The venture capital division of America’s largest exchange has made a strategic investment into a leading Ethereum staking protocol. The firm stated that it has been purchasing RPL tokens from the Rocket Pool team as part of the strategy.

On Aug. 9, Coinbase Ventures announced that it has recently made a strategic investment into Rocket Pool, an Ethereum staking platform.

Coinbase Ventures Into Ethereum Staking

Rocket Pool is a liquid staking network for Ethereum that allows users to stake ETH while retaining liquidity.

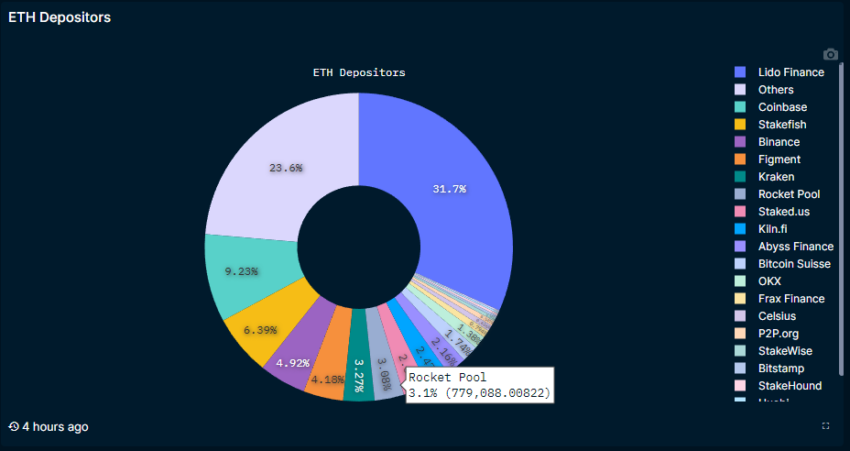

According to Nansen, it has a staking market share of around 3% with around 780,000 ETH staked. Comparatively, market leader Lido has a 32% market share with roughly 8 million ETH staked.

Coinbase Ventures stated, “We believe scaling Ethereum’s infrastructure in a safe, decentralized manner is critical to bringing the next billion users on-chain.”

“We know the Rocket Pool team shares this belief and we’re delighted to support them via active participation in their Oracle DAO and using ETH from our corporate balance sheet to operate several hundred nodes on the Rocket Pool network,”

Coinbase offers its own Ethereum staking service, but the caveat is that it takes a whopping 25% commission on staking rewards. Comparatively, Lido and Rocket Pool only take around 10%, making them a much more lucrative choice.

DeFi decentralization advocate Chris Blec pointed out that Coinbase gets paid in Rocket Pool tokens for being a member of its DAO.

“I wish you would have mentioned that Coinbase has been getting paid (and continues to get paid) $250k-$500k per year in newly minted RPL for being a member of the Oracle DAO multisig.”

There are currently 23.1 million ETH staked and securing the network, according to Ultrasound.Money. This tranche is valued at $42.5 billion, equivalent to roughly 19.2% of the entire circulating supply.

Furthermore, the Ethereum supply has declined by around 303,000 ETH since the Merge in September 2022. Moreover, more than 900,000 ETH have been burnt since then.

RPL Token Outlook

Rocket Pool’s native RPL token jumped 6% on the announcement reaching an intraday high of $28.70.

RPL was trading at $28.44 at the time of writing but has lost 22% over the past month as altcoin markets retreated.

Additionally, the staking protocol token is down 54% since its April all-time high of $61.90.

Ethereum prices have remained flat at $1,844 at the time of writing, with little impact from the bullish staking fundamentals.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.