The Ethereum layer-2 scaling ecosystem is becoming a two-horse race between market leaders Arbitrum and Optimism.

The two leading Ethereum layer-2 solutions providers have a combined market share of 84%, according to ecosystem analytics platform L2beat.

They use rollup technology that batches and processes transactions off Ethereum (ETH). A compressed version is then pushed back to the Ethereum main chain, thus reducing transaction time and costs.

Arbitrum One is the current industry leader with a total value locked (TVL) of $3.38 billion, giving it a dominant 53.7% market share. Optimism is second with $1.91 billion TVL and a 30.5% share of the L2 market.

On Feb. 28, DeFi researcher “DeFiIgnas” compared the two most popular layer-2 ecosystems.

Ethereum Layer-2 Growth

Additionally, Arbitrum recently surpassed Ethereum for daily transactions, but it has now fallen back below it, according to Dune Analytics.

In December, BeInCrypto reported that the combined transaction activity on layer-2 networks had surpassed that of Ethereum.

Optimism’s transactions have fallen sharply since the Galaxy Quests rewards program ended. However, they have been boosted by the recent partnership with Coinbase and its new L2 platform Base.

Optimism is lagging behind Arbitrum despite launching earlier, the researcher noted before adding:

“Due to Optimism’s permissioned launch, Arbitrum gained an early lead in transactions and users.”

Both networks are heavily VC-backed, with Optimism raising $178 million at a valuation of $1.65 billion and Arbitrum raising $143 million, valued at $1.2 billion.

Arbitrum is the leader for cheaper gas fees, despite handling more transactions and having three times more active wallets, the researcher reported. Furthermore, Arbitrum launched the Nitro upgrade in August 2022. This increased throughput and reduced gas fees considerably.

Optimism will launch the Bedrock update in April, offering modularity, simplicity, and Ethereum equivalence for L2 solutions.

Furthermore, the DeFi ecosystems of both networks are growing faster than any other major chain.

Arbitrum grew by 62% over the past month, overtaking Polygon and Avalanche, and Optimism grew by 35%, surpassing Fantom and Cronos. The researcher concluded:

“Ultimately, the competition between them is great for users and all DeFi ecosystem as we get better user experience.”

L2 Ecosystem Outlook

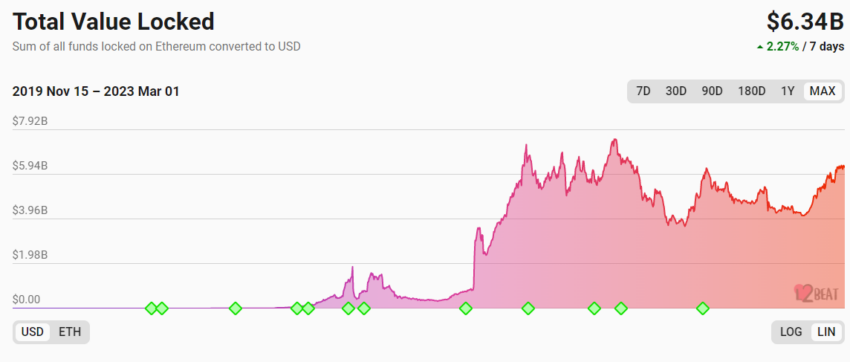

The TVL for the entire L2 ecosystem is $6.34 billion, a gain of 53% since the beginning of 2023. It is now just 15% down from its all-time high of $7.47 billion in April 2022, according to L2beat.

Aside from the leading two, dYdX is the third largest layer-2 network in terms of TVL, with a market share of nearly 6%.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.