The price of the leading artificial intelligence-related token Bittensor (TAO) has trended within an ascending channel since early September. Trading at $575 as of this writing, the altcoin has since noted a 150% uptick.

However, as buying pressure loses momentum, TAO is poised to shed some of these gains. This analysis highlights what token holders should look out for.

Bittensor May Lose the Support of Bulls

Bittensor’s price has remained within an ascending channel since the beginning of September. This channel is formed when an asset’s price consistently makes higher highs and higher lows over a given period, creating a clear uptrend. The upper line of the channel represents resistance, while the lower line represents support, where buying interest usually increases.

However, due to waning demand for the altcoin, Bittensor currently trades close to the lower line of its ascending channel at $558.80.

Read more: How to Invest in Artificial Intelligence (AI) Cryptocurrencies

When an asset trades near this lower line, it means the price is close to the channel’s support level. At this point, buyers often step in to push the price back up, making it a potential entry point for traders.

However, if the asset fails to hold above this lower line and breaks below the channel, it signals a weakening uptrend or the start of a bearish reversal.

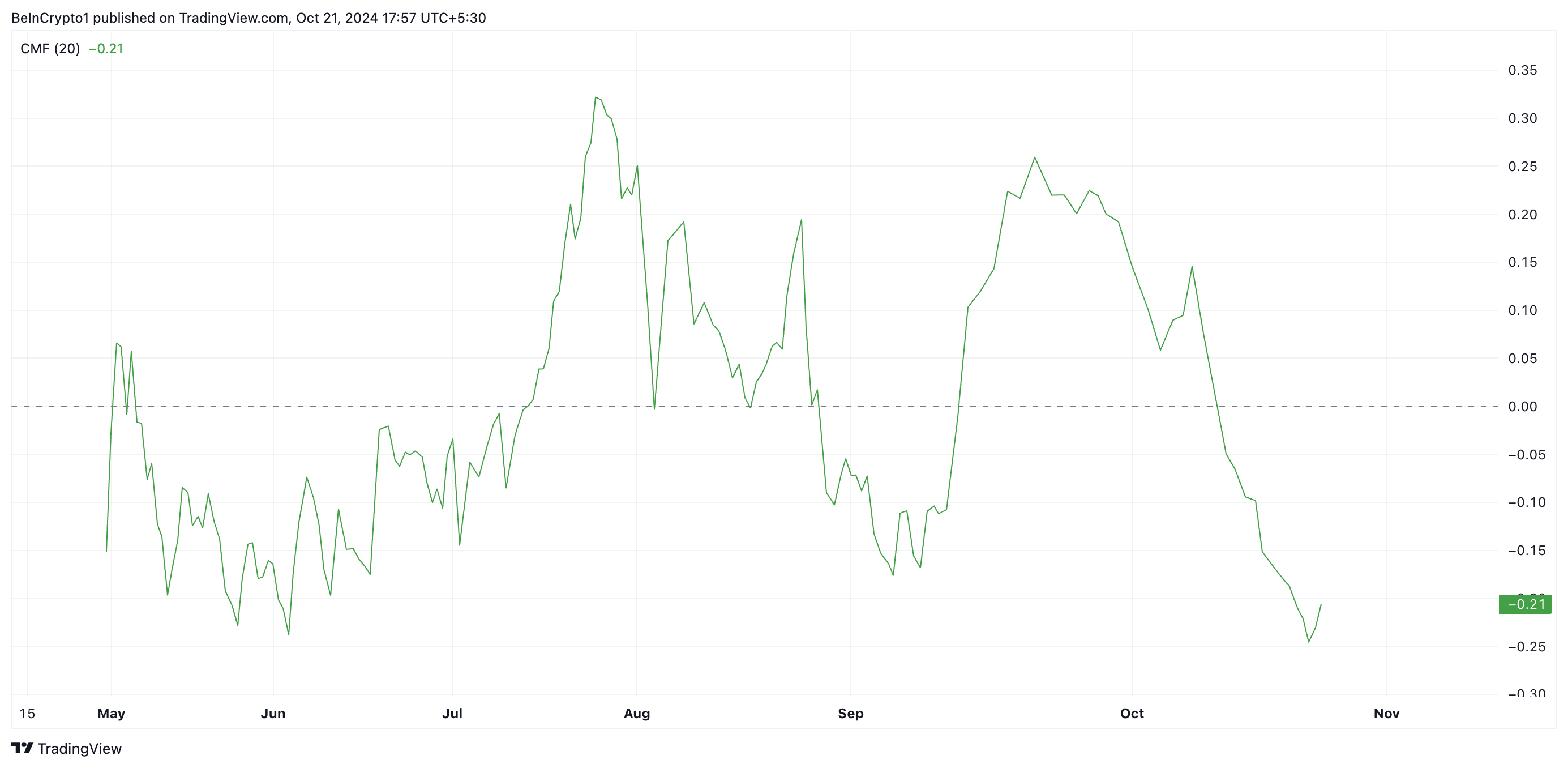

BeinCrypto’s assessment of TAO’s key indicators reveals that this might be true for the altcoin. For example, its Chaikin Money Flow (CMF) is on a downward trend, below the zero line at -0.21.

This indicator measures the strength of money flow into or out of a security over a specific period. When negative, selling activity outweighs buying activity, suggesting that more traders or investors are selling the asset than buying it. Traders interpret this as a potential signal for a continuation of a downtrend.

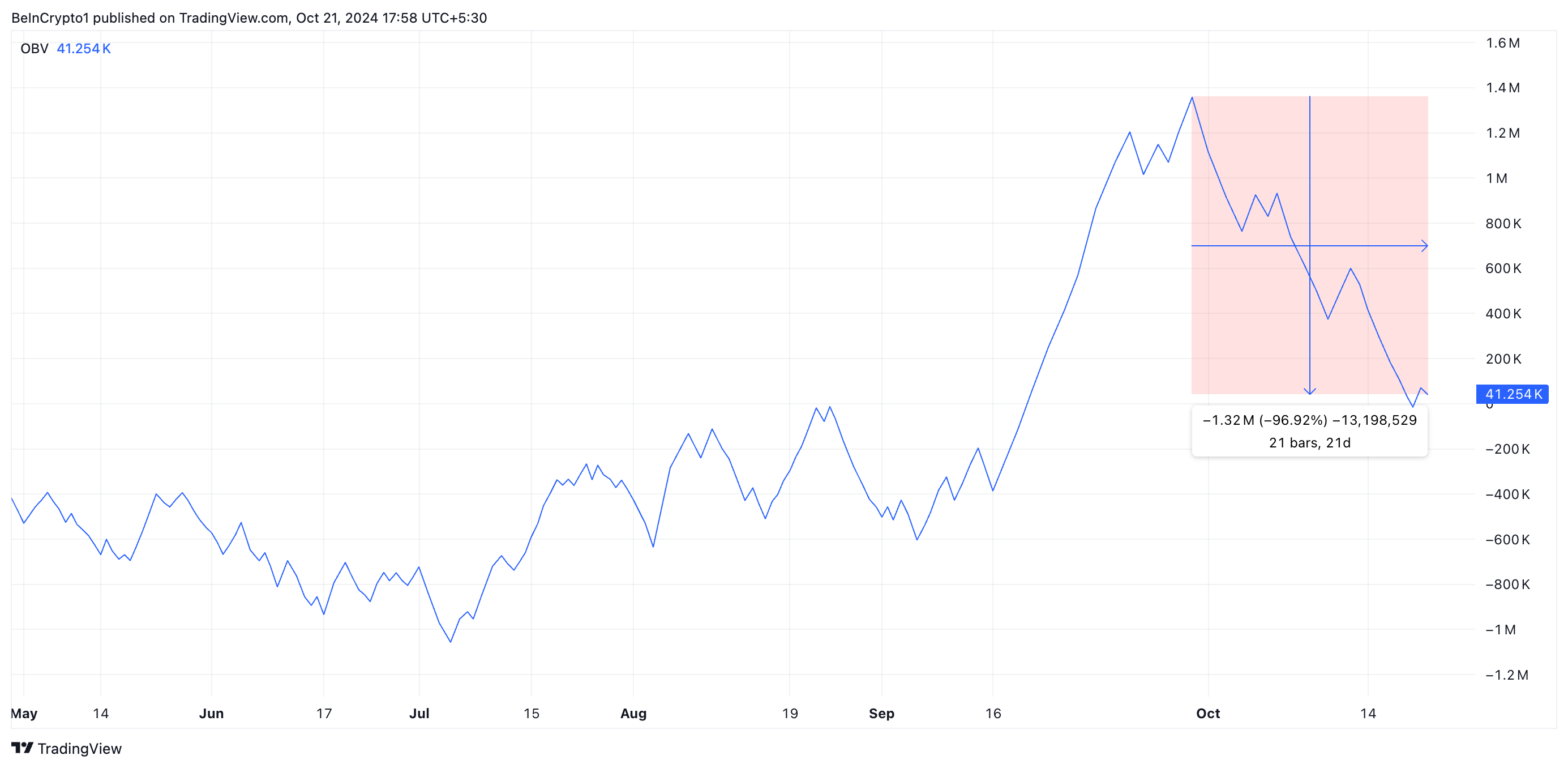

Furthermore, TAO’s declining on-balance volume (OBV) supports this bearish outlook. It is at 41,254 at press time, noting a 97% fall over the past 21 days.

The OBV measures buying and selling pressure based on volume. When it falls, it means there is more selling volume than buying volume, suggesting that sellers are more active in the market than buyers, leading to downward momentum in price.

TAO Price Prediction: The Altcoin Has Two Options

If the current selling momentum continues, Bittensor’s price risks falling toward the key support level of $558.80. Without new buying pressure entering the market, the bulls may struggle to defend this line, potentially pushing the altcoin down to $219.60. Should this level fail to hold, TAO could retreat further to its August 5 low of $163.70.

Read more: Top 9 Safest Crypto Exchanges in 2024

However, if fresh demand enters the market, Bittensor’s price may rebound off the lower boundary of the ascending channel, attempting to break above the resistance at $736. A successful breakout could propel the altcoin toward the $1,249 mark, signaling a bullish reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.