Another decentralized finance protocol (DeFi) appears to have been exploited on Polygon, expanding the list of platforms losing funds.

Reports are coming in of an exploit on the SafeDollar DeFi stablecoin protocol though details are thin on the ground at the time of press.

DeFi analytics websites DeFiPrime and RugDoc have posted incident alerts within the last couple of hours claiming that the SafeDollar protocol has been attacked.

SDO collapses to zero

According to the contract address on the Polygon Scan dashboard, $248,000 in USDC and Tether was withdrawn from the protocol on June 28.

Editor’s note: The losses were originally reported to be $248 million, this has been changed to reflect the correct amount.

At the time of press, there was no update on the SafeDollar Twitter feed. The platform itself shows the SDO stablecoin has dropped to zero.

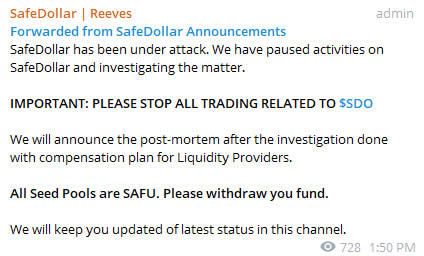

The protocol’s Telegram channel issued a warning of the attack and urged users to cease trading of SDO:

This isn’t even the first time the protocol has been exploited. On June 22 SafeDollar detailed a post mortem of an attack that resulted in a loss of 9,959 SDS tokens, valued at around $95,000 at the time.

Polygon exploit and rug pull season

SafeDollar is an algorithmic stablecoin that combines unique features of seigniorage, deflation protocol, and synthetic assets. Earlier this month the protocol airdropped 100,000 dollar pegged SDO tokens to a number of DeFi communities including bDollar, Iron Finance, MidasDollar, Safemoon, and Quickswap.

Safedollar launched its Initial Decentralized Exchange Offering (IDO) on PolyDEX’s launchpad on Monday, June 14.

The stablecoin protocol has potentially become the latest Polygon-based platform to suffer an exploit or economic meltdown. Earlier this month, the Malt Protocol suffered a collapse of its elastic supply algorithmic stablecoin.

On June 22, BeInCrypto reported that the Polywhale team had carried out a “soft rug pull” by dumping their tokens and pulling the plug on the project.

On June 17, Iron Finance detailed what it called a “DeFi bank run,” which led to its Titan token collapsing, but that protocol was based on Binance Smart Chain.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.