The anti-crypto army, led by Senator Elizabeth Warren, is facing strong opposition from influential conservative groups in the United States.

A letter from David M. McIntosh, Grover Norquist, and Adam Brandon, the presidents of Club for Growth, Americans for Tax Reform, and FreedomWorks, respectively, to Senator Marshall, criticizes his support for Senator Warren’s efforts to impose new regulations on digital asset companies.

These groups argue that such regulations would stifle innovation, punish job creators, and drive investment away from America.

Elizabeth Warren’s Anti-Crypto Army

Senator Warren has been actively working to recruit conservative Senate Republicans to join her in regulating the crypto industry. She is pushing for a bill that imposes tougher anti-money laundering restrictions on digital asset providers. This includes requirements for verifying customer identities.

Despite being an outlier in the Senate, her partnership with Republican Party lawmakers reflects a broader coalition. This alliance consists of progressives, conservatives, watchdog groups, and bankers who are concerned about the potential risks associated with the unregulated growth of the crypto industry.

However, the crypto industry and its proponents vehemently oppose Warren’s anti-money laundering bill.

A Member Board of Directors at Coinbase, Katie Haun argues that these efforts are “misguided, reckless, and potentially unconstitutional.” She affirms that America is on a “dangerous path of closing off the banking system to those disfavored by a particular administration.”

Lobbyists and some former regulators also express concerns about the bill, fearing it could stifle the industry’s growth and innovation.

A recent study reveals that the U.S. risks losing around one million web3 developer positions and numerous related non-technical jobs within the next seven years if the current trend of regulatory enforcement continues, driving technological innovation abroad.

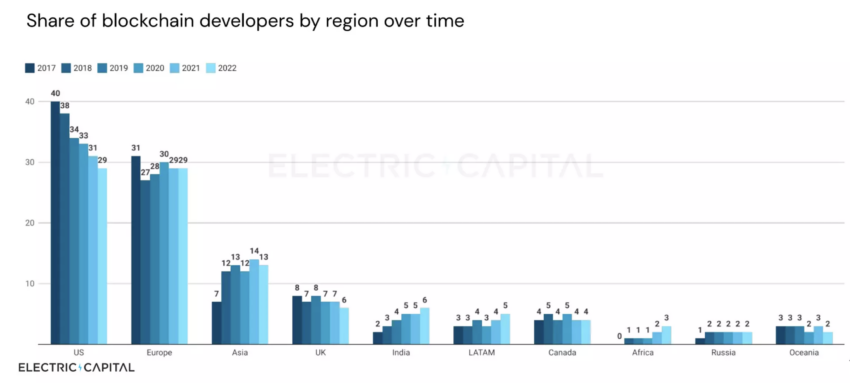

According to the report, the U.S.’s global percentage of web3 developers has fallen from 40% to 29% in the past six years, with no indications of deceleration. The U.S. is losing nearly 2% of the web3 developer market share annually.

Consequently, high-quality, well-paid job opportunities are migrating from the U.S. to regions offering more favorable conditions, such as clear regulations or a commitment to fostering technological advancements.

Gaining Support Among Lawmakers

Despite this resistance, Warren remains focused on addressing national security concerns as her legislation’s primary focus. It also raises other issues, such as consumer protection and environmental impact.

Senator Warren’s partnership with Senator Roger Marshall, a Kansas Republican, highlights the potential for a bipartisan coalition working to regulate the crypto market. Marshall shares Warren’s concerns about national security risks, and both senators are actively working to build support for the bill.

Meanwhile, other senators like Mike Rounds and Sherrod Brown are expressing skepticism about cryptos and discussing possible regulations. This further illustrates the growing interest in regulating the crypto industry from both sides of the aisle.

The anti-crypto movement is gaining momentum in the U.S. Senate, with lawmakers from both parties expressing concerns about the potential risks associated with an unregulated crypto industry.

Interestingly, this comes at a time when the U.S. Federal Reserve is promoting the use of its new instant payment infrastructure, FedNow. FedNow is designed to enable financial institutions of all sizes to provide secure and efficient instant payment services.

It aims to become a potential competitor to cryptos in the realm of real-time, around-the-clock transactions.

As the debate over crypto regulation continues, it is worth considering whether the push for more stringent oversight is partly influenced by the desire to promote the adoption of FedNow.

If successful, the FedNow Service could provide an alternative to cryptos for individuals and businesses seeking instant payment solutions. However, the interconnection between Warren’s bill and the promotion of FedNow remains uncertain.

What is clear, though, is that the ongoing debate over crypto regulation has the potential to shape not only the future of digital assets but also the broader financial landscape in the U.S.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.