Illuvium price saw renewed interest weeks after the Coinbase listing amid the larger crypto market’s bullishness, but on-chain metrics present a bumpy ride for ILV holders.

ILV is the utility and governance token of an open-world fantasy battle game built on the Ethereum (ETH) blockchain. At press time, Illuvium price noted a 10% uptick which ignited bullishness for ILV holders but are these gains here to stay? Let’s find out!

Retail Interest in Illuvium Rises

Along with the 10% daily gains, ILV price also noted a massive spike in 24-hour trade volumes. According to data from CoinMarketCap, Illuvium daily trade volumes were around $15.14 million, noting a 112.54% rise over the last.

Illuvium price gained considerable traction after cryptocurrency exchange Coinbase listed the ILV crypto on Oct. 13. Coinbase allowed users to trade ILV on the Ethereum network (ERC-20 token).

After the listing, ILV price shot up but quickly declined in tandem with the global crypto market following one of the worst forecasted releases of new US inflation data. However, with bullishness back on the table, Illuvium price is battling the long-term $60 resistance.

Roadblocks Ahead for ILV

Illuvium price traded at $60.87 at press time, once the $60 resistance is cleared with enough retail support, the next key resistance would be at the $79 mark.

Daily RSI for ILV price also presented a healthy rise in buyers. It remains to be seen whether buyers can continue to grow.

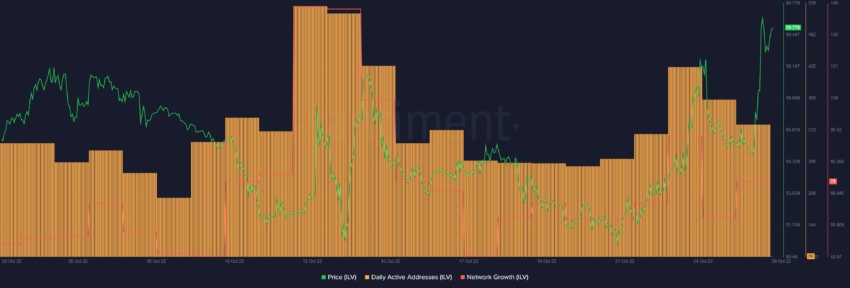

Despite the rise in Illuvium price and trade volumes, ILV saw no major uptick in network growth and daily active addresses, which could mean that the price rise was largely retail-backed.

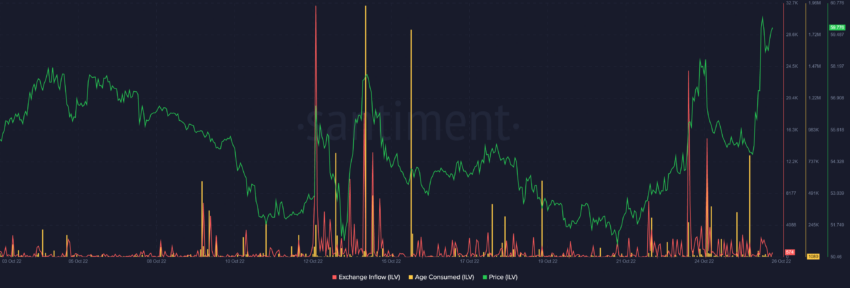

Furthermore, a sudden spike in Age Consumed metric for ILV could mean that older coins were moving as price appreciated. There was also a notable rise in ILV exchange inflows which could point toward some ILV holders selling at the $60 price level.

Even though data from GenXanalytics presented that ILV holders saw decent growth. It is worth noting that the Top 10 ILV Holders hold 95.92% of ILV’s supply, according to data from CoinMarketCap.

Seemingly, ILV price rise could be due to the larger market’s bullishness. However, in the near term, if Illuvium price establishes above the $60 mark, ILV can make some strides in the positive direction.

In case of a bearish turn in price, ILV price can revisit the lower $55 support level.

Disclaimer: BeIinCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.