The latest liquidity farming pool from Yearn Finance has been launched as the DeFi protocol restructures and adds new incentives.

Total value locked across the entire DeFi ecosystem is at an all-time high of $12.65 billion today, but not all protocols are enjoying the flow of collateral.

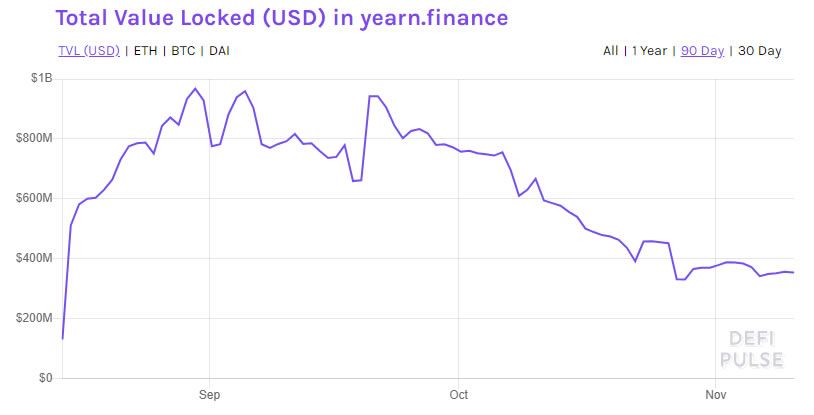

Yearn Finance, for example, has lost 63% of its cryptocurrency collateral which has fallen from $967 million in early September to $354 million today according to DeFi Pulse.

Great insights on the new https://t.co/hhLPp2Jwb5 yveCRV vault. This is a new kind of meta vault, this kind of vault symbiosis has been the ultimate goal of yearn, so finally seeing one come online is really exciting

— Andre Cronje (@AndreCronjeTech) November 9, 2020

– yveCRV earn higher fees than base veCRV https://t.co/IYxy20CkiY

Yearn Finance Introduces ‘Backscratcher’ Vault

A cryptocurrency analyst going by the Twitter handle Ceteris Paribus (@ceterispar1bus) has delved into the new vault, claiming that it is a more positive-sum approach compared to farms being parasitic to one another. The idea is to establish a vault with restricted withdrawals or locks — in this case, for a four year time period. Depositors would gain yields from both veCRV four-year lock return, in addition to a small percentage of all boosts to stablecoin and Bitcoin Curve vaults. The protocol explained why it needed to leverage Curve and increase locked liquidity in order to provide these better returns;“Optimal use of Curve remains the key yield farming strategy for several pools today. Yearn needs a huge and growing pool of locked veCRV to support high yields across multiple vaults as deposits of stablecoin and bitcoin increase.”veCRV is short for voting escrow CRV and is a token used for governance proposals and pool parameters in the Curve Finance DAO. CRV token holders receive veCRV tokens by locking up their CRV tokens, and Yearn Finance now provides the new pool offering additional rewards for long-term lockup. Yearn’s three other CRV vaults will also get a yield boost from the ‘backscratcher’ vault — hence the name.

Four Years Too Long?

Considering that DeFi has moved so fast this year and that liquidity pools, governance tokens, and protocols have come and gone in the span of just a few months, a four-year lockup may be asking a lot from those that do not have huge bags to throw around. However, the veCRV token balance has increased by almost two million in the past few days, so many must feel that the incentive is a positive addition. https://twitter.com/bantg/status/1325705423756926977

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored