In the volatile cryptocurrency market, large financial movements often trigger fear among investors. Such is the case with the recent $10 million transfer of Solana (SOL) tokens from the bankrupt crypto exchange FTX’s Solana wallet to the Ethereum network via the Wormhole bridge.

While the sum might not be seismic in the $2 trillion crypto market, the timing and circumstances may cause turbulence.

Bankruptcy Court Recommend Cap on Token Sales

FTX debtors filed a proposal last month with the Delaware Bankruptcy Court. They outlined a structured approach to the sale of their digital assets, designed to mitigate the impact on market prices. The proposition recommends a cap of $100 million per week for most token sales, with an adjustable ceiling of up to $200 million.

Assets like Bitcoin (BTC) and Ethereum (ETH) received special classification as “insider” assets, demanding a 10-day notice to creditors before sales.

Want to learn more about Solana? Click here.

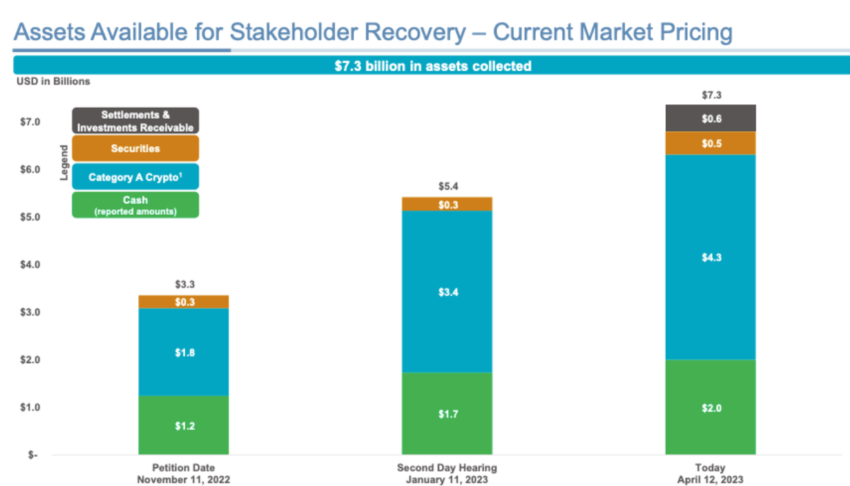

Despite not being legally binding, the proposal shows FTX’s future strategy as it undergoes a bankruptcy review on Sept. 13. Even before filing for bankruptcy, FTX had disclosed crypto holdings worth an estimated $3.4 billion in April.

However, details about the composition of these holdings, particularly in liquid assets like Bitcoin and Ethereum, remain undisclosed.

FTX debtors intend to enlist a financial adviser to temper the fallout from any prospective sales. This adviser would guide token sales, particularly those with limited liquidity, to avoid sudden, drastic price drops.

Some Tokens May Be Staked

FTX aims to hedge its Bitcoin and Ethereum holdings to secure a more stable revenue stream from any sales. This way it can cushion against the inherent volatility of cryptocurrencies.

Read more about what led to the FTX collapse in our Learn article.

The estate may also stake certain tokens. This move is aimed at generating returns for creditors and possibly impacting the prices of those specific digital assets.

Previously, FTX had proposed assigning Mike Novogratz’s Galaxy Digital to oversee the sale and management of its recovered crypto. While the firm has yet to make a final decision, the initiative suggests a diligent approach toward safeguarding the financial interests of FTX’s creditors.

Solana co-founder Anatoly Yakovenko has publicly urged FTX to redistribute its SOL holdings to its users. He says that giving users control over these SOL assets could be a mutually beneficial solution for the Solana network and FTX’s former clients.

“My wish would be to distribute the sol to all the FTX customers directly. Probably the least worse outcome for everyone,” Yakovenko said.

Venture capitalist Adam Cochran underscored the movements of large SOL holdings, like the recent $10 million Solana transfer, are bound to unsettle markets. He said stakeholders should be vigilant.

“Probably a case to be made that selling it all in liquidation would result in a worse price and therefore be poor fiduciary responsibility,” he added.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.