Following the success of Compound’s COMP token distribution, savvy investors are chasing the next big thing — tokens from other liquidity platforms.

Less than five days since its launch, Compound’s COMP tokens have surged to an all-time high above $150 making it the most successful DeFi token to date, and the first unicorn for the industry.

This type of market action is reminiscent of the 2017 crypto bubble, which sent random altcoins ‘to the moon’ as the hype and fear of missing out (FOMO) swelled like the brewing storm it turned out to be.

Following Compound’s overnight success, investors are now turning to what could be the next big thing in liquidity farming, tokens from other DeFi platforms such as Aave.

Zero to Hero: The COMP Success Story

According to Uniswap, volume surged yesterday when it was announced that Coinbase would be listing COMP. Over $3.7 million in daily volume for June 18 pushed liquidity up to $1.3 million and token prices to an ATH of $155.

Listing on a completely illiquid market to pump the price up on thin books, and then listing on Coinbase days after is a pretty creative offload strategy.Defimarketcap.io currently lists COMP’s market cap at $1.5 billion, which is triple that of industry leader MakerDAO. According to this analytics provider, COMP prices have surged 136% over the past 24 hours. Each day, Compound smart contracts distribute 2,880 COMP to users of the protocol, 50% to suppliers, and 50% to borrowers. On June 18, Coinbase Pro announced that it would be listing COMP on Monday, June 22. There was, however, a very notable disclaimer at the bottom of the company blog post:

Coinbase owns COMP tokens as a result of a 2018 investment in Compound. Coinbase intends to maintain its investment in Compound for the foreseeable future and maintains internal policies that address the timing of permissible disposition of its digital assets, including COMP tokens.Again, reminiscent of 2017, it appears that the Coinbase pump and dump patterns could be returning to crypto markets via DeFi protocols. So far COMP has yet to dump; it is only five days old after all. Nevertheless, industry observers such as Cermak think it is only a matter of time.

Liquidity Mining in Action

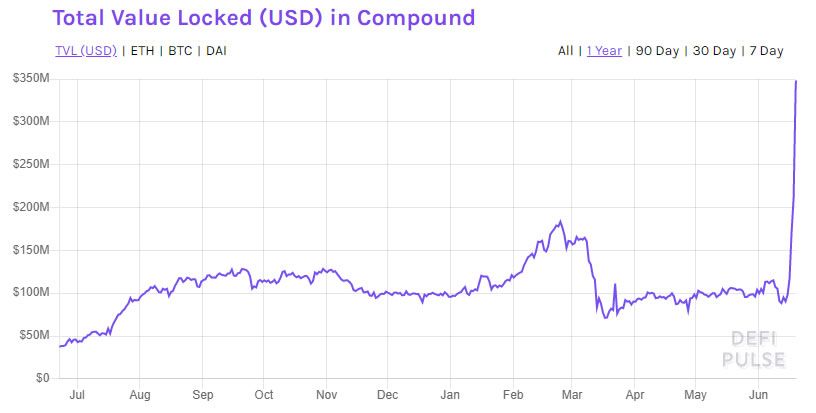

This new method of wealth generation is a token distribution mechanism for DeFi protocols which has been termed ‘liquidity farming’ or ‘liquidity mining.’ Participants in the respective platforms can earn tokens by providing digital assets, or liquidity, to the network. The end-goal is to increase usage and liquidity of the protocol, and for Compound, it is clearly working. According to DeFi Pulse, the total value locked on the platform has surged to an all-time high this week of $350 million as lenders and borrowers scramble to get their COMP tokens for participation.

Imagine you start off lending 100 DAI, but by the end, you’re lending 300 DAI and borrowing 200 USDT, qualifying you to earn more $COMP tokens daily.These legitimate exploitations of the system are perfectly fine when token prices are surging, but it could all come crashing down if the naysayers’ predictions play out.

Alternative DeFi Tokens Targeted For Big Gains

The resounding success of Compound’s token could herald new hype for similar DeFi platforms wishing to reward their users for providing liquidity or taking out loans. Investors have already started to chase tokens from different DeFi protocols in the hope that they too will ‘go to the moon.’ A former partner at Goldman Sachs, ‘SpartanBlack’ [@SpartanBlack_1], postulated that following the success of COMP, investors are now chasing $LEND and $KAVA, expecting both projects to implement something similar,At $160M and $107M market cap, they offer considerable upside if they can replicate the same dynamics with their platforms as Compound, especially in the case of Aave ($LEND) which already has a decent amount of liquidity.Since the beginning of the week, LEND liquidity has surged over 4000% from $17,000 to over $700,000 according to Uniswap. Token prices are currently up over 25% on the day which also suggests investors are loading up in anticipation of something big.

Overall, this is a good outcome for the industry as it gives crypto asset holders an opportunity to enhance the returns on their assets while participating in the success and governance of these decentralized lending platforms which is the true ethos of decentralized systems.In the wake of Compound’s ‘zero to hero’ success story, the likelihood of other DeFi platforms following suit is pretty high. It remains to be seen whether COMP will come tumbling down, but a correction following those huge gains is inevitable. Investors, however, are unperturbed and are already clamoring for the next best thing in the fast-paced world of decentralized finance.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored