Due to an influx in liquidity in decentralized protocols and applications (dApps), Cardano continues to soar in total value locked in March 2022.

Cardano has been an integral part of the blockchain technology space since its launch in 2017 by Charles Hoskinson. Although the project lacked use cases in the first four years of its existence, 2022 has seen Cardano reach new milestones. This comes at the back of the completion of the Alonzo Hard Fork upgrade in September 2021 which has seen more than seven dApps built on the protocol, per data retrieved from DeFiLlama.

According to Be[In]Crypto Research, Cardano TVL has gained 39,000% since the beginning of 2022. On Jan. 1, Cardano had a total value locked of $822,261, and this rallied to approximately $326 million on March 24, 2022.

Cardano is a blockchain protocol that was designed for visionaries, innovators, and change-makers. As the first peer-reviewed protocol, Cardano has the aim of building a sustainable future that will assist people to work in tandem with one another to help solve global problems with innovative solutions.

Aside from being a mainstay in the decentralized finance revolution brought forth by the possibilities of cryptography, Cardano has several use cases in agriculture, government, retail, education, healthcare, and finance.

What contributed to the increase in Cardano’s total value locked?

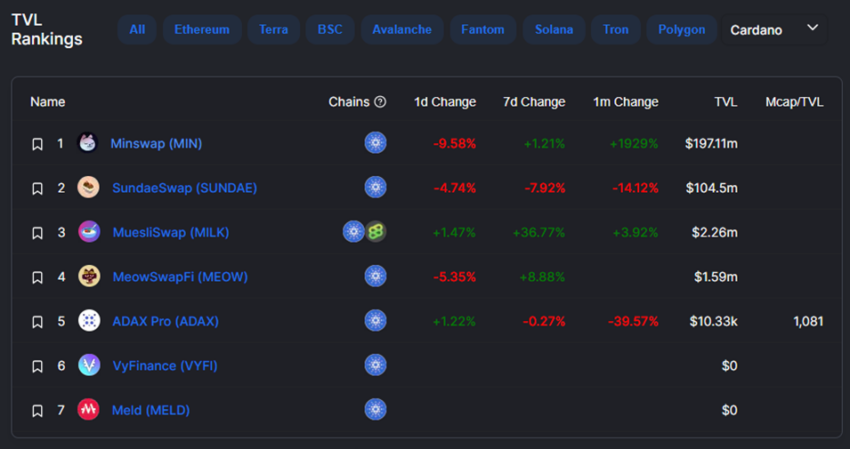

Cardano has seven dApps contributing to value locked in the form of decentralized exchanges (MiniSwap, ADAX Pro, MuesliSwap, SundaeSwap, and MeowSwap) as well as Meld and VyFinance.

Two protocols (MiniSwap and MuesliSwap) have stood out in the last days towards the end of March.

When Be[In]Crypto Research conducted a study into Cardano TVL in the middle of March, MiniSwap had a total value locked of approximately $95.36 million, and MuesliSwap had a TVL of approximately $1.6 million.

As of writing, there has been a spike of 106% in MiniSwap TVL to approximately $197.11 million. MuesliSwap also saw an increase of 41% to approximately $2.26 million.

After crossing the $300 million milestone near the end of March buoyed by the increased liquidity in the dApps earlier mentioned, Cardano has gained some distance on blockchains such as Gnosis (GNO), Oasis (ROSE), Fusion (FSN), Bitcoin (BTC), Telos (TLOS), Neo (NEO), Algorand (ALGO), and Tezos (XTZ) among others.

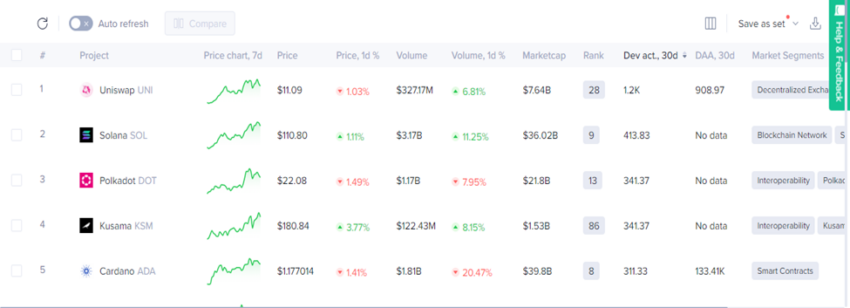

Cardano trails Kusama (KSM), Polkadot (DOT), Solana (SOL), and Uniswap (UNI) with approximately 311.33 in development activity the whole of March 2022.

This means that there could be more dApps running in the Cardano ecosystem which could take its total value locked towards the $500 million mark in the near future.

The total value locked in has also had a positive impact on the price of ADA. ADA reached a new high of $1.24 which is a 29% increase from March 1, 2022’s price of $0.9599.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.