The sudden drop in the crypto market today has garnered significant attention. Bitcoin (BTC), the largest cryptocurrency by market capitalization, briefly dipped to $49,000 before stabilizing at $52,765.

Ethereum (ETH) mirrored this volatility. CoinGecko data shows it briefly touched $2,100 before trading at $2,359.

Investor Nerves Shaken as Crypto Volatility Surges

These swift fluctuations led to extensive liquidations. According to Coinglass data, the liquidation amount in the last 24 hours has reached $1.06 billion, with $901.33 million from long positions and $159.41 million from short ones. BeInCrypto reported that, around five hours ago, the liquidation figure was only approximately $800 million.

Read more: What Causes Bitcoins Volatility?

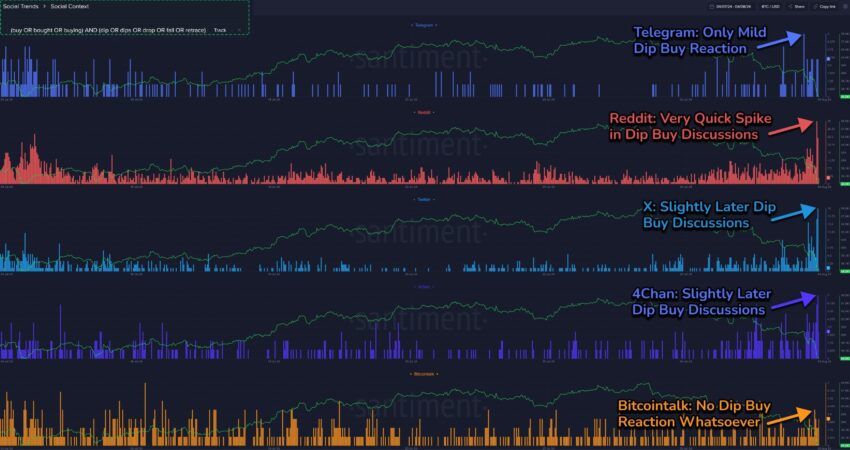

This dramatic sell-off highlights the intense volatility within the crypto markets, shaking investor confidence. The on-chain analytic platform Santiment reported that discussions about buying have spiked, but not as much as investors and market watchers expect on such a dramatic drop.

“Expect for the bigger reaction to come as the US wakes up for their Monday morning shock. Emotional sell-offs will only accelerate the timing of crypto’s rebound,” it noted.

Furthermore, analysts at the on-chain analytic tool CryptoQuant noted that BTC has broken below its support level of $57,000. This might suggest a further drop to $40,000, according to them.

“Currently, traders are facing their most negative unrealized profit margins since November 2022,” CryptoQuant’s analysts added.

Despite the market panic, several analysts provided more optimistic insights into the situation. Charles Edwards, the founder of Capriole Investments, mentioned that the key $52,000 level could trigger a market bounce. Otherwise, the next support could be $44,000.

Prominent crypto trader Bitcoin Jack also suggested that odds might favor a retest of the bottom of the market’s parabolic channel.

“Price just hit the upper bound, again. Bottom in 2026 if we started here. Just an idea, been wrong on this before, so good luck and have fun,” Bitcoin Jack wrote.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Similarly, CryptoKaleo believes the current conditions present a solid buying opportunity. He advises a measured approach to avoid attempting to “nail the pico bottom.”

“The game plan is still the same. Accumulate now – send into the end of the year,” CryptoKaleo concluded.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.