China’s second-largest property developer, Evergrande, has reportedly filed for Chapter 15 bankruptcy in New York. According to an Aug. 17 report, the move aims to protect its assets within the United States from creditors.

The report indicates that Evergrande’s Chapter 15 petition reveals active restructuring proceedings. These are reportedly taking place in Hong Kong and the Cayman Islands.

Evergrande Near-Bankruptcy Scare in 2021

In a Manhattan bankruptcy court, an associated firm named Tianji Holdings also pursued Chapter 15 protection.

Previously, Evergrande was reportedly teetering on the brink of bankruptcy. In September 2021, reports indicated that Evergrande was on the verge of debt default. Furthermore, it reportedly had $300 billion worth of liabilities.

Evergrande urgently required funds. For instance, the company’s year-end commercial report for 2021 showed that its core entity had $32 billion, approximately 10% of its total liabilities.

Tether Assures No Exposure

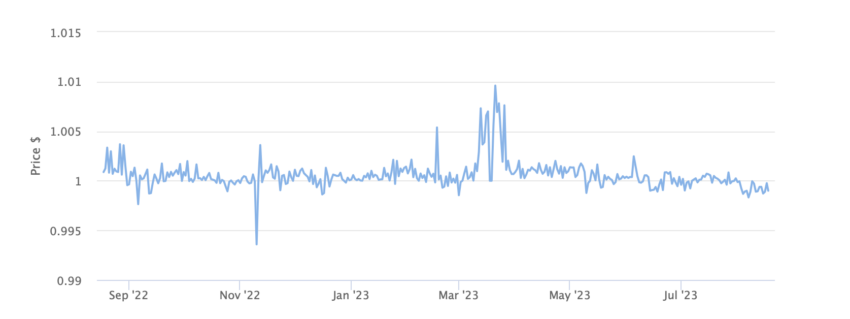

At the time, there were fears over the potential consequences for the Tether stablecoin, with nearly half (50%) of its assets relying on commercial paper and certificates of deposits for backing.

Presently, Tether stated that it held no exposure to Evergrande:

“Tether does not hold any commercial paper or other debt or securities issued by Evergrande and has never done so. As we have indicated in our published statements and our most recent assurance attestation with a reporting date of June 30, 2021, the vast majority of the commercial paper held by Tether is in A-2 and above rated issuers.”

This is a developing story and will be updated as more information comes to light.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.