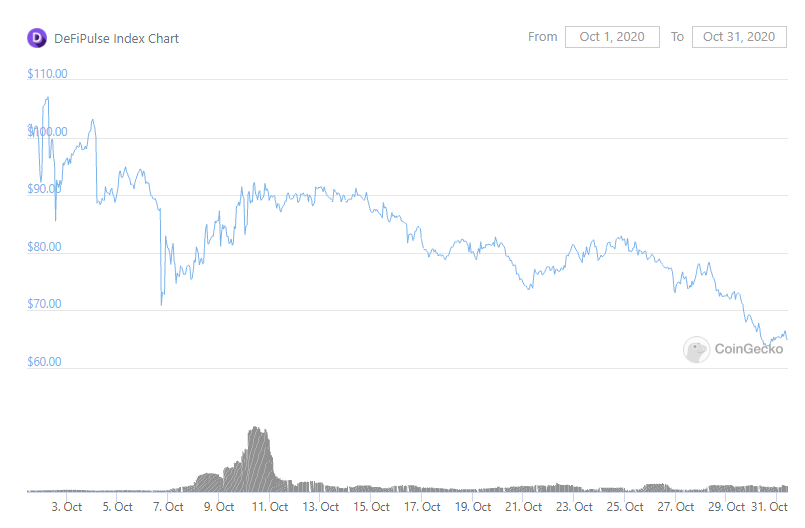

Fitness-focused DeFi protocol DTrack will host its pre-sale on Nov. 5. The deal is happening at a time when interest in DeFi seems to be flagging, with investors moving to store-of-value assets like bitcoin instead.

DTrack, or DefiTrack, is a platform that is tokenizing exercise. The project has announced its pre-sale will launch on Nov. 5. The platform monetarily rewards users for exercising, including VR exercises, and supporting smartwatch integration, all of which are facilitated through a mining app.

We will launch presale on November 5th. We hope you all support us. ⭐️ pic.twitter.com/vMCNEryCws

— DTRACK (@DTRACK_DTK) October 29, 2020

Proof-of-Exercise

The project was first announced in 2018, with not much in the way of development updates until recently. The team has described its mission as wanting to motivate people to exercise with currency, i.e., the DTrack token. DTrack uses a unique proof-of-exercise consensus mechanism for its token model. The algorithm is a smart contract-based rewards system that detects a user’s location and sends it to the smart contract. It also tracks a user’s steps and heartbeat through the DTrack mobile app, with the smart contract delivering the block reward. Several DeFi tokens have launched in the past few months — and more appear on Uniswap every day. Despite its unique offerings and relatively longer existence, DTrack is competing with dozens of newly designed projects.DeFi Mania Appears to Be Dying Down

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored