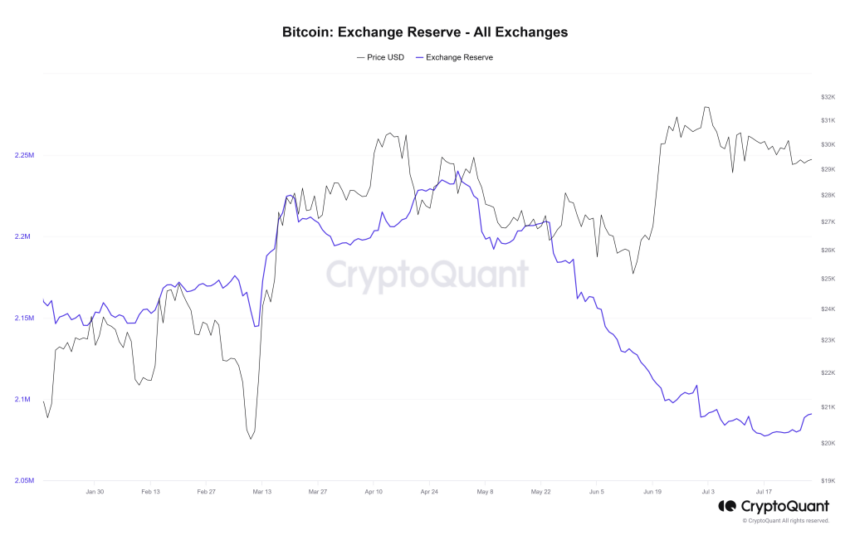

Bitcoin (BTC) balances on leading cryptocurrency exchanges such as Coinbase, Binance, and Kraken are near a six-year low, according to data from analytics platform CryptoQuant.

The decline came as the broader market stabilized after massive losses in August and the first half of September.

Bitcoin Reserves on Exchanges Continue to Fall

According to CryptoQuant, exchanges currently hold only 2.09 million BTC. The maximum amount of the cryptocurrency to be issued will be 21 million coins, and by the end of 2023, more than 19.7 million will be in circulation.

At first glance, a decrease in Bitcoin held on exchanges is a bullish signal and indicates a strengthening market and expectations of rising prices. However, given the current regulatory landscape, traders and investors may opt for self-storage amid growing uncertainty. This means that they will transfer BTC to centralized platforms again at a more favorable moment.

Click here to learn more about Bitcoin.

SEC Tightens Screws on Crypto Exchanges

The amount of BTC held on exchanges has been declining throughout 2022. However, in November, the indicator accelerated the rate of decline; around this time, the once popular cryptocurrency exchange FTX collapsed, blocking billions of client funds.

In the first quarter of 2023, after the collapse of a number of regional banks in the United States, the outflow of funds slowed but then continued to decline. The trend can be explained by the fact that the US Securities and Exchange Commission (SEC) is cracking down on large cryptocurrency platforms, accusing them of non-compliance with legal requirements.

Click here to learn more about the 2023 US banking crisis.

In June, the regulator sued both Binance and Coinbase claiming that both exchanges were offering clients unregistered securities.

The US branch of Binance has found itself at the center of several scandals. Over the past few months, the platform has experienced key layoffs, massive staff reductions, and operational outages. Trading volume on Binance.US dropped by more than 95% amid a barrage of negative news.

Do you have anything to say about the balance of Bitcoin on exchanges or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.