Ethereum Classic (ETC) is trading inside bullish long- and short-term patterns. Still, technical indicators do not paint a bullish picture.

ETC has been falling since reaching an all-time high price of $179 in May 2021. Since later that month, it has been trading inside a descending wedge, which is considered a bullish reversal pattern. Therefore, an eventual breakout from the wedge would be expected.

On Aug 13, the price made an attempt at breaking out from the resistance line of the wedge, which at the time coincided with the $42.50 horizontal resistance area. While the attempt was unsuccessful, the resistance further weakened since this was the fourth attempt at breaking out.

Furthermore, the weekly RSI has already broken out from its resistance line and moved above 50 in the process. This is considered a sign of a bullish trend.

As a result, the weekly time frame readings suggest that an eventual breakout from the wedge and the $42.50 horizontal resistance area is expected.

Daily movement

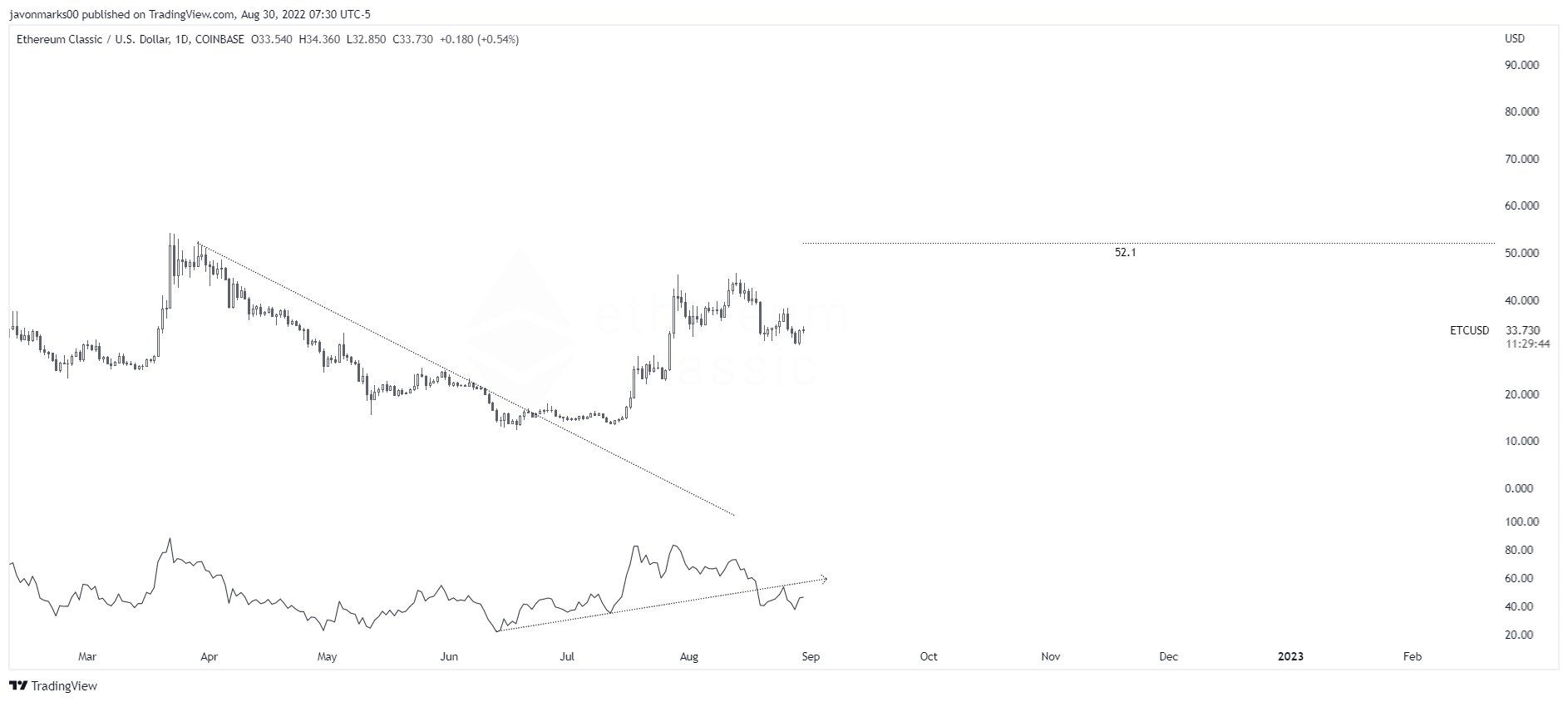

Cryptocurrency trader @javonnnm tweeted a chart of ETC, stating that the price is likely to reach $52.

However, the daily chart does not provide definitive clues as to the direction of the trend. The chart further reiterates the importance of the $42.50 resistance area, which albeit in the daily time frame is closer to $45. The area has intermittently acted as both resistance as support since Oct 2019.

The daily RSI is bearish, since it has broken down from an ascending support line and is now below 50. So, the daily time frame does not give a clear sign that suggests a breakout is expected.

Finally, the six-hour chart shows another descending wedge, this one in place since the beginning of Aug. While the wedge is considered a bullish pattern, the six-hour RSI has yet to break out from its descending resistance line. Moreover, it is still below 50.

So, while the price action is bullish, technical indicator readings are not.

Therefore, the direction of the trend is not entirely clear. Whether ETC breaks out or down from the short-term wedge could determine the direction of the future trend.

ETC wave count analysis

The wave count shows that ETC has completed a five-wave upward movement (white) that ended with the $45.36 high of July 29. Since then, it has been decreasing inside what is likely to be an A-B-C corrective structure. Since waves A:C have had a 1:1 ratio, it is possible that the correction is complete.

So, the wave count is more in alignment with the bullish price count than the relatively bearish technical indicator readings. A decisive decrease below $30.35 (red line) would invalidate this particular wave count, while a breakout from the previously shown wedge would confirm it.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.