Jason Urban, Co-Head of Galaxy Digital Trading, believes that Ethereum will likely flip Bitcoin going forward.

In a recent interview with Kitco News at the Bitcoin Conference 2022, Urban explained that while the ‘flippening’ will not be imminent, he expects the soonest Bitcoin-Ethereum flip in the next two to three years.

“Ethereum is the copper, Bitcoin is the digital gold. It allows for the ecosystem to be built in so many ways, as do the other layer ones,” he stated.

Everything that could go right with Ethereum

Urban opined that Ethereum’s upcoming merge, along with its energy-related implications are driving interest in the platform, given more users tare taking Environmental, Social, and Governance (ESG) factors into consideration ahead of any prospective investment decisions.

However, ETH Merge, which is expected to take place somewhere in this quarter, is not devoid of concerns. Ethereum developer Tim Beiko agreed that there’s a lot of skepticism within the ecosystem, “because Ethereum has promised proof of stake for five years; i’s hard to convince people that this time it’s for real.”

Despite that, Mike McGlone, Bloomberg Intelligence’s senior commodity strategist highlighted in his April note that Ethereum’s transition from a PoW to a PoS consensus brings an upside for the project. McGlone is seeing a 220% spike in current valuations, which leaves ETH at over $9,300.

Institutional interest a plus

Urban also points to institutional interest as another source for why Ethereum continues to lead the charge.

“There’s scalability and things that now become very valuable and will allow ETH to grow and so smart institutional investors are seeing that,” he explained.

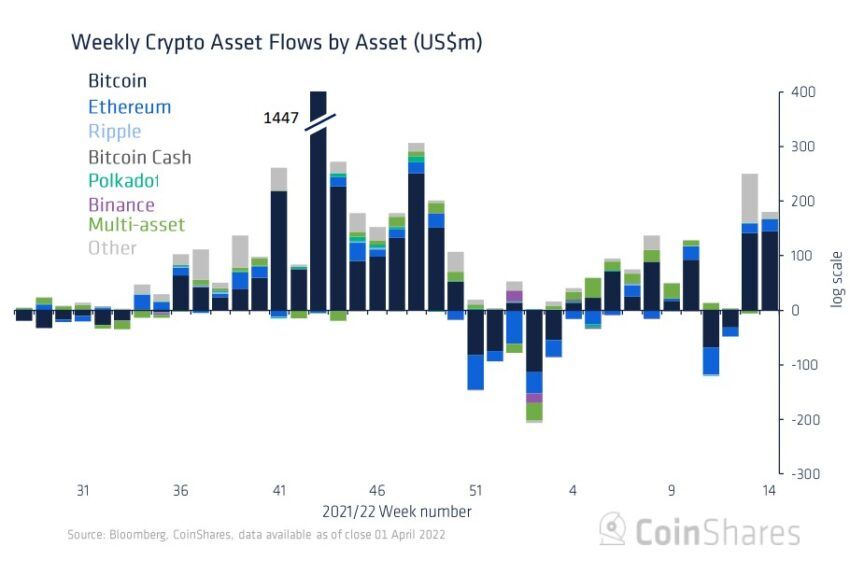

If we look at the latest fund flows on CoinShares‘ weekly charts, Bitcoin is currently maintaining its lead. The report highlighted that Bitcoin saw inflows of $144 million in the last week, as of April 4. This brought year-to-date inflows to $350 million.

Ethereum, on the other hand, saw fund flows of $23 million in the last week – however, maintains a YTD flow of -$111 million.

When it comes to the price levels of the two tokens, Ethereum has registered minor gains in the past 24 hours.

However, the king coin remains slightly in the red as per analysis by CoinGecko – but, Urban predicted 2022 levels for the top two:

“If you had asked me at the beginning of the year, I would have answered that I believe bitcoin would reach $100,000 this year. Ether is around the $6,500 to $7,000 level.”

What do you think about this subject? Write to us and tell us!

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.