According to market analysts, Ethereum ETFs could make their debut by mid-June.

The newly approved funds aim to broaden Ethereum investment by allowing shares to be traded on stock exchanges, mirroring the cryptocurrency’s price movements.

Analysts Predict Ethereum ETF Debut by Mid-June

Eight ETF applicants, including VanEck, BlackRock, and Fidelity, received regulatory approval on May 23. Hashdex was the only issuer not green-lighted that day. However, the approval doesn’t mean the instruments will be available on the exchanges tomorrow: applicants must secure approved S-1 registration statements before trading begins.

Bloomberg analyst James Seyffart suggests this process could take a few weeks, potentially up to five months. Another Bloomberg analyst, Eric Balchunas, predicts a mid-June launch.

“My guess is there’s only one round of comments on the S-1s. And during BTC one round took two weeks ish. So I this mid-June is certainly poss. Just a guess, tho. We will see,” Balchunas said.

Read more: Ethereum ETF Explained: What It Is and How It Works

VanEck quickly filed its amended S-1 after the 19b-4 approval, with other applicants expected to follow. Gabriel Shapiro from Delphi Labs notes that the SEC’s approval came from its Trading and Markets unit. A SEC commissioner can challenge this decision within ten days.

Expectations for spot Ethereum ETFs are high. Seyffart predicts they could attract 20% of spot Bitcoin ETFs’ flows, while Balchunas estimates a conservative 10-15%. Since their launch, spot Bitcoin ETFs have accumulated $13.3 billion in net inflows. Capturing 20% would mean spot ETH ETFs could see around $2.66 billion in inflows.

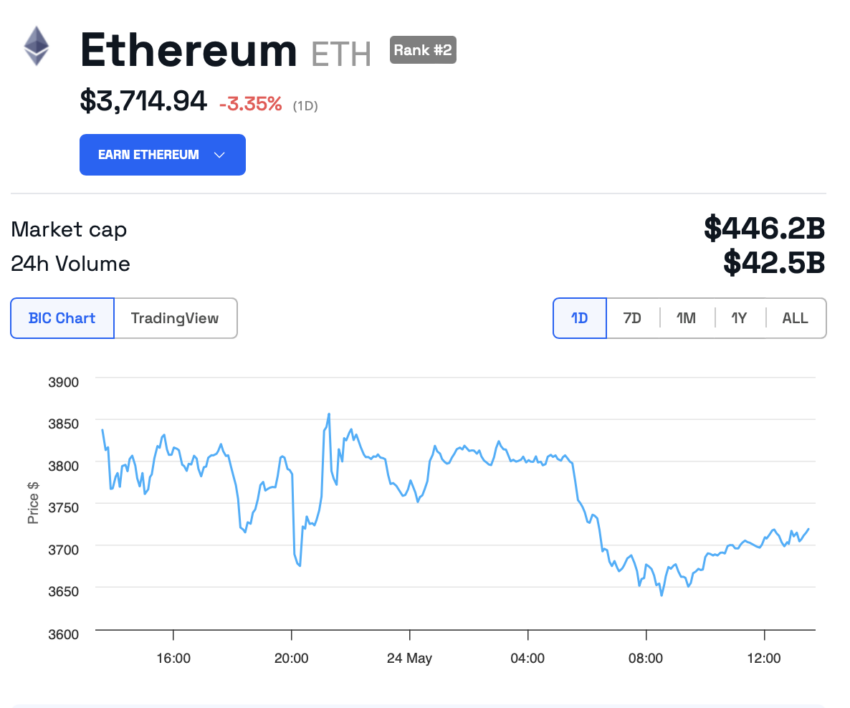

However, the dynamics of the second most capitalized cryptocurrency are still far from bullish. Following the SEC decision, Ethereum’s price increased by just 1%. At the time of the approval, ETH was trading at $3,840. According to BeInCrypto, it has since dropped 3.5% to $3,714.

Read more: How to Invest in Ethereum ETFs?

This situation exemplifies the “sell the news” phenomenon. Ethereum’s price surged 10% minutes after rumors of an imminent ETF approval began circulating. Now that the news is confirmed, the market has started to sell off.

Bitcoin had a similar response when spot Bitcoin ETFs were approved in January. It took a full month of volatility before BTC returned to pre-approval price. Once it did, it climbed to a new all-time high.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.