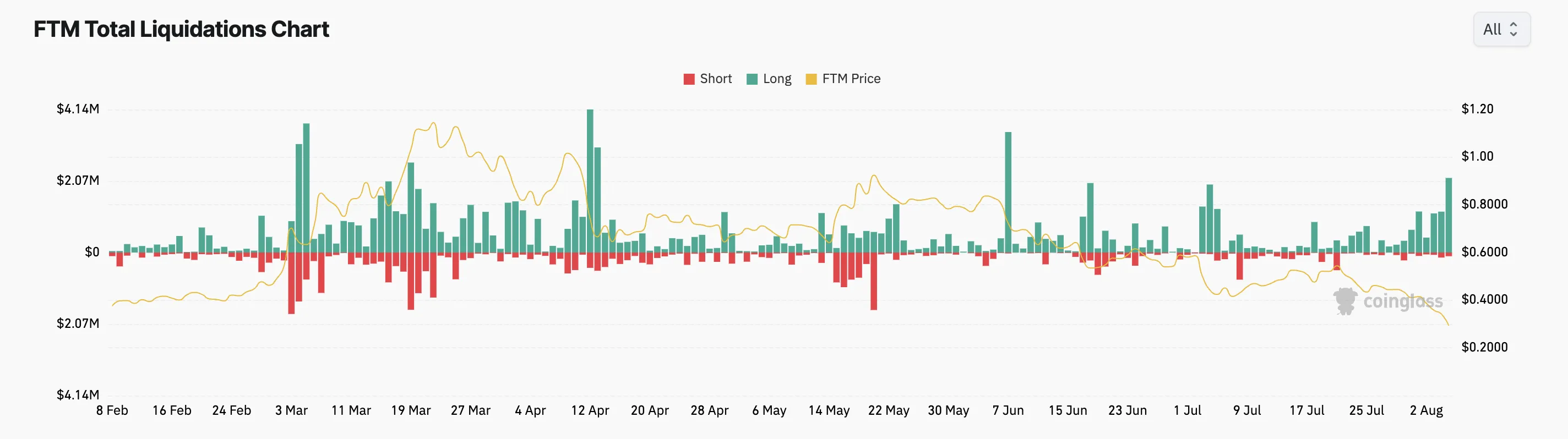

The coin’s derivatives traders are not spared from the losses. According to Coinglass, several long positions have been liquidated over the past 24 hours. As of this writing, this totals $2.16 million and represents the coin’s single-day highest long liquidations in two months.

Read More: What Is Fantom (FTM)?

FTM Price Prediction: More Pains Lie Ahead

As assessed on a one-day chart, FTM’s key technical indicators hint at the possibility of a further price decline. For example, the coin’s Elder-Ray Index signals that the bearish sentiment that trails it is significant. At press time, the indicator’s value is -0.19.

The Elder-Ray Index measures the relationship between the strength of buyers and sellers in the market. When its value is below zero, it means that bear power is dominant in the market.

Also, FTM trades below its 20-day exponential moving average (EMA), signaling a decline in buying activity. The 20-day EMA measures the average price of an asset over the past 20 days. When an asset’s price falls below it, it signals a spike in selling pressure.

If FTM maintains this trend, its value may plunge to $0.25.

However, if it witnesses a trend correction and its demand rises, this may push its price toward $0.48.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.