As Chainlink’s LINK tokens witness significant movements in the market, apprehensions mount regarding the asset’s stability and future price trajectory.

Within the last day alone, transfers from notable Chainlink wallets have injected a substantial number of tokens into various platforms, reigniting debates on the implications for the digital asset.

LINK Network Activity Sparks Concerns

In the last 24 hours, four Chainlink wallets transferred a substantial 18.75 million LINK across various platforms, equating to $119 million. These wallets, earmarked for holding a non-circulating supply, transferred 15.7 million LINK, worth around $100 million, to Binance and 3.05 million LINK, worth roughly $19 million, to a multi-sig wallet labeled 0xD50f.

This is not the first time such a movement has been observed. On March 4, there was a similar transfer amounting to roughly $95 million worth of LINK to Binance.

On-chain analysis firm Lookonchain highlighted that these designated wallets have consistently moved LINK to Binance quarterly since August 2022. These transfers account for a massive 71.8 million LINK, equivalent to $446 million.

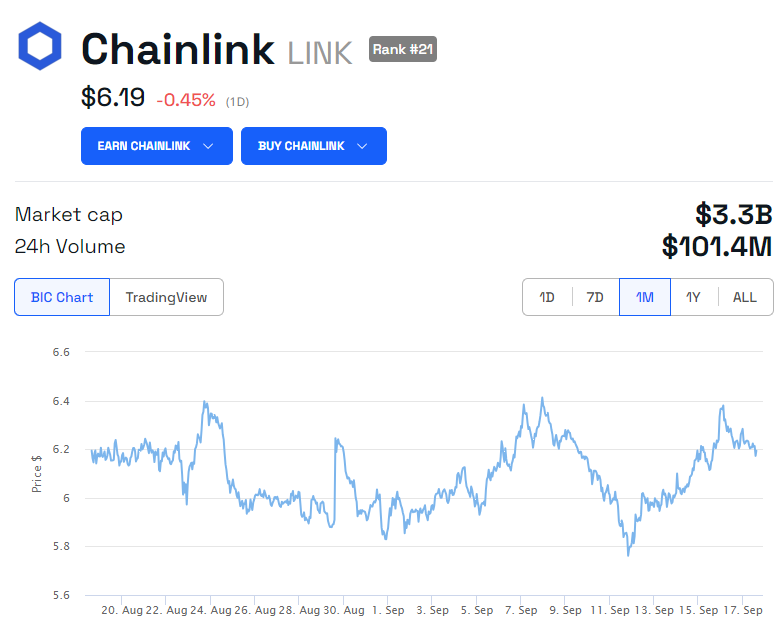

This influx of LINK into circulation has raised eyebrows concerning its potential impact on the token’s price. Over the past day, the token’s value has slightly declined by 0.5% to $6.19.

This recent dip is part of a broader trend – LINK’s value has dwindled by 20% over the last year and is now 88.7% off its all-time high.

Chainlink Scores Key Partnerships

While Chainlink’s long-term price trajectory and the recent uptick in LINK movement might raise concerns, not all indicators are bleak.

BeInCrypto reported a significant rise in Chainlink’s Network Growth. Additionally, Ali Martinez, BeInCrypto Global Head of News, recently highlighted that whale addresses acquired over 4 million LINK tokens within a span of ten days.

Such enthusiasm is possibly driven by Chainlink’s recent partnerships with traditional finance players. The company, renowned for its oracle services, successfully tested tokenization in collaboration with SWIFT. This effort involved partnering with several banking giants, including BNY Mellon, BNP Paribas, Euroclear, and Lloyds Banking Group.

Furthermore, the Australia and New Zealand Banking Group (ANZ) recently utilized Chainlink’s Cross-Chain Interoperability Protocol to test its A$DC stablecoin, originally launched in March 2022.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.