The IRS is claiming $44 billion in taxes relating to FTX, Alameda Research, and its subsidiaries. The filing of taxes under administrative priority means that the claims supersede those of the creditors.

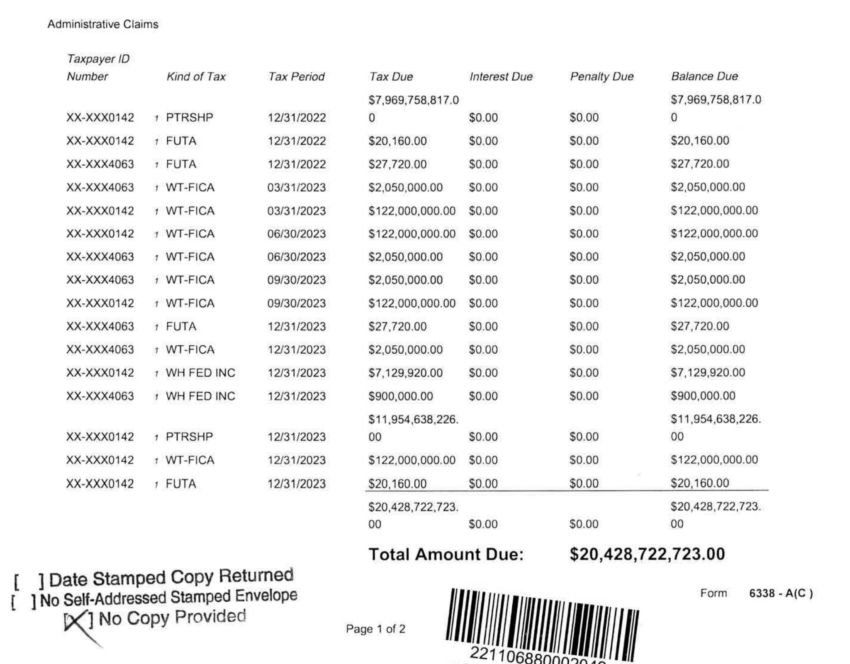

A tax bill associated with Alameda Research has been circulating the internet. It shows that the Internal Revenue Service (IRS) is claiming priority over creditors in the FTX bankruptcy case. The tax agency is claiming $44 billion in tax claims from the bankrupt exchange.

The categorization classifies the claims as an administrative priority, indicating that the IRS’ claims take precedence over the funds owed to the exchange’s creditors. However, the ongoing dispute over creditors’ dues is still determining the exact implications of this situation. For instance, Nick van Eck, a partner at General Catalyst, expresses curiosity about the methodology used to calculate the amounts and the process for obtaining the funds.

The IRS filed 45 claims against the exchange and its subsidiaries in the filings. These filings were published on April 27 and 28. Alameda Research dues amount to $20.4 billion in unpaid partnership taxes and federal payroll taxes.

The IRS has not provided any details on the matter. An agency spokesperson stated that “federal law prevents the IRS from confirming or denying any correspondence with regard to any taxpayer case.”

Sam Bankman-Fried’s Lawyers Hard at Work

There have been a number of developments in the FTX saga. Most notably, Sam Bankman-Fried’s lawyers asked the judge to toss out criminal charges, saying that it was more of a civil issue. Additionally, his legal team has also accused FTX’s lawyers from Sullivan & Cromwell of working as prosecutors in the case.

Furthermore, Deputy Assistant Secretary Sandra Lee of the Financial Stability Oversight Council (FSOC) also stated that following the recommendations of a report could have avoided the FTX collapse.

Shaq Says Legal Papers Inadequately Served

There is controversy forming in other aspects of the FTX case. Basketball legend and pundit Shaquille O’Neal allegedly avoids being served in a legal complaint against him. Notably, O’Neal promoted FTX last year. His legal team claims that two servers inadequately served papers by tossing them in front of his car.

Other celebrities and well-known figures also became embroiled in the FTX case via promotions and endorsements. These include Tom Brady, Steph Curry, Larry David, and Naomi Osaka.

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.