Regulators are taking cryptocurrencies more and more seriously, and the IRS seems to be leading the way with a plan to obtain more accurate information from taxpayers regarding their financial activities with cryptocurrencies.

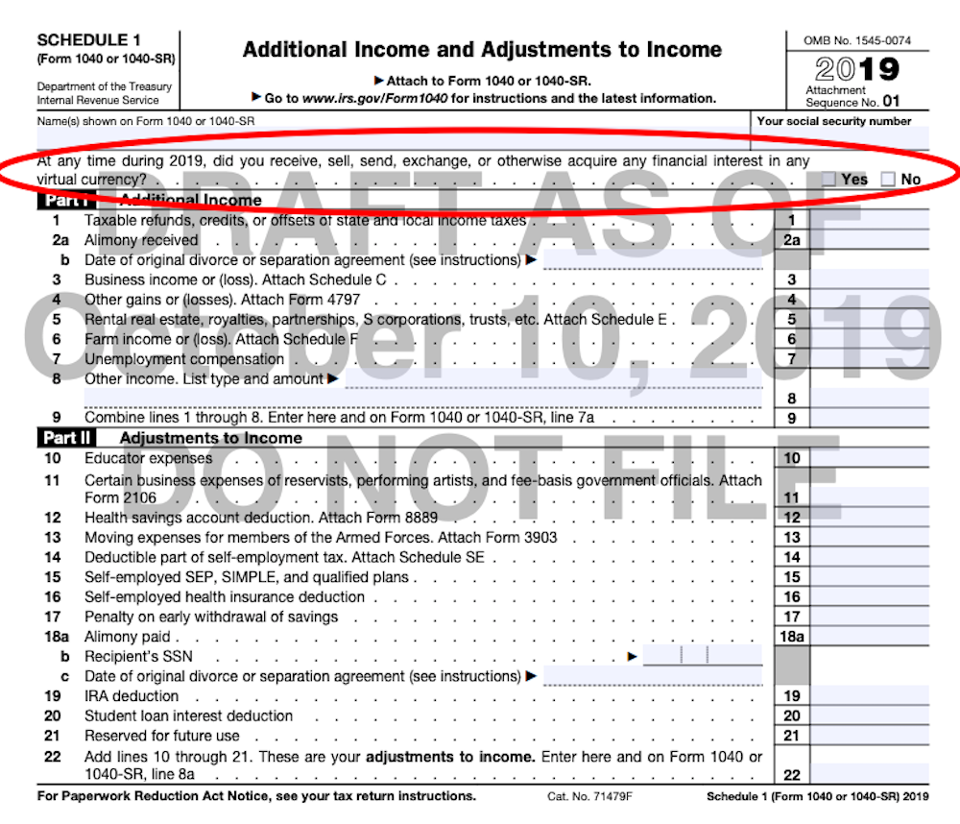

A new checkbox on Form 1040 now asks taxpayers whether “at anytime during 2019 did [they] received, sell, send, exchanged or otherwise acquire any financial interest in any virtual currency”.

The IRS put this new checkbox at the top of Schedule 1, so it does not appear directly as a declarable income on the front page of Form 1040. However, taxpayers are not exempt from declaring this information even though they are not obligated to file Schedule 1.

Failure to answer this question could lead to civil and criminal consequences. Also, it seems like the wording of the question wants to emulate the strategy previously used by the IRS to pursue offshore accounts, which may be a sign of a plan that could lead to more serious policies and regulations.

Failure to answer this question could lead to civil and criminal consequences. Also, it seems like the wording of the question wants to emulate the strategy previously used by the IRS to pursue offshore accounts, which may be a sign of a plan that could lead to more serious policies and regulations.

The IRS Is Stepping Up Its Crypto Game

Over the last few months, the IRS has become quite serious about cryptocurrencies. A few days ago, BeInCrypto reported on the agency issuing a number of guidelines on the treatment of cryptocurrencies, causing some controversy about the way it sought to regulate tokens received after a hard fork, especially in the case of an airdrop where a person gets coins without their consent or even without their knowledge. Also, at the end of July, the IRS sent more than 10,000 warning letters to people who failed to report their operations with cryptocurrencies accurately. The warnings – which came in the way of letter 6173, letter 6174, and letter 6174-A – alerted taxpayers that the IRS had information on their trading activity, and urged them to correct the necessary faults by paying the fines and interest associated with these misconducts.

According to an article by Forbes, IRS Commissioner Chuck Rettig not only warned of the dangers of omitting these warnings but also confirmed that the operations with cryptocurrencies are already under the agency’s scope:

The warnings – which came in the way of letter 6173, letter 6174, and letter 6174-A – alerted taxpayers that the IRS had information on their trading activity, and urged them to correct the necessary faults by paying the fines and interest associated with these misconducts.

According to an article by Forbes, IRS Commissioner Chuck Rettig not only warned of the dangers of omitting these warnings but also confirmed that the operations with cryptocurrencies are already under the agency’s scope:

“Taxpayers should take these letters very seriously by reviewing their tax filings and when appropriate, amend past returns and pay back taxes, interest, and penalties … The IRS is expanding our efforts involving virtual currency, including increased use of data analytics. We are focused on enforcing the law and helping taxpayers fully understand and meet their obligations.”What do you think about this new policy by the IRS? Will it be better or worse for the ecosystem? Let us know in the comments below!

Images are courtesy of Shutterstock, Forbes.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jose Lanz

José Lanz is a Venezuelan lawyer, professor and writer with a background in economics, specializing in strategic planning. Lanz currently focuses on covering the world of cryptocurrencies, fintech and blockchain technologies. His work has appeared in several English-language publications. Before getting fully involved in this world, he used to write for several local Spanish-language publications on a variety of topics. Also, Lanz is a strong believer that chocolate is better than coffee.

José Lanz is a Venezuelan lawyer, professor and writer with a background in economics, specializing in strategic planning. Lanz currently focuses on covering the world of cryptocurrencies, fintech and blockchain technologies. His work has appeared in several English-language publications. Before getting fully involved in this world, he used to write for several local Spanish-language publications on a variety of topics. Also, Lanz is a strong believer that chocolate is better than coffee.

READ FULL BIO

Sponsored

Sponsored