United States Federal Reserve policies and a looming interest rate cut may be linked to the recent meteoric rise of the Bitcoin and cryptocurrency market, at least according to Deutsche Bank executive Jim Reid.

In an interview with CNBC aired June 26, the research strategist said that alternative currencies start to become a lot more alluring to investors when uncertain policy changes are on the horizon. Reid referred to Fed chair Jerome Powell’s recent statement on economic uncertainty due to the ongoing trade war with China and said:

“If central banks are going to be this aggressive, then alternative currencies do start to become a bit more attractive.”

Dwindling Investor Confidence in Central Banks

Powell did not confirm an imminent interest rate cut. Instead, he said that the central bank will monitor the situation closely and act accordingly. Addressing the Council on Foreign Relations in New York, he said:“The crosscurrents have reemerged, with apparent progress on trade turning to greater uncertainty and with incoming data raising renewed concerns about the strength of the global economy.”The statement, likely, did not reassure equity traders, given that the S&P posted a one percent loss and the Dow Jones Industrial Average reported a drop of 0.7 percent. Simultaneously, the US dollar dropped to a three month low against the euro.

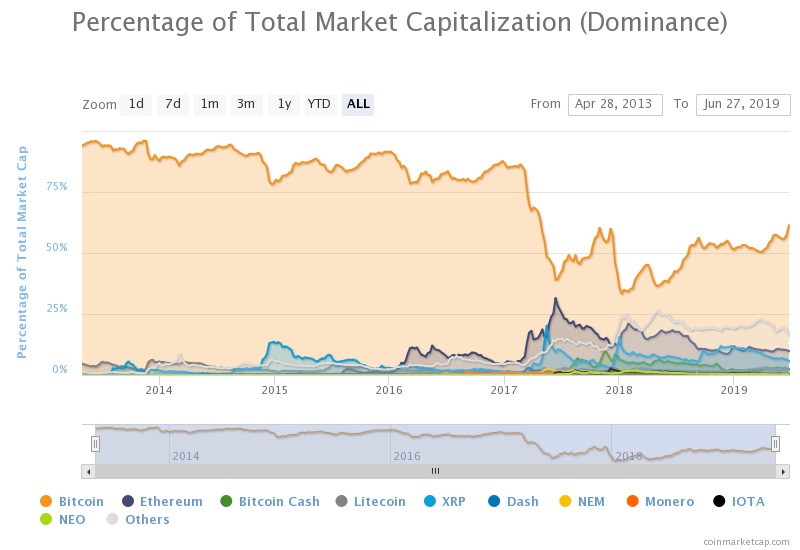

In contrast, Bitcoin’s valuation has risen by 50 percent since the start of June and has shown no sign of relenting.

Conversely, however, altcoins have not performed as spectacularly. Ethereum’s price rose by approximately 30 percent, while Litecoin inched upwards by 20 percent.

The cryptocurrency market’s cumulative valuation, meanwhile, hit $373 billion for the first time in over a year.

In contrast, Bitcoin’s valuation has risen by 50 percent since the start of June and has shown no sign of relenting.

Conversely, however, altcoins have not performed as spectacularly. Ethereum’s price rose by approximately 30 percent, while Litecoin inched upwards by 20 percent.

The cryptocurrency market’s cumulative valuation, meanwhile, hit $373 billion for the first time in over a year.

Gold Enjoys Record Growth

The digital currency market is not the only asset class that is currently experiencing record growth for 2019. The precious metals market surged in response to the rate cut news, as reported by CNBC on June 25. At over $1,400 per ounce, Gold hit its highest price point since May 2013 — over six years ago at this point. Apart from a slowing economy, Deutsche Bank’s Jim Reid believes that Bitcoin’s recent price jump was also partly influenced by Facebook’s announcement of its own cryptocurrency, Libra. Even though the token will not launch until the first half of 2020, many enthusiasts believe that Facebook’s presence in the ecosystem will help legitimize de facto projects such as Bitcoin and Ethereum in the eyes of the masses. Do you believe the cryptocurrency market is warming up for an extended bull run? Let us know your thoughts in the comments below.

Top crypto projects in the US | April 2024

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Rahul Nambiampurath

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

Rahul Nambiampurath's cryptocurrency journey first began in 2014 when he stumbled upon Satoshi's Bitcoin whitepaper. With a bachelor's degree in Commerce and an MBA in Finance from Sikkim Manipal University, he was among the few that first recognized the sheer untapped potential of decentralized technologies. Since then, he has helped DeFi platforms like Balancer and Sidus Heroes — a web3 metaverse — as well as CEXs like Bitso (Mexico's biggest) and Overbit to reach new heights with his...

READ FULL BIO

Sponsored

Sponsored