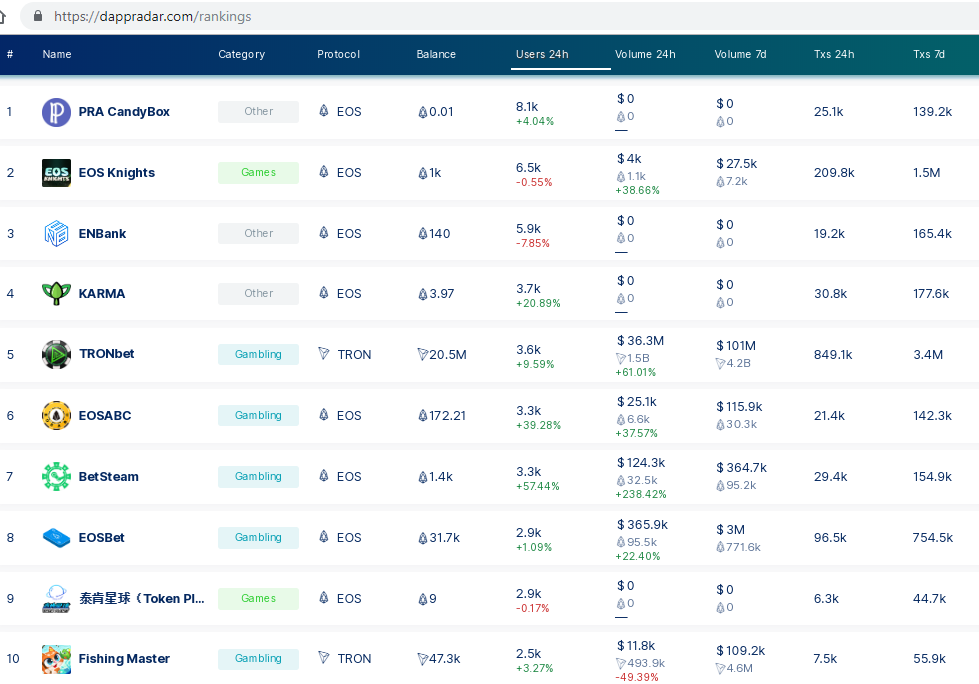

EOS (EOS) allows users to develop decentralized applications (dApps). Currently, the top four dApps with the most active users are built on EOS.

Tron (TRX)—a competitor of EOS—was leading the charts. Now only two of the top ten dApps are built using TRON while eight are deployed on EOS. As the dApp competition heats up, EOS’s new dominance may help its price reach new heights.

Key Highlights For Mar 6

- The price of EOS reached a high of $4.50 on Feb 24 before a market-wide flash crash brought the value to lows of around $3.20

- The price has made successive lower lows.

- EOS is possibly trading in a descending wedge.

- There is resistance near $4.05 and $4.40.

- There is support near $3.60 and $3.35.

Tracing The Support

The price of EOS on Binance was analyzed on 1-Hour intervals from Feb 24 to Mar 6. A flash crash on Feb 24 caused the price of EOS from over $4.50 to under $3.40 in a matter of hours. It has been making successive lower lows since as part of a gradual downward trend.

Five points along this trend were traced to create a descending support line. The number of times a line is touched and its validity have a positive correlation. This means that the more times the line is touched, the more valid it is likely to be as a predictor of future prices.

[bctt tweet=”Currently, the top four dApps with the most active users are built on EOS according to dApp radar. TRON is no longer leading the race.” username=”beincrypto”]

Slight drops in value on Mar 3 and 4 brought EOS to around $3.20. For a moment, trading sank below the support.

Subsequently, price gradually began to increase. Growth accelerated throughout Mar 5— when highs of over $3.90 were reached. Growth appears to be continuing.

A flash crash on Feb 24 caused the price of EOS from over $4.50 to under $3.40 in a matter of hours. It has been making successive lower lows since as part of a gradual downward trend.

Five points along this trend were traced to create a descending support line. The number of times a line is touched and its validity have a positive correlation. This means that the more times the line is touched, the more valid it is likely to be as a predictor of future prices.

[bctt tweet=”Currently, the top four dApps with the most active users are built on EOS according to dApp radar. TRON is no longer leading the race.” username=”beincrypto”]

Slight drops in value on Mar 3 and 4 brought EOS to around $3.20. For a moment, trading sank below the support.

Subsequently, price gradually began to increase. Growth accelerated throughout Mar 5— when highs of over $3.90 were reached. Growth appears to be continuing.

Possible Resistance Line

Possible support and resistance

Support and resistance areas are created when price reaches a certain level numerous times. They can act as a floor and ceiling for the price, respectively. There are resistance areas near $4.03 and $4.40. There are support areas near $3.60 and $3.35.

Support and resistance areas are created when price reaches a certain level numerous times. They can act as a floor and ceiling for the price, respectively. There are resistance areas near $4.03 and $4.40. There are support areas near $3.60 and $3.35.

Recent Upward Move

After the final low on Mar 4, EOS has seen price gains of over 20%. The magnitude and speed of the increase may suggest that the downtrend is close to ending and future price increases are in store.

It appears as if this new upward trend may serve as a short term support. Points are not traced on this line, and it is unknown whether it will continue into the future.

After the final low on Mar 4, EOS has seen price gains of over 20%. The magnitude and speed of the increase may suggest that the downtrend is close to ending and future price increases are in store.

It appears as if this new upward trend may serve as a short term support. Points are not traced on this line, and it is unknown whether it will continue into the future.

Looking Out For A Reversal

The moving average convergence divergence (MACD) is a trend indicator that shows the relationship between two moving averages (long and short-term) and the price. It is used to measure the strength of a move. The relative strength index (RSI) is an indicator which calculates the size of the changes in price in order to determine oversold or overbought conditions in the market. In the case of EOS, the price reached the same level of $3.80 during Mar 5 and Mar 6. This movement is called a triple top. It is considered a bearish reversal pattern.

During the same interval, the MACD and RSI did not act in an identical manner. They both reached a high during the first high of the price, then made successive lower highs one the second and third price high. This is called a bearish divergence. It often precedes drops in price

In the case of EOS, the price reached the same level of $3.80 during Mar 5 and Mar 6. This movement is called a triple top. It is considered a bearish reversal pattern.

During the same interval, the MACD and RSI did not act in an identical manner. They both reached a high during the first high of the price, then made successive lower highs one the second and third price high. This is called a bearish divergence. It often precedes drops in price

Final Analysis

Combining MACD and RSI bullish/bearish divergence with support/resistance essentially predicts price fluctuations. It is especially effective when there is a bearish divergence on a bearish pattern or resistance line and vice versa. If both indicators are in agreement, it can be used to further add validity to the divergence analysis. Given the above information, the price of EOS may drop to the resistance areas near $3.6 and eventually $3.35. Do you think the price of EOS will break out or will drop to the support areas outlined? Let us know your thoughts in the comments below, and be sure to check out our latest Bitcoin (BTC) Price Predictions! Disclaimer: This article is not trading advice and should not be construed as such. Always consult a trained financial professional before investing in cryptocurrencies, as the market is particularly volatile.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored