A Binance-using Bitcoin whale has transferred nearly 110,000 BTC, currently valued at $604,505,000, into a private wallet — as the market leader’s price reaches year-to-date lows.

The Big One

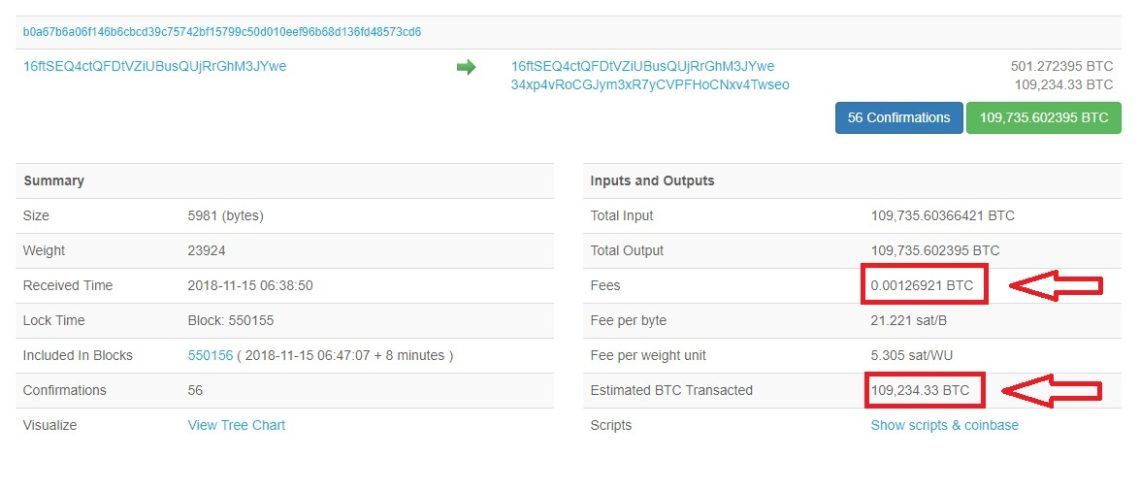

In a recent transaction on the Bitcoin blockchain, a user transferred 109,234 BTC — worth more than $600 million in current prices — into a private wallet. With any normal financial institution — like a bank, for example — a wire transfer could cost you, on average, $30 to $50 for an outgoing international transfer of a significantly more minuscule amount by comparison.

This transaction incurred a fee of just 0.00126 BTC or just under $7 — which is virtually free, considering the amount that was sent.

[bctt tweet=”A Bitcoin whale has transferred $600 Million in BTC into a private wallet for only… $7.” username=”beincrypto”]

One feels that it is safe to assume that transferring millions of dollars with a large-scale financial custody firm would require the need to fill out mountains of paperwork and wait a significantly longer period of time for the transaction to take place — not to mention how much you would be paying to make a transaction that size happen.

Institutional investors with deep pockets entering the digital asset space are catching on to just how convenient and secure it is to send large amounts of money across the world for microscopic fees and at an exponentially faster speed than with a traditional institution — as well as having no hoops to jump through or conditions to limit the transaction. All that’s needed is a pair of Bitcoin wallets.

With any normal financial institution — like a bank, for example — a wire transfer could cost you, on average, $30 to $50 for an outgoing international transfer of a significantly more minuscule amount by comparison.

This transaction incurred a fee of just 0.00126 BTC or just under $7 — which is virtually free, considering the amount that was sent.

[bctt tweet=”A Bitcoin whale has transferred $600 Million in BTC into a private wallet for only… $7.” username=”beincrypto”]

One feels that it is safe to assume that transferring millions of dollars with a large-scale financial custody firm would require the need to fill out mountains of paperwork and wait a significantly longer period of time for the transaction to take place — not to mention how much you would be paying to make a transaction that size happen.

Institutional investors with deep pockets entering the digital asset space are catching on to just how convenient and secure it is to send large amounts of money across the world for microscopic fees and at an exponentially faster speed than with a traditional institution — as well as having no hoops to jump through or conditions to limit the transaction. All that’s needed is a pair of Bitcoin wallets.

Reason For Concern?

The timing of a transaction like this one is intriguing, coming less than 24 hours after the Bitcoin price plunged from $6,250 to around today’s $5,400 level — causing plenty of panic not seen since the Silk Road and Mt. Gox days on social media. This marks a new 2018 low point, at a time when many expected the high volatility but assumed it would give Bitcoin a big push to the upside instead. The sending wallet seems to be originating on the Binance cryptocurrency exchange and funds were sent to an unknown private wallet.It is unclear how many (if any) of these bitcoins were acquired during the sell-off that occurred yesterday. This could simply be the accumulations of a whale moving funds from exchange to cold storage — which could be considered a positive signal that the big money is in HODL mode. Do you see a transfer of this amount of Bitcoin to be a positive or negative sign? Let us know your thoughts in the comments below! Disclaimer: The author of this article holds Bitcoin (BTC) and various altcoins. This is not financial advice, and should not be construed as such. It is for informational purposes only. BeInCrypto is not responsible for any financial decisions made by any readers. Trading in cryptocurrency is notoriously volatile and we recommend anyone interested consult with a trained financial professional.109,234 $BTC ($618,182,514.50 USD) transferred from #Binance-wallet to Unknown wallet Tx:https://t.co/7WReUnOzJG

— Crypto Watch (@whalewatchio) November 15, 2018

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kyle Baird

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

READ FULL BIO

Sponsored

Sponsored