If you want to explore DeFi on your mobile device, Telcoin is a good place to start. The platform helps users get their hands on decentralized applications focusing on finance. The ecosystem is steadily aligning itself with telecom service providers — blurring the lines between web2 and web3. This Telcoin price prediction will consider Telcoin and its native token, TEL, from an investment perspective.

- Telcoin price forecast and fundamental analysis

- Telcoin tokenomics and the price prediction

- TEL price forecast and other key metrics

- Telcoin price prediction and technical analysis

- Telcoin (TEL) Price Prediction 2023

- Telcoin (TEL) Price Prediction 2024

- Telcoin (TEL) Price Prediction 2025

- Telcoin (TEL) Price Prediction 2030

- Telcoin (TEL’s) long-term Price Prediction until 2035

- Is this Telcoin price prediction model accurate?

- Frequently asked questions

Want to get TEL price prediction weekly? Join BeInCrypto Trading Community on Telegram: read TEL price prediction and technical analysis on the coin, ask and get answers to all your questions from PRO traders! Join now

Telcoin price forecast and fundamental analysis

Decentralized finance for mobile users is clearly a strong use case. And Telcoin is currently looking at a massive 5 billion telecom-specific user base.

Did you know? Telcoin uses the telecom infrastructure to pave the way for remittances. Using the network, mobile operators can enable low-cost international transfers.

Here are some additional insights that will help with any investment-specific decisions regarding Telcoin:

- The product lineup comprises a user-managed DEX and a financial network termed the “Send Money Smarter” network.

- Its founder, Paul Neuner, was also the brain behind the popular mobile-specific fraud management solution, Mobius.

Overall, Telcoin looks like a project with strong potential. And the mentioned insights could make TEL — the native token — a good investment option.

Telcoin tokenomics and the price prediction

Telcoin is an Ethereum-specific project. And its native token, TEL, is ERC-20 compatible. But what about tokenomics?

“Another reminder that Telcoin wallets are assisted self-custody. Wallet assets are not on our balance sheet.”

Paul Neuner, Founder of Telcoin: X

Firstly, Telcoin has a fixed supply of 100 billion TEL tokens. Also, as per initial distribution, 25% of the total supply went to the investors in a crowd sale, whereas the team kept 15% of the reserves to themselves. And finally, 5% made it to the liquidity fund for development. As of now, 50% of the cap forms the circulating supply. Subsequent releases will depend on network growth and ecosystem adoption.

As of December 2023, almost 71% of Telcoin tokens are in circulation.

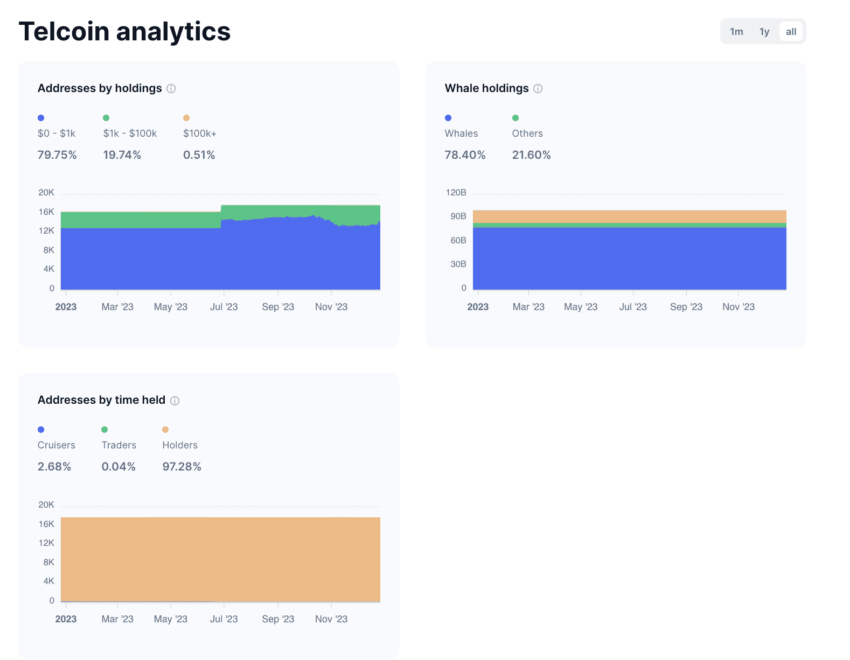

One thing to keep in mind is the biased token concentration. Per the holder statistics back in January 2023, the top 100 TEL holders controlled almost 84% of the circulating supply. This might cause concern if the crypto market bottoms deeper any time soon.

However, as of December 2023, the TEL whales control 78.40% of the supply.

TEL price forecast and other key metrics

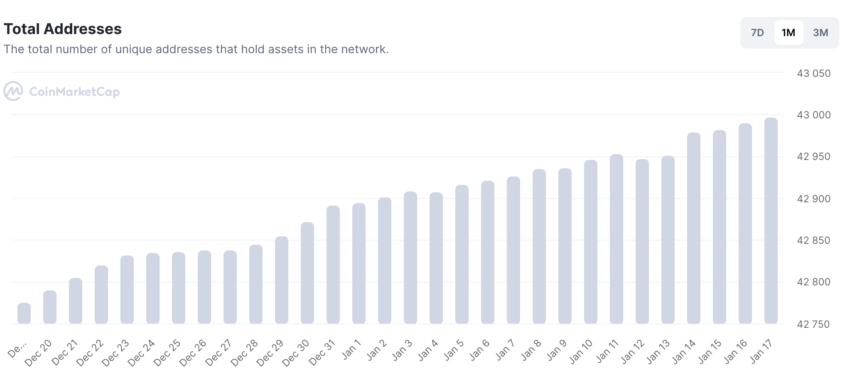

The monthly pattern of TEL token addresses showed steady growth as of January 2023, with levels reaching as high as 43,000 addresses. This might be an optimistic push for Telcoin’s short-term price action.

Telcoin’s market capitalization peaked on May 12, 2021, reaching $2.83 billion. At that time, the daily trading volume was $118.93 million. As of November 2023, things seem to have changed, with the market cap at $197 million and the daily trading volume at $1.42 million level. In December 2023, these figures have dropped further. This metric shows a drop in the adoption and transaction volume, with fewer traders being as active as before.

Yet, we expect this condition to pick up by the end of 2023, especially as and when the price of TEL grows.

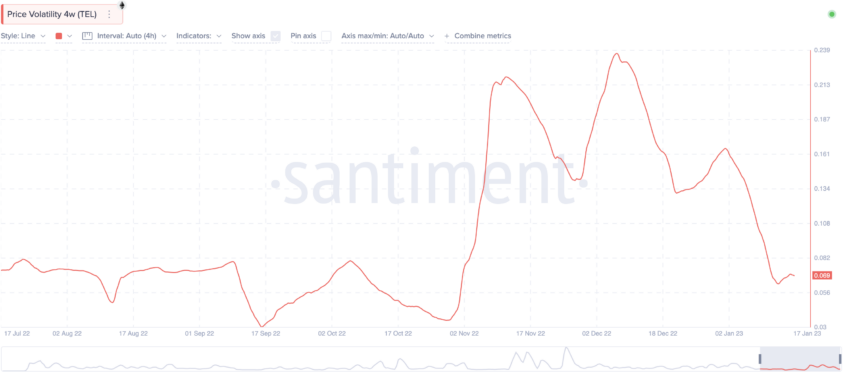

Still, there is a reason why we were optimistic regarding the TEL price forecast in early January, especially in the short term. The 4-week volatility chart showed a dip, which might increase prices soon.

Telcoin price prediction and technical analysis

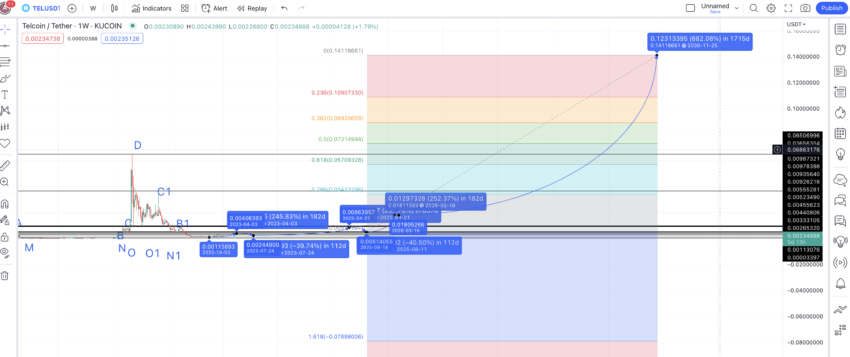

The next step is to rely on historical data and technical analysis for Telcoin (TEL) price prediction. Here is a weekly Telcoin price chart showing a clear pattern of sorts:

Notice that Telcoin started trading at a high before slipping into a range-bound phase. Post the range-bound trading, the token made a couple of higher highs before reaching its highest price of $0.065 back in May 2021.

Once the peak was attained, there were a couple of distinguishable lower highs before the price of TEL again started moving in a range. Notice that TEL has recently started to show an upmove thanks to the crypto market rally. This way, the price of TEL might be completing the path from the left side of the chart to the right.

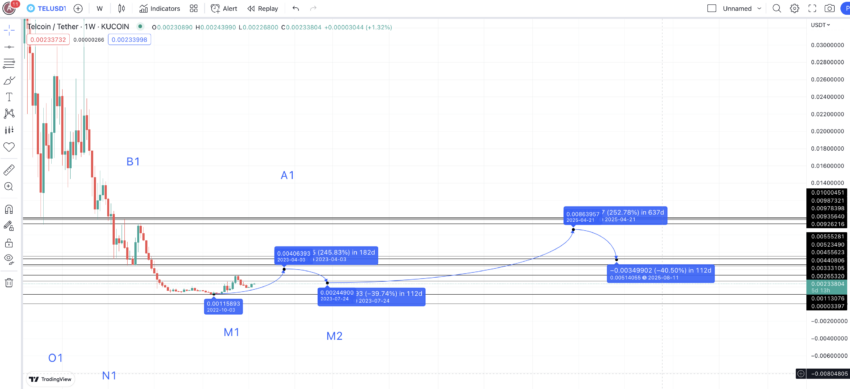

Let us now revisit the weekly chart, but upon marking all the highs and lows clearly:

Pattern identification

Our first task is to find the average distances between the highs and lows using the chart above. Notice we are assuming the entire pattern will repeat itself. Therefore, we can expect the price of TEL to follow the A to A1 path again.

Also, we do not know if A1 is the high we seek. Therefore, once we take the average of all the high-to-low and low-to-high points, we can cross-check and see if A1 is the point we were looking for.

Price changes

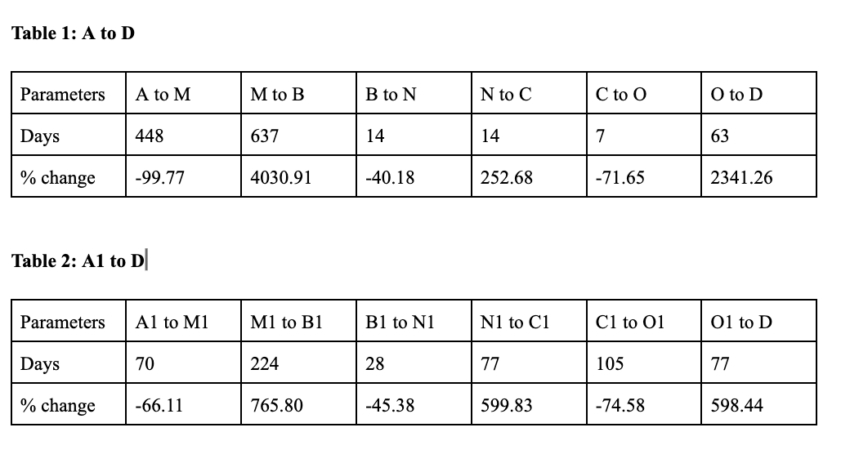

We shall prepare two tables here. One traced the path from A to D, and the other traced the path from A1 to D.

Columns with positive values signify low-to-high movements, whereas columns with negative values signify high-to-low movements. Plus, each price point might also act as a strong resistance/support line, which the future price of TEL might adhere to.

Calculations

The average price percentage and distance of low-to-high movements come out to be 1431.48% and 182 days. Note that the max low-to-high distance is 637 days, and the lowest percentage hike is 252.68% (from Table 1). We will adhere to these figures initially due to the bear market conditions.

The average price percentage and distance of low-to-high movements are -66.27% and 112 days. Note the max high-to-low distance is 448 days, and the lowest percentage drop is -40.18% (from table 1). The time of drop can fall anywhere between 7 days and 448 days, depending on the state of the crypto market.

So, if M1 is the last low, we can expect the next high to be anywhere between 182 days and 637 days. A 252.68% hike seems legit, keeping the current market conditions in mind.

Telcoin (TEL) Price Prediction 2023

Our TEL 2023 price prediction was moderately successful as it reached close to $0.0032 against our proposed level of $0.004. Here is what our 2023 price analysis comprised:

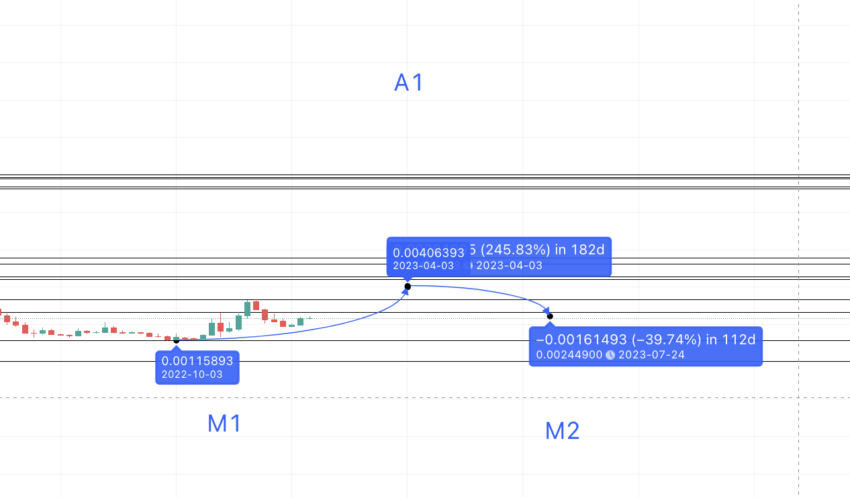

From M1, using the average low-to-high distance of 182 days and the lowest growth percentage of 252.68%, we can plot the next high at $0.00400. This can be the new, readjusted A1 or even A2 if you are already looking for a new pattern.

Assuming that the same chart pattern is repeated, the next point could be M2 or the new low. Also, as the path from A to B (both on the left and right side of the chart) is a range-bound one with the low at M, our task is to locate the next M2 after A1. We can take the average distance of 112 days and the lowest drop of -40.18% to plot the same.

Therefore, M2 or the Telcoin (TEL) price prediction 2023 low could surface at $0.00245.

Telcoin (TEL) Price Prediction 2024

For 2024, we should focus on TEL’s short-term price analysis, especially to gauge the prospective levels in sight.

At present, TEL seems to have broken below the lower trendline of a pennant pattern. The dips are sharp, which we expect to take support at $0.00125. That could be the lowest point of 2024, as we expect the bull market to lift all boats. Even the RSI, making lower lows, is confirming a short-term dip.

If things improve and the prices surge, the first level to breach for TEL would be $0.003, after which it can even trace a high of $0.0066, depending on market conditions. If those levels are reached, the low for 2023 could form at $0.004, which is akin to a strong support zone.

Projected ROI from the current level: 387%

Telcoin (TEL) Price Prediction 2025

Outlook: Bullish

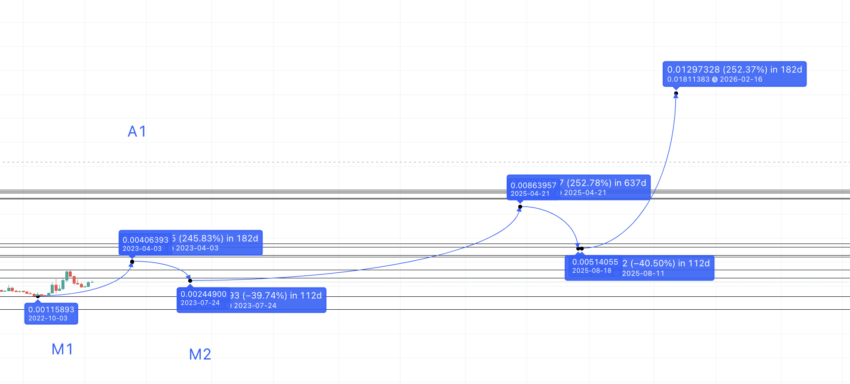

Notice that the chart’s path between every A to B is flat. Therefore, taking your time while tracing the next high or B2 from the lows of M2 makes sense. The price hike could still be 252.68%, depending on the state of the crypto market. The time from M2 to B2 could take between 182 days and 637 days — data from the above tables.

This puts the Telcoin price forecast for 2025 at $0.00864. However, unlike the left side of the pattern, B2 here surfaces above A1, validating an uptrend of sorts. In that case, the next dip to N2 could take 112 days and might not drop as high as the average suggests.

From this point B2, the low could surface in 112 days and at a drop of 40.18% (the lowest figure from the tables above). This puts the long-term Telcoin price forecast at a low of $0.00514 in 2025.

Projected ROI from the current level: 538%

Telcoin (TEL) Price Prediction 2030

Outlook: Bullish

As per the Telcoin (TEL) price prediction 2026 model, the next high might show up in 182 days from the last low in 2025. The percentage hike can vary, but in an uptrend, we can expect the minimum growth of 252.68% to hold. This puts the maximum price of Telcoin in 2026 at $0.0181.

Using the 2026 high and 2025 low, we can draw the Fib lines to draw the TEL price forecast lines till 2030.

That way, we can expect the Telcoin price prediction for 2030 to surface at a high of $0.1411. This price level should surface by the end of 2030 but can also show up earlier.

However, for the TEL price forecast to reach the 14-cent mark, it will first need to breach the 6.5-cent mark, the previous all-time high price, by at least 2029.

Projected ROI from the current level: 10328%

Telcoin (TEL’s) long-term Price Prediction until 2035

Outlook: Bullish

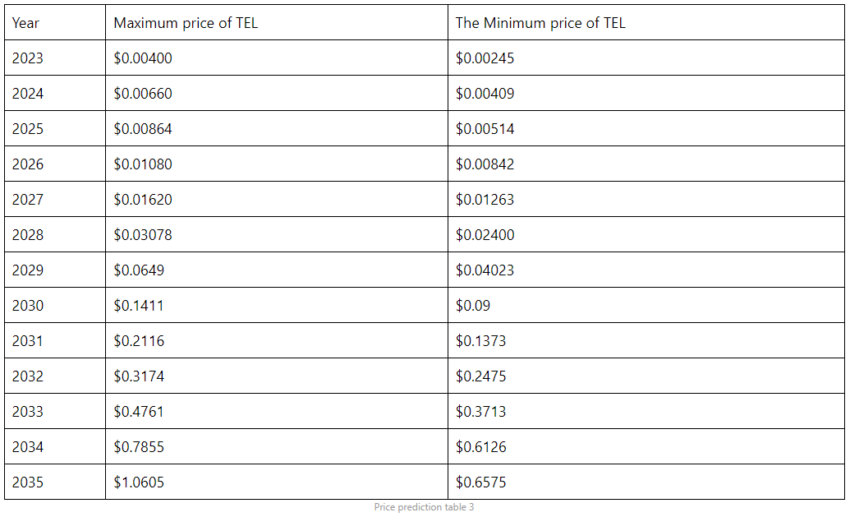

Trudging through the historical data gives us the minimum and maximum prices of TEL till 2030. However, if you plan on holding this token till 2035, here is a table that might help you retrace the prices till 2035.

You can easily convert your TEL to USD

It is important to note that the price of TEL each year might not be completely accurate. The market capitalization of Telcoin, trading volume at the time of calculation, and the state of the broader crypto market will have major roles in price determination. Therefore, it is always advisable to focus on the average prices through the timeline instead of fixating on the minimum and maximum prices of TEL.

Is this Telcoin price prediction model accurate?

This Telcoin price prediction model uses historical data to establish long-term and sustainable price patterns. Therefore, the long-term Telcoin price predictions arrived at using this model are fairly attainable and realistic. Plus, our inferences also involve heavy consideration of the project fundamentals and tokenomics, ensuring the model is holistic and impactful.

Frequently asked questions

Is Telcoin coin a good investment?

What is Telcoin’s all time high?

Who owns Telcoin crypto?

What is Telcoin used for?

Is Telcoin the same as XRP?

Is Telcoin Ethereum based?

What type of coin is Telcoin?

Disclaimer

In line with the Trust Project guidelines, the educational content on this website is offered in good faith and for general information purposes only. BeInCrypto prioritizes providing high-quality information, taking the time to research and create informative content for readers. While partners may reward the company with commissions for placements in articles, these commissions do not influence the unbiased, honest, and helpful content creation process. Any action taken by the reader based on this information is strictly at their own risk. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.