“What, you trade crypto? You’re crazy, they’re only used for illegal things like scams, money laundering, and cybercrime?”

It’s a question we’ve all heard. But is it really the case?

The value of illicit crypto transactions has increased by an unbelievable 80% compared to the previous year, according to Chainalysis’ annual crypto crime report. Examples include fraud, darknet crimes, and money laundering.

In 2020 it was $7.8bn, in 2021 it hit $14bn. Alas, crypto scams still make up the bulk of all fraudulent activity.

A scam can take many forms. Twitter user @Zeneca_33 posted this example with a piece of wise advice: “A good rule in crypto space, never click on links.”

Sadly, the above example is a particularly convincing example of a scam. If the user hadn’t verified the link, he would have lost his ETH.

Other scammers simply invent entire projects to swindle money from investors. Better-known examples include Onecoin, Bitconnect, and Bitclub Network.

Darknet, terrorism and money laundering

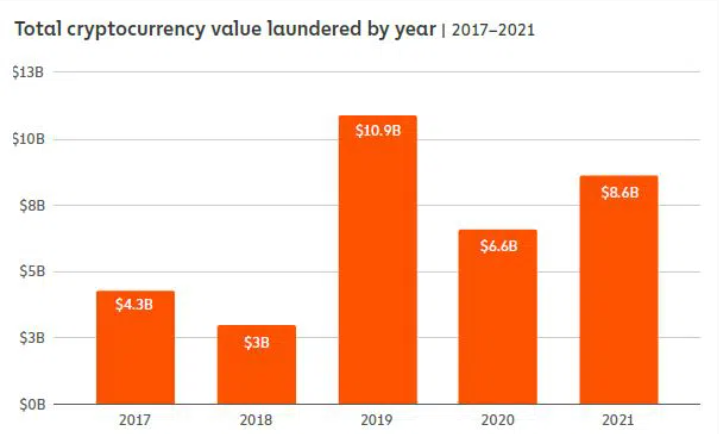

While scams account for the bulk of illegal activity, criminals also used exchanges to launder money, accounting for $8.6bn – an increase of 30% on the previous year but down from the all-time high in 2019.

Darknet activity also set a new record, turning over $2.1bn. Of this, an estimated $300m came from fraud shops, which sell stolen logins, credit cards, and such. The remaining $1.8bn was generated by the narcotics market.

For the darknet markets that manage to survive, Chainalysis says competition is fiercer than ever, and these competitors are prepared to play dirty.

Data leaks, DDoS attacks, and doxxes are common occurrences in the space, according to Flashpoint’s Senior Director of Research Ian Gray.

Hydra, a market that serves only Russian-speaking countries, remains the largest darknet market by far, accounting for 80% of market revenue worldwide. Among its dubious activities, drugs make up the majority of sales.

Stick to fiat – It’s far safer than crypto

It is estimated that cybercriminals have laundered over $33bn in crypto since 2017, mostly on centralized exchanges. By comparison, the UN Office of Drugs and Crime estimates between $800bn and $2tr of fiat currency is laundered each year.

In other words, the amount of global money laundered through crypto accounts for just 0.05% of all transaction volume.

And, of course, the transparent nature of blockchains makes it easier to trace how cryptocurrency moves between wallets and how the funds are converted to cash.

Also, the sad truth is that those who hold our fiat money often commit the greatest crimes. For example, the US bank Bancorp had to pay the US government $613m in 2018 for not complying with money laundering guidelines. The bank failed to recognize a large number of unauthorized transactions and was convicted and fined.

By far the biggest scandal, however, actually occurred in connection with a drug cartel. HSBC was fined $1.9 billion for collaborating with the Sinaloa cartel, one of the bloodiest drug cartels in Mexico. Incidentally, not a single manager was arrested or punished by the responsible managers.

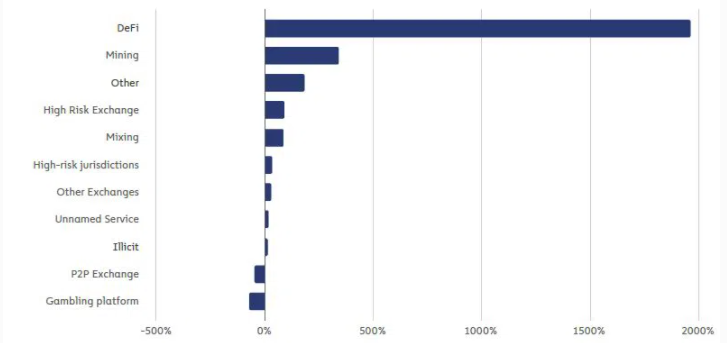

Why DeFi is so popular with money launderers

Chainalysis also mentions the popularity of rug pulls in the DeFi area. Rug pull means the developers pull the money out of the project. They have two options for this: either a back door is built into the smart contract or all tokens are sold by the team.

DeFi transaction volume grew 912% in 2021 and with the right technical skills, it’s possible to get them listed on exchanges, even without a code audit. A code audit confirms the project’s governance rules and is undertaken by a third party.

Chainalysis notes many investors could likely have avoided losing funds to rug pulls if they’d stuck to DeFi projects that have undergone a code audit – or if DEXes required code audits before listing tokens.

Got something to say about crypto scams or anything else? Write to us or join the discussion in our Telegram channel.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.